The flight from risk assets is driven by signals of U.S. President Donald Trump’s readiness for a recession. Investors remain cautious, favoring long-dated call options, while technical indicators suggest a potential rebound due to extreme fear levels in the market.

Bitcoin’s price hit new lows for the year, dropping below $80,000, serving as a leading indicator for risk assets, according to QCP Capital.

Analysts pointed to Trump’s recent interview, in which he showed indifference to recession risks. Despite his reputation as a stock market supporter, the U.S. president acknowledged the possibility of a market correction, viewing a Wall Street downturn as a form of “economic correction.”

QCP Capital also noted the decline in U.S. Treasury yields and the weakening dollar, both historically positive factors for risk assets.

Analysts observed increased demand for long-term call options with high expirations, signaling readiness for a quick recovery from support levels around $75,000.

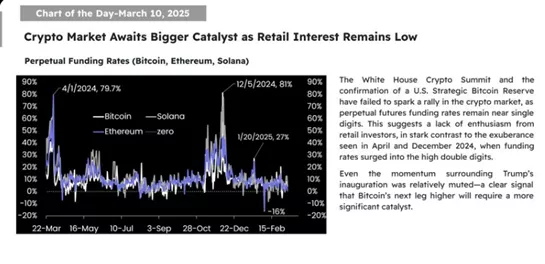

Meanwhile, Matrixport remains skeptical about a short-term crypto market rebound, citing slowing inflows into stablecoins, which typically indicate improving investor sentiment.

Recession on the Horizon?

JPMorgan recently raised the probability of a U.S. recession from 30% to 40%, citing the country’s “extreme policies.”

Goldman Sachs adjusted its recession probability from 15% to 20%, stating that this estimate could increase if Trump’s administration remains committed to its policies despite worsening economic data.

Crypto investor Anthony Pompliano suggested that Trump may be increasing economic uncertainty to pressure the Federal Reserve (Fed) into cutting interest rates.

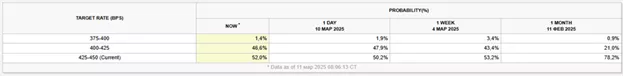

According to CME FedWatch, the probability of monetary policy easing in May now stands at 48%, up from 21.9% a month ago.

Technical Outlook

The Kobeissi Letter suggested that a short squeeze could occur after markets reach extreme fear levels.

“Markets do not move in a straight line in the long term. A short squeeze is inevitable,” the analysts wrote.

Researcher Timothy Peterson calculated that since 1990, the VIX fear index has been higher only 11% of the time.

“The probability that today’s downturn marks the bottom is 89%,” he estimated.

A bullish divergence in the RSI on the four-hour timeframe could strengthen the chances of a rebound, according to trader Cas Abbe.

Analyst Rekt Capital recommended watching oscillator signals on the daily chart to confirm a sustainable recovery.

Leverage Wipeout

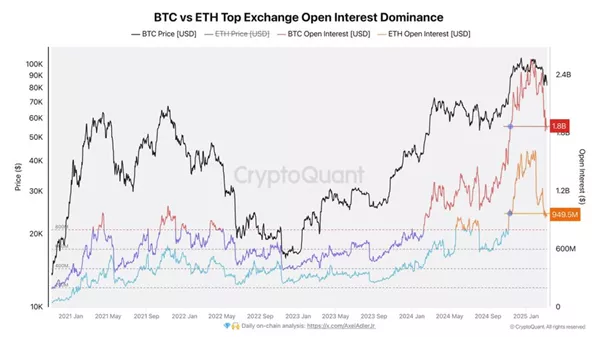

According to CryptoQuant, a sharp drop in open interest in Bitcoin and Ethereum futures suggests a deleveraging process, which could help stabilize the market.

Total open interest fell by $1.37 billion, with $668 million in Bitcoin and $700 million in Ethereum liquidations.

Earlier, YouHodler’s Head of Markets, Ruslan Lienkha, warned that the current correction could turn into a medium-term bearish trend.

Former BitMEX CEO Arthur Hayes did not rule out a Bitcoin drop to $70,000 before a recovery.

Meanwhile, CryptoQuant CEO Ki Young Ju predicted an extended consolidation phase between $75,000 and $100,000, similar to early 2024, before another upward move.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.