Issuers of U.S. spot Ethereum ETFs expect to receive the green light from the SEC “soon” to include staking of their underlying asset, ConsenSys founder Joseph Lubin told Cointelegraph.

The Ethereum co-creator noted that providers of exchange-traded products are looking for “the best solutions” to manage any technical complexities:

“I think it will be great for the technology and the ecosystem, because they rely on us, as a base-layer environment, to do more sophisticated, robust, and diversified work. I suspect it will also lead to a broader range of participants,” Lubin added.

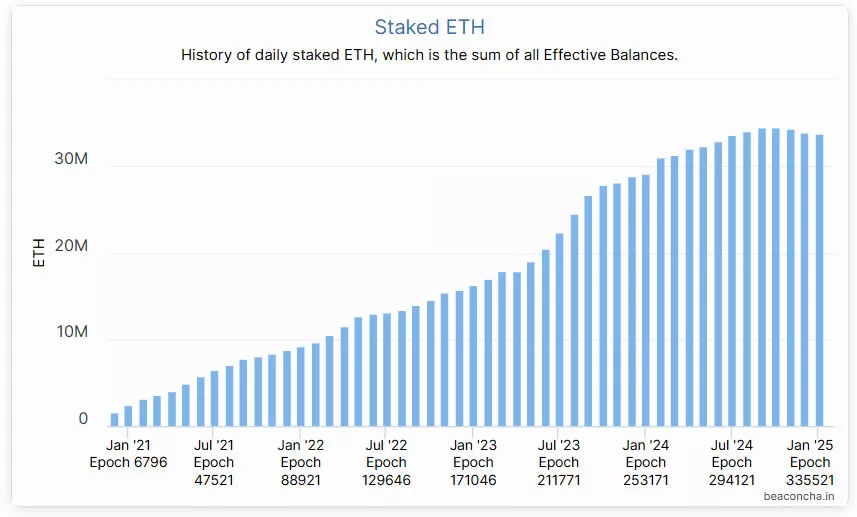

According to Beaconchain explorer data, validator deposits on Ethereum total about 33.7 million ETH, or roughly 28% of the network’s circulating supply. U.S.-listed ETFs hold a bit over 3% of ETH’s market capitalization, per SoSoValue.

In early December 2024, Bernstein analysts predicted that the new SEC leadership would allow ETH-ETF investors to earn staking rewards. A similar outlook about regulatory changes under President Donald Trump was shared by Ruslan Lienha, an executive at the YouHodler exchange.

Hester Peirce, an SEC commissioner known as “Crypto Mom,” hinted in a December interview with Coinage that the agency’s stance could shift as new members join the Commission:

“If the majority of commissioners who don’t want something to happen are replaced by a majority with the opposite view, then it will definitely be easier,” she said, referring to the possible approval of “staking” ETFs.

On January 20, former SEC Chair Gary Gensler stepped down. Acting head Mark Uyeda created a cryptocurrency task force led by Peirce.

Context

- President Donald Trump has nominated Paul Atkins, a crypto-friendly lawyer, to be the next SEC chair.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.