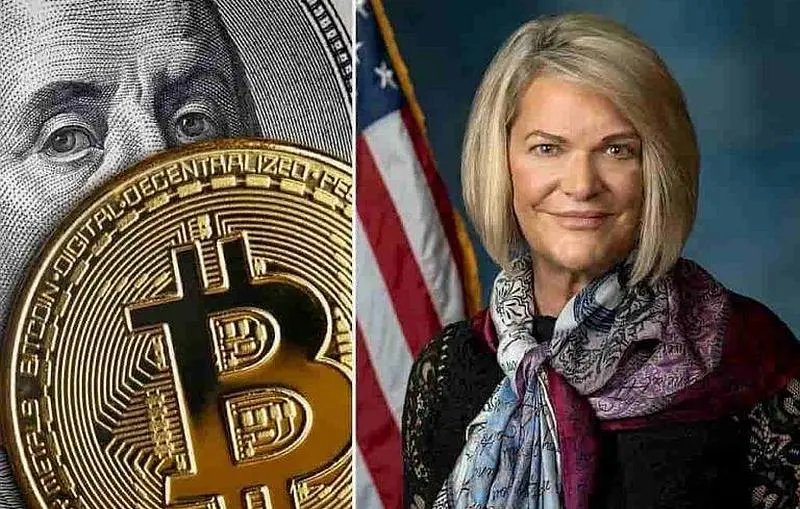

The Federal Deposit Insurance Corporation (FDIC) may face criminal proceedings if it has indeed destroyed documents related to crypto oversight, according to a letter from Senator Cynthia Lummis of Wyoming.

The FDIC is attempting to hide Operation Chokepoint 2.0 and the FDIC must preserve all documents related to digital assets immediately. Tim Scott and I will get to the bottom of it. pic.twitter.com/98uLVVs60D

— Senator Cynthia Lummis (@SenLummis) January 16, 2025

In her letter, Lummis references “Operation Choke Point 2.0,” an alleged continuation of the U.S. Justice Department’s 2013 initiative aimed at restricting banking services to “high-risk” sectors such as payday lenders and firearm dealers. Crypto industry representatives claim similar tactics are currently being deployed against digital assets.

According to the letter, unnamed FDIC employees alleged that the agency destroyed documents tied to cryptocurrency oversight.

“Whistleblowers also informed me that FDIC leadership closely monitors staff access to these materials to prevent their delivery to the Senate before they are destroyed, and that certain employees have been threatened with legal action to deter them from speaking out,” Lummis emphasized.

She characterized the FDIC’s purported actions as unacceptable and illegal. The senator demanded the preservation of documentation related to the agency’s work on digital assets since January 1, 2022, including:

- Oversight and resolution issues involving Signature Bank.

- Oversight and liquidation of Silvergate Bank.

- Supervision of all insured depository institutions that have offered or sought to offer digital asset services.

- Planned and executed enforcement actions connected to cryptocurrencies.

“If it turns out that you [FDIC Chair Martin Gruenberg] or your staff deliberately destroyed materials or attempted to obstruct the Senate’s oversight functions, I will immediately refer the matter for criminal investigation to the U.S. Department of Justice,” Lummis concluded.

In August 2022, Republican Senator Pat Toomey requested the FDIC confirm or deny allegations that it pressured banks over their partnerships with crypto companies, citing insider reports of inappropriate agency conduct.

Context

- In late 2024, the story continued when Coinbase revealed agency letters from two years prior, urging financial institutions to halt transactions with digital assets. Earlier, the exchange sued both the SEC and FDIC over what it described as efforts to “cut the crypto industry off” from banking services.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.