Former first lady of the United States Melania Trump re-enters in the infopolis promoting her token melaniameme (melania)launched in the Solana network. In the new AI video, she called it “the way to the future” and noted the project’s official account.

However, the high-profile video remained unanswered questions about how the project team sold tokens worth more than $10 million, which was previously raised by blockchain analytics.

Into The Future@TrueMELANIAmeme https://t.co/eles222J1r

— MELANIA TRUMP (@MELANIATRUMP) October 1, 2025

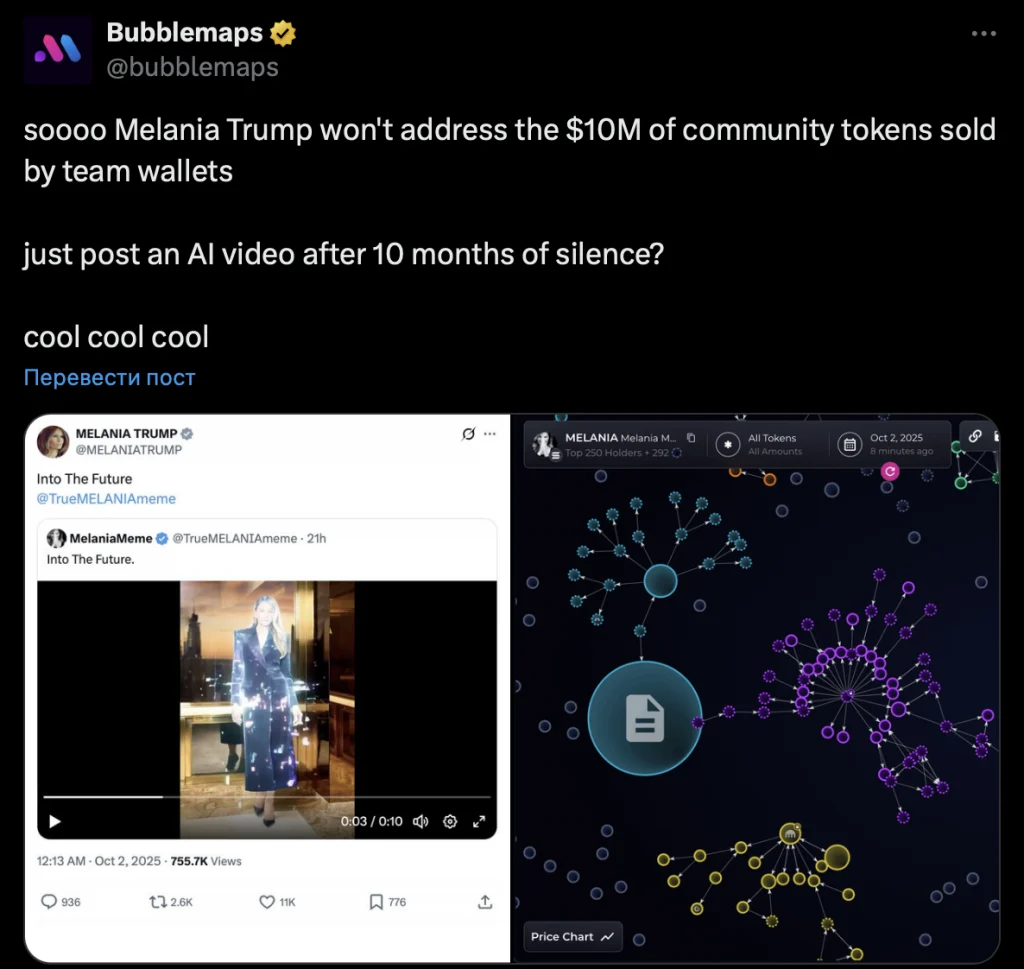

Analytical Platform BubbleMaps stated:

“Melania Trump does not comment on the sale of $10 million tokens from the team’s wallets. Simply uploads AI videos after 10 months of silence.”

At the same time, on April 7, the developers transferred $30 million from the community fund, which were sold out without any explanation.

soooo Melania Trump won't address the $10M of community tokens sold by team wallets

— Bubblemaps (@bubblemaps) October 2, 2025

just post an AI video after 10 months of silence?

cool cool cool https://t.co/EswN99uTEy pic.twitter.com/v1gcBz27Ey

Moreover, at the end of April, three days before the fall, the team dropped another $1.5 million tokens after the price rose by 21%. According to lookonchain, the sales strategy looked like DCA (dollar averaging).

Melania token lost 98% of the cost

Since the launch in January, the price of the coin has fallen to almost zero. At the time of writing, the token was trading around $0.18which is 90% lower than the launch price and 98% lower than the historical maximum in $13.73.

In the creation of the token was involved and Hayden Davispreviously known as a co-founder Libra (Libra). He also launched other memcoins of the current cycle.

For example, in March, he introduced a Wall Street Wolf-style token, where more than 80% of the offer came from insiders. As a result, the token lost 99% of the cost in two days.

A few weeks earlier, the project collapsed libra – Eight insider wallets have made liquidity worth $107 million, which nullified the capitalization of $4 billion in just a few hours.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.