According to JPMorgan analysts, the second-largest cryptocurrency by market capitalization will continue to face “intense competition” from rival blockchain projects like Solana. This was reported by The Block.

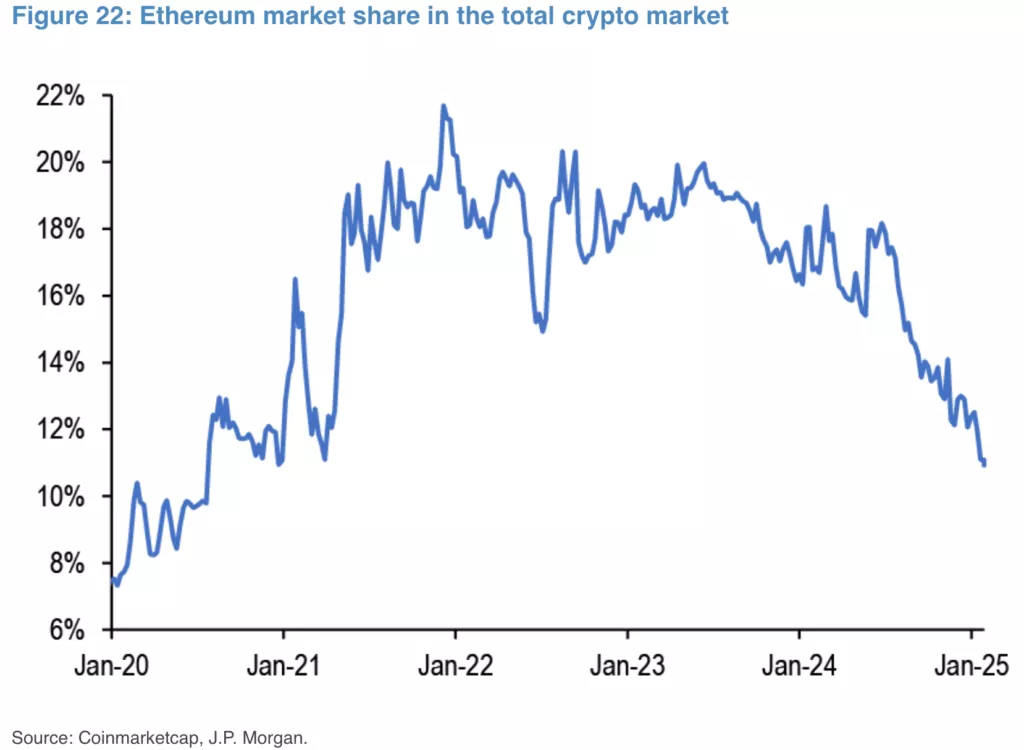

Experts noted that while the market overall has been growing amid the U.S. elections, ETH has underperformed compared to Bitcoin and many altcoins. Ethereum’s share of the total crypto market capitalization has dropped to its lowest level in four years, indicating growing pressure from competitors.

Why Is Ethereum Lagging Behind?

Analysts cite two main reasons for Ethereum’s weak performance: rising competition from newer blockchains like Solana and Layer 2 (L2) solutions that offer lower fees and higher efficiency.

Even after the Dencun upgrade, which improved scalability through a new transaction type for large binary data blobs (BLOBs), more activity has shifted to L2 networks, weakening Ethereum’s base layer, according to analysts.

The growing competition has also driven leading decentralized applications to migrate to their own custom blockchains to improve performance and reduce costs. dYdX and Hyperliquid have already made this move, and experts highlight that Uniswap’s upcoming transition to Unichain will be particularly significant. A shift by the leading DEX away from Ethereum could reduce fee revenues and increase the risk of network inflation, as fewer transactions would mean lower token burn rates.

Despite these challenges, Ethereum’s ecosystem remains dominant in stablecoins, DeFi, and tokenization. However, analysts question whether it can maintain its leadership.

To boost institutional adoption, Ethereum co-founder Vitalik Buterin and the Ethereum Foundation recently invested in Etherealize, a startup founded by former Wall Street trader Vivek Raman. The company focuses on integrating and promoting Ethereum among financial institutions, emphasizing use cases like tokenization.

Previously, Buterin reaffirmed Ethereum’s commitment to scaling through L2 solutions.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.