On August 12, Bitcoin declined by 2% $122,000 to $118,000. Founder MN Trading Michael van de Poppe called the day candle ‘quite ugly’ and allowed to reduce quotes to $116 800.

I don't like this daily candle on #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) August 11, 2025

It has taken all the liquidity on the highs and immediately inversed towards the range high resistance.

Quite ugly daily candle.

Wouldn't be surprised if we'll test $116.8K before continuing. pic.twitter.com/BiYtBLEtfG

The day before, BTC rose to $122 150, close to the historical maximum $123 100 July 15th. Investors were expecting a new record, but the price turned down.

“Bitcoin took all the liquidity at the highs and immediately rolled back to the upper limit of the resistance range,” Wang de Poppé explained.

According to the data Coinglass, a 1.75% drop to the predicted level can lead to the elimination of longs worth about $1.63 billion. Despite this, the analyst maintains a positive outlook for BTC.

Cryptotrader Rekt Capital noted that the breakdown of the level $126,000 able to open the way to further growth.

#BTC

— Rekt Capital (@rektcapital) August 11, 2025

If Bitcoin is able to convincingly break ~$126,000 then chances are price will go a lot higher and quickly$BTC #Crypto #Bitcoin

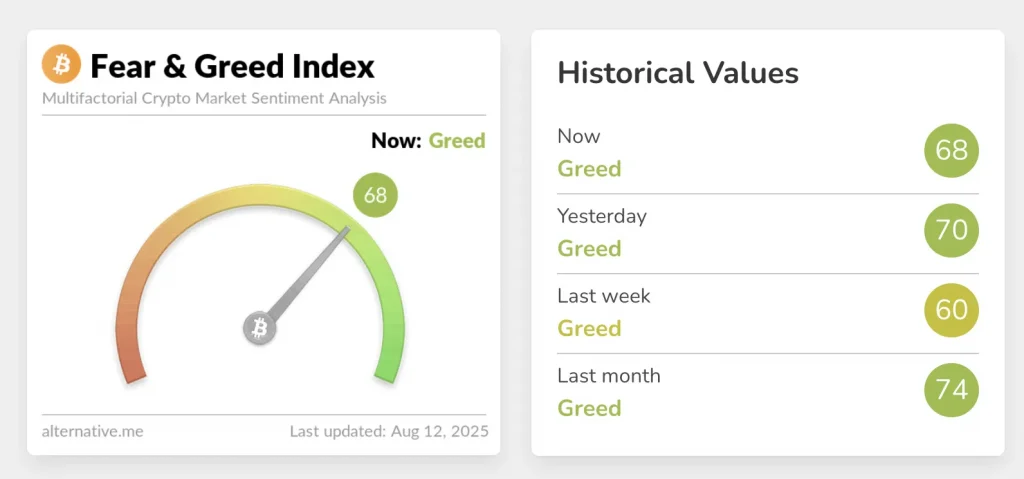

Fear and greed index is kept at the mark 68, which corresponds to the ‘greed’ zone.

Spot Bitcoin-ETFs also demonstrate a steady influx of funds: the funds attracted in a day $178.1 million.

Previously founder capriole Investments Charles Edwards estimated the fair value of BTC in $167 800.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.