After surging past $100,000, Bitcoin quickly fell below $96,000, losing 6% within 24 hours.

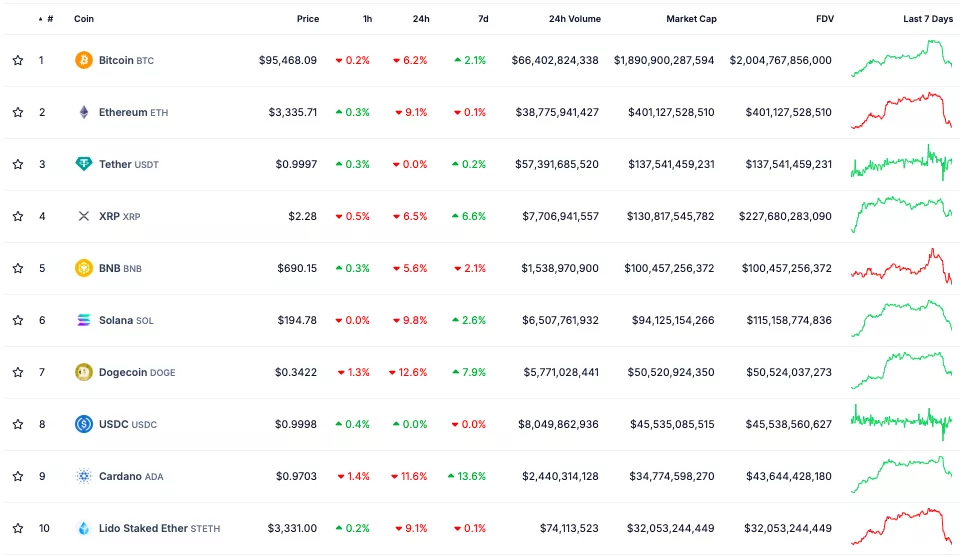

As of now, the digital gold is trading at $95,500, with a market capitalization of $1.89 trillion.

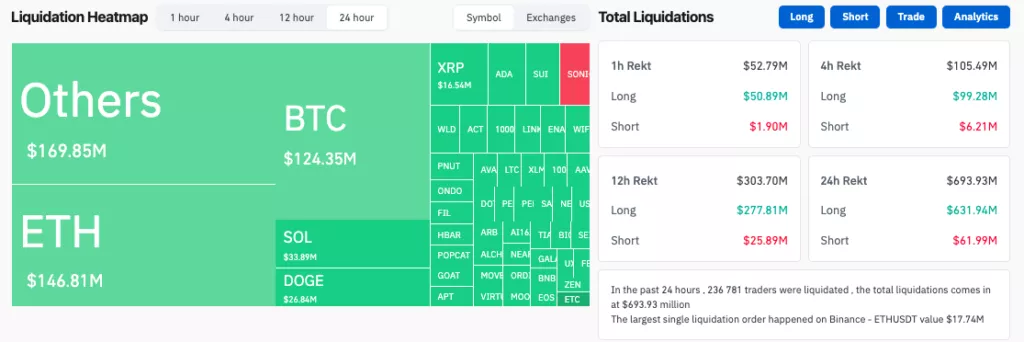

According to Coinglass, liquidation volume over the past 24 hours exceeded $690 million, with the majority ($631 million) coming from long positions.

Bitcoin’s decline pulled all top-10 cryptocurrencies into the “red zone.” Ethereum saw a sharper drop, losing 9% to $3,330.

Solana (SOL) fell by 9.8%, dropping below $200. Dogecoin (DOGE) corrected by 12.5%, while Cardano (ADA) shed 11.6%.

Min Chong, an analyst at Presto Research, told The Block that broader markets, including equities, are also experiencing declines amid macroeconomic concerns over persistent inflation.

“Not just cryptocurrency, but Nasdaq and S&P 500 have dropped by more than 1%. This is driven by inflation fears after ISM reported faster-than-expected economic growth in the U.S. This heightened concerns about persistent inflation, pushed bond yields higher, and sent 10-year Treasury yields to their highest levels since April,” he explained.

The inauguration of U.S. President-elect Donald Trump on January 20 is expected to add further volatility to the market, Chong noted.

Crypto trader Daan Crypto Trades commented that it will be “interesting” to see how Bitcoin behaves in the short term.

$BTC About $1.6B in Open Interest wiped out since the local high yesterday.$ETH also saw about $1B in Open Interest get rinsed out on this move.

— Daan Crypto Trades (@DaanCrypto) January 7, 2025

Going to be interesting seeing how this plays out in the short term. Overall market still remains choppy which is usually the case… pic.twitter.com/hk7g04UEcB

“The market remains unstable overall, which is typical for the end and start of the year,” he added.

Glassnode analyst James Check wrote in a report that demand for Bitcoin is declining despite a slowdown in sales. He noted that spot trading volumes have also plummeted since November, dropping 54% in just six weeks.

Previously, technical analyst Ali Martinez highlighted the $104,700-$105,770 range as a critical resistance zone. Breaking through this level could push Bitcoin to new highs.

Earlier, Galaxy Research experts predicted Bitcoin could reach $150,000 in the first half of 2025 and $185,000 by the fourth quarter.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.