Ripple has formed a partnership with decentralized oracle network Chainlink to accelerate the integration of the RLUSD stablecoin into the DeFi sector.

.@Ripple x @Chainlink: $RLUSD has adopted the Chainlink standard for verifiable data to fuel DeFi adoption with real-time, secure pricing data.

— Ripple (@Ripple) January 7, 2025

The future of stablecoins is here: https://t.co/mq3cThLGQJ pic.twitter.com/993Ac0o282

“Chainlink price feeds are now live, providing a secure and reliable source of RLUSD data on the Ethereum mainnet. This enables developers to integrate support for the stablecoin into their DeFi apps for use cases such as trading, lending, and more,” according to the press release.

Developers note that the newly issued “stablecoin,” available on both XRP Ledger (XRPL) and Ethereum, can be integrated natively with applications and smart contracts.

“However, to support RLUSD as an asset, many DeFi platforms first require a high-quality, reliable source of pricing data,” the fintech company explained.

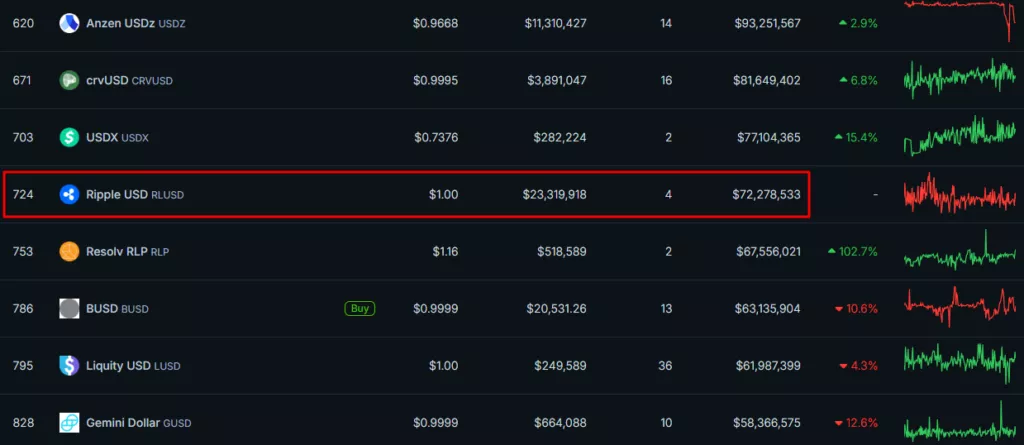

As of now, RLUSD—launched in December—ranks 724th on CoinGecko, with a market capitalization of approximately $72.2 million.

Context

- Ripple started testing the stablecoin in April. At the time, company CEO Brad Garlinghouse remarked that the asset—suitable for payments, RWA, and DeFi—would become the “gold standard” for the corporate sector.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.