Activity in XRP options and futures has surged alongside the token’s rapid price appreciation, pointing to optimism among investors, according to Nansen analyst Nikolaj Sondergaard, as reported by The Block.

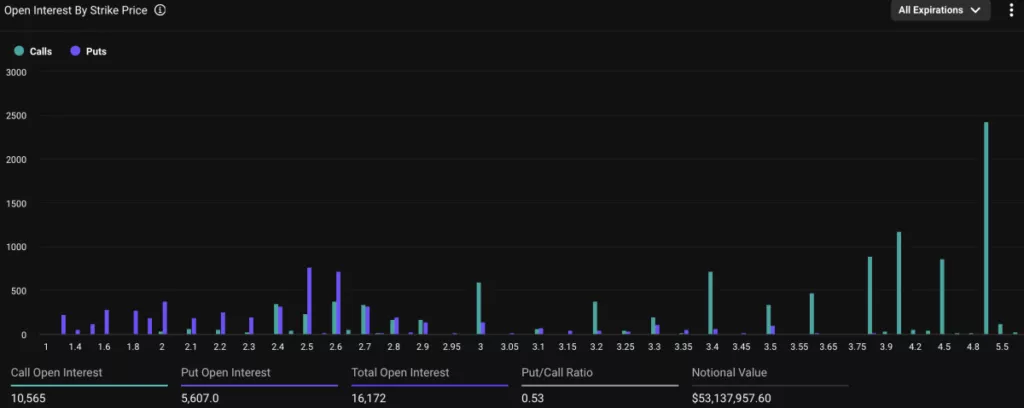

“Looking at XRP options data, interest in call options significantly exceeds interest in puts, confirming a bullish market stance,” the analyst emphasized.

A call option gives the holder the right (but not the obligation) to buy the underlying asset at a prearranged price before a specific expiry date. A put option similarly allows the holder to sell the asset.

Sondergaard added that the put/call ratio has increased over the last 24 hours, indicating greater activity by traders hedging their long positions.

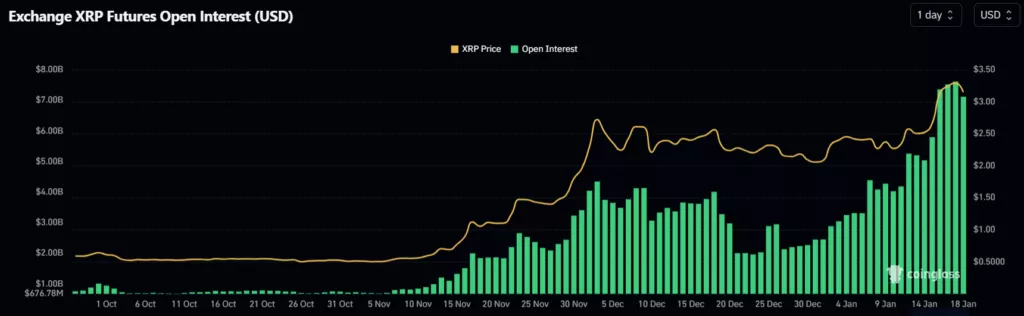

XRP Futures Activity Open interest (OI) in XRP futures is hitting record highs. As the token’s price rises, OI approaches $8 billion, up 46% from the start of the week.

According to Unity Wallet COO James Toledano, the market is eagerly awaiting regulatory clarity.

“If an XRP ETF is approved, we could see significant institutional inflows, driving the asset to new highs in 2025,” he told The Block.

At the time of writing, XRP is trading around $3.15, up 31% over the past seven days with a market capitalization exceeding $180 billion, per CoinGecko.

Context

- On January 16, XRP hit a seven-year high on several major exchanges, approaching $3.4.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.