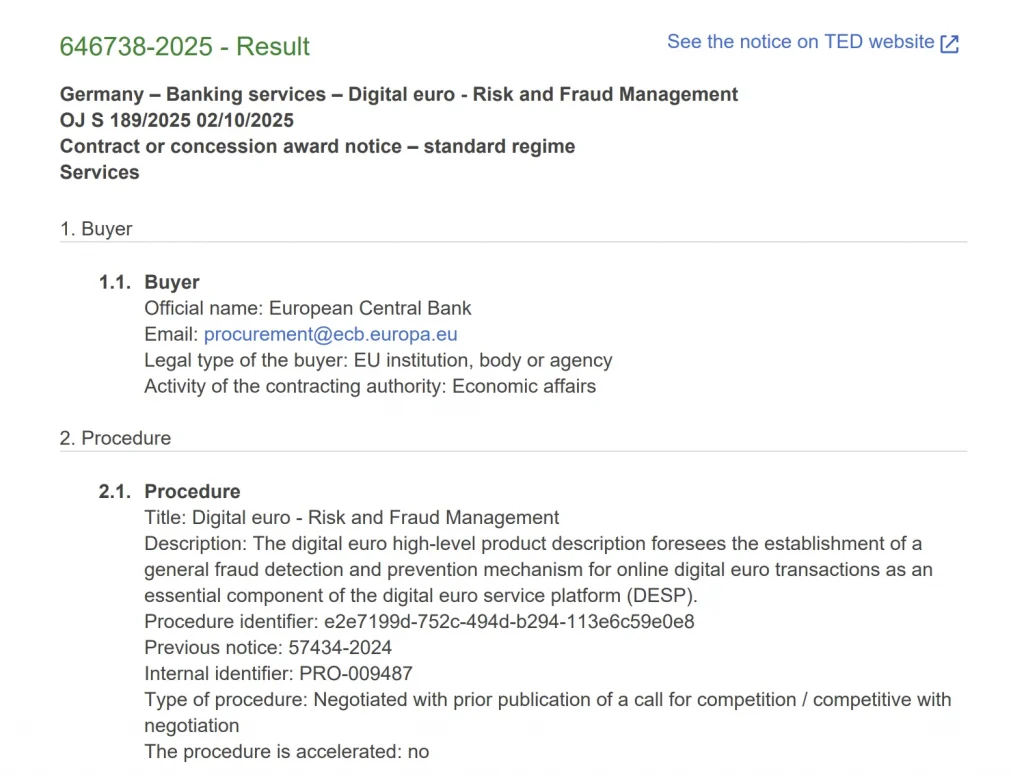

European Central Bank (ECB) announced the conclusion of agreements with seven companies that will develop key components for the possible launch of a digital euro (cbdc) by 2029.

agreements with a potential digital euro. source: ECB

According to the statement, partners will develop systems to combat fraud and risk management, the creation of secure channels for the exchange of payment information, as well as software for the digital euro infrastructure. Among the selected companies are Feedzaispecializing in detecting fraud with AI, and giesecke+devrientknown for its security technologies.

Head of Giesecke+Devrient Ralph Wintergerst noted:

“Under the ECB Governance Board and in accordance with EU law we will design, integrate and develop a digital euro service platform.”

Preparation for launch in 2029

Work on the concept of digital euro has been going on since 2021, and in 2023 the project moved into the training phase. however, the decision to launch it will be made only after the final adoption regulations on digital euro. According to ECB representatives, the real development of components will begin later and will depend on the decision of the Governing Council.

At the same time, the existing agreements do not involve payments to companies at the current stage and include mechanisms for adjusting the conditions in the event of changes in legislation.

One of the functions of the digital euro should be alias lookup – the ability to send or receive transfers without knowing the details of the other side. Also, work is underway on offline payments, which will allow the use of digital euros even without access to the Internet.

Attention to the risks of stablecoins

At the same time, ECB representatives and EU financial regulators warn of potential threats to regional markets by stablecoins. This is in stark contrast to the US position, where in July the Stablecoins Act was signed with the support of Congress and President Donald Trump.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.