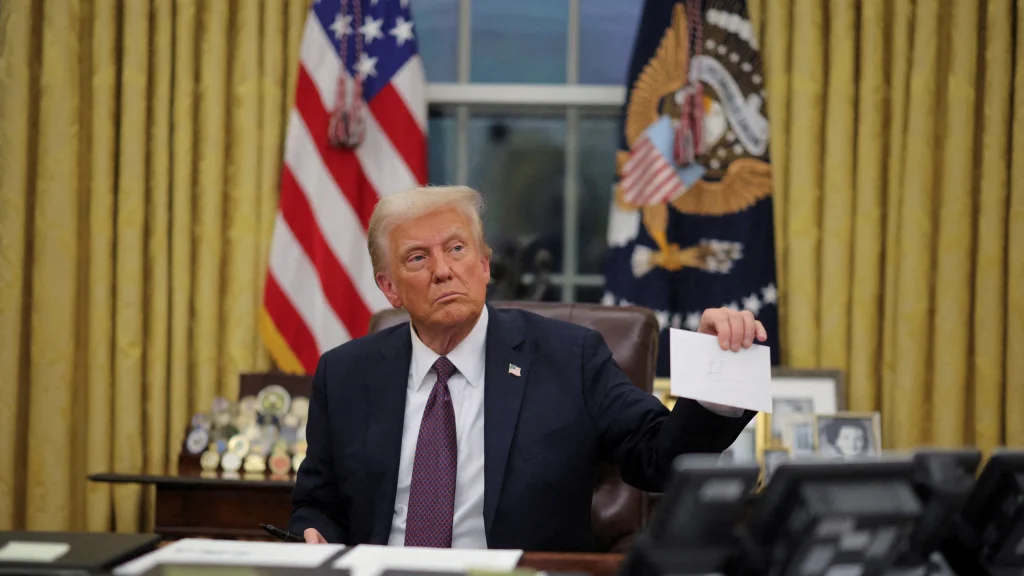

Gerald Connolly, a member of the U.S. House of Representatives, has called for an investigation into a possible conflict of interest related to Donald Trump’s cryptocurrency ventures.

In a letter to the chairman of the House Committee on Oversight and Reform, the congressman noted that the sitting president may be profiting from the World Liberty Financial (WLFI) platform and the TRUMP meme coin. According to him, this potentially violates ethics guidelines and poses risks to national security.

WLFI and Justin Sun

Connolly emphasized that the largest investor in WLFI is Justin Sun, founder of Tron, who is under SEC investigation for alleged securities fraud. There is also the question of foreign influence, the congressman added.

He wrote that Sun’s purchase of 30 million WLFI tokens enabled the company to exceed its revenue threshold, allowing it to disburse funds directly to Trump and his family.

“It’s alarming that this isn’t the only cryptocurrency enterprise the president is engaged in,” said Connolly.

TRUMP Meme Coin

Three days before his inauguration, Trump launched the TRUMP meme coin. According to Connolly, 80% of the token supply belongs to the Trump Organization, which is in charge of selling numerous products under the president’s brand.

“Ethics experts have already raised serious concerns that Trump is ‘literally cashing in on his presidency by creating financial instruments so people can funnel money to his family tied to his office,’” Connolly underlined.

On January 19, TRUMP hit an all-time high of $73.43, but plummeted after Trump officially took office. As of writing, the coin trades at $36—down 51% from its peak.

Whales Profit from TRUMP

Cathie Wood, founder and CEO of ARK Invest, told Bloomberg she sees no “real utility” in the token, calling it merely “the president’s meme coin.”

.@ARKInvest CEO and CIO Cathie Wood says we don't know if President Trump's memecoin holds much utility, but Trump is "ushering in the next phase of the crypto revolution." She speaks with @scarletfu, @kgreifeld and @EricBalchunas on "ETF IQ" https://t.co/YbD2ANk8TA pic.twitter.com/pxlEjL3ZUA

— Bloomberg TV (@BloombergTV) January 22, 2025

“I think in these first days [as president] he’s ushering in the next phase of the cryptorevolution,” she added.

However, Wood clarified that ARK is not interested in such assets, holding only Bitcoin, Ethereum, and Solana.

PANews researchers analyzed the holdings of the top 1000 TRUMP investors. They estimate an average purchase of $591,000 in TRUMP per wallet.

The Wealth Truth Behind the TRUMP Token

— Wu Blockchain (@WuBlockchain) January 22, 2025

Author | Frank, PANews

This article examines the top 1,000 holders. Whales had an average buy – in of $591,000, with nearly 40% buying in below $15. The most powerful address invested $1.09 million within a minute. Success with TRUMP… pic.twitter.com/FAzTbIWkXv

Most large holders bought below $15. The highest volume of sales occurred on January 19, when the price ranged from $65–70.

Investigators flagged one address that invested $1.09 million in TRUMP at $0.18 just one minute after the launch. Partial data shows that it sold tokens worth over $20 million, although at its peak, the value of that wallet’s holdings reached $477.

Previously, the same address traded GRIFT, CHILLGUY, and MOODENG tokens, suggesting it may belong to an insider at Jupiter, a Solana-based DEX liquidity aggregator.

“TRUMP fueled FOMO in the market because, on the one hand, its astronomical $82 billion market cap created an exaggerated sense of engagement; on the other, whales who bought early shared their orders publicly, stoking demand,” the researchers concluded.

Context

- According to a Dune dashboard, most TRUMP holders are either breaking even or at minor losses up to $1,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.