Crypto traders expect Bitcoin’s price to decline further in March, accumulating $550 million in put options with a $70,000 strike price, according to Amberdata, as reported by DLNews.

Derive research head Sean Dawson highlighted growing bearish sentiment in his March 11 report. Nearly 43% of options sold on the platform in a day were puts, indicating active hedging against a BTC downturn.

“The market is facing significant challenges as macroeconomic conditions deteriorate, and crypto assets are no exception. The coming weeks will be crucial in assessing how broader economic factors impact digital asset prices and trading behavior,” Dawson stated.

However, not all market participants are pessimistic. Deribit data shows an increase in call option positions with a $100,000–120,000 strike price.

At the same time, the put-to-call ratio remains bearish at 0.52.

Bearish Factors Affecting Bitcoin

BTC’s decline is linked to macroeconomic uncertainty, including:

- Ongoing trade wars initiated by Donald Trump’s administration are pressuring markets.

- The Federal Reserve remains unclear on interest rate cuts.

- Disappointment in the crypto community due to:

- The U.S. crypto reserve directive, which did not include expected government BTC purchases.

- A White House crypto summit with Trump, which lacked regulatory clarity.

- Outflows from spot Bitcoin ETFs fueled negative sentiment.

Against this backdrop, analysts predict BTC may fall to $70,000.

One Bitcoin now buys 27.7 ounces of gold. At its peak in 2021, one Bitcoin bought 36.3 ounces of gold. That means that in terms of gold, which is real money, the price of Bitcoin has fallen by 24%. So Bitcoin has been in a stealth bear market for the past three and a half years.

— Peter Schiff (@PeterSchiff) March 14, 2025

Bitcoin is often compared to gold. On March 14, the precious metal hit an all-time high, surpassing $3,000 per ounce.

Bullish Outlook

Nansen analyst Aurelie Barter believes a BTC pullback to $71,000–72,000 is a natural correction within the ongoing bull market.

Former BitMEX CEO Arthur Hayes considers a 36% BTC correction to be normal, predicting a new rally once major economies ease monetary policy. He maintains a long-term BTC target of $1 million.

CryptoQuant analysts see BTC as oversold and anticipate a potential rebound.

Santiment highlighted rising USDT transaction activity, signaling that traders are preparing to buy BTC.

“Market sentiment is dominated by exhaustion and capitulation, but this isn’t always a bearish indicator,” Santiment noted.

CryptoQuant also pointed out BTC’s historical correlation with the S&P 500. The U.S. stock market has experienced sharp downturns at the start of Trump’s presidency, but it has consistently recovered, maintaining a long-term uptrend.

Bitget Research chief analyst Ryan Li emphasized that institutional adoption and regulatory clarity make BTC more resilient than traditional assets.

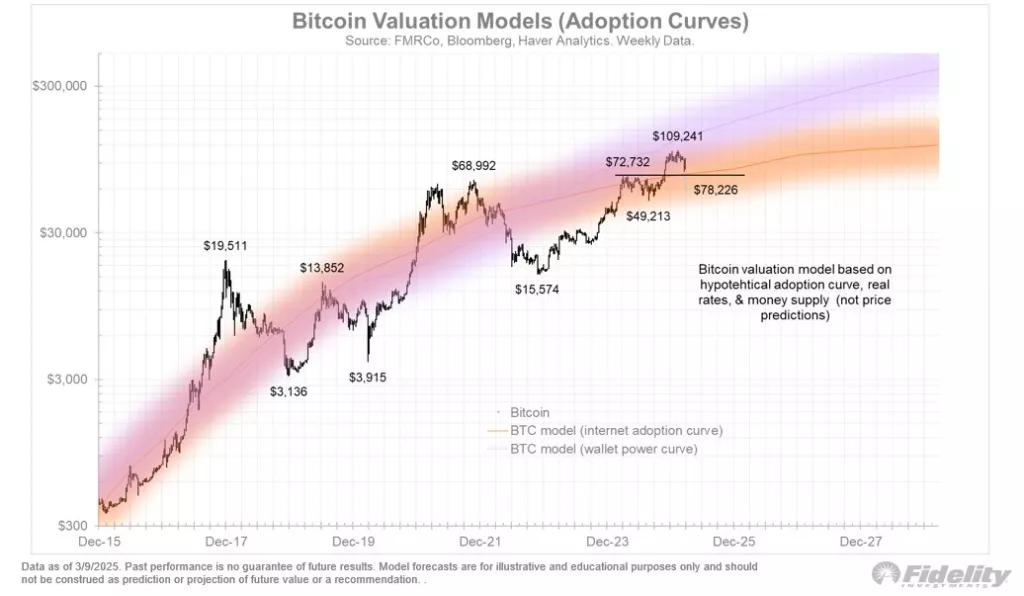

Fidelity Investments global macro strategy director Jurrien Timmer said BTC’s $109,000 all-time high was likely an anomaly. The price has now returned to a more justified trend, suggesting further growth ahead.

Conclusion

QCP Capital attributed Bitcoin’s decline to Trump’s indifference to recession risks, which has fueled market uncertainty.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.