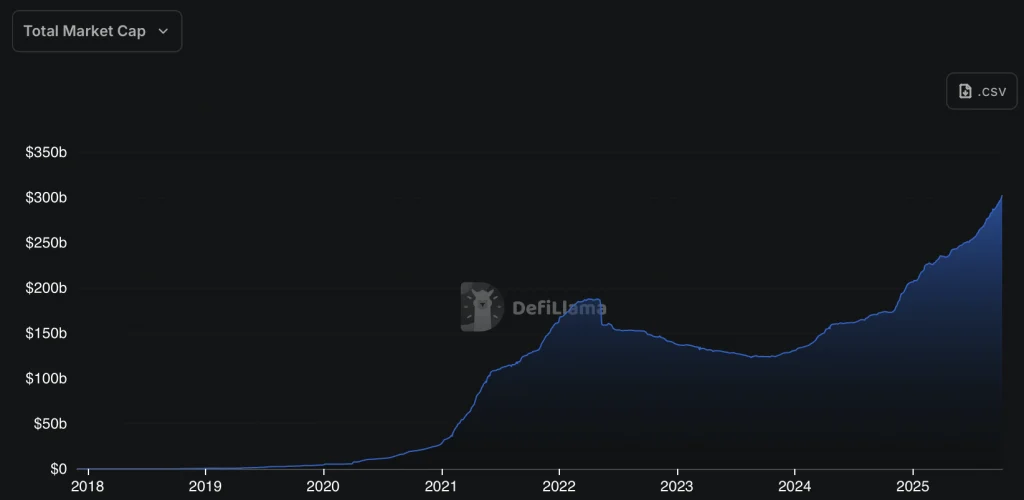

the volume of the stablecoin market for the first time exceeded $300 billion, which, according to analysts, can become a ‘reactive fuel’ for the growth of the cryptocurrency market and a signal of increasingly closer integration of crypto with global finance.

According to Cointelegraph, the overall supply of stablecoins has reached a new record, showing Growth by 46.8% since the beginning of the yearwhich is already ahead of the pace of increase in 2024.

This milestone coincided with the beginning of October, traditionally one of the strongest months for Bitcoin, which increases the optimism of investors and the expectations of the so-called ‘Uptober’ rally.

Founder of the Synthetic Dollar Protocol Falcon Finance Andrey Grachev He noted that the increase in the volume of stablecoins is not just “money on pause”:

“These funds are actively moving through the markets. Monthly transfer volumes are calculated in trillions. This is the capital that works, not waiting in the wings,” he said in an interview with Cointelegraph.

Grachev also stressed that stablecoins are actively used for calculations, opening positions and providing access to the dollar in regions where traditional banks do not cope with their tasks.

Taken: defillama

In addition to investments, stablecoins find application in payments, transfers, settlements between companies and even as a savings tool. The growth of their volume may indicate an increase in the use of tokens in everyday calculations and institutional transactions.

$300 billion – ‘reactive fuel’ for the crypto market

According to Ricardo Santos, Technical Director of FinTech Company Mansa Financespecializing in solutions based on stablecoins, overcoming the $300 billion mark can become Significant signal for restoring interest in digital assets and confirming the growing role of stablecoins in the world economy.

“The expansion of the stablecoins supply is often perceived as a sign of a new liquidity equivalent to the dollar, which can quickly flow into Bitcoin, Ethereum or Altcoins. In this sense, the level of $300 billion is a real rocket fuel for the next growth cycle,” he said.

Santos also drew attention to the growth in the use of stablecoins in countries such as Nigeria, Turkey and Argentinawhere residents use dollar tokens as ‘Actual Dollars’ for daily transactions.

In addition, major international players, such as Visa — continue to integrate the stablecoins into their payment systems, making them part of the traditional financial infrastructure.

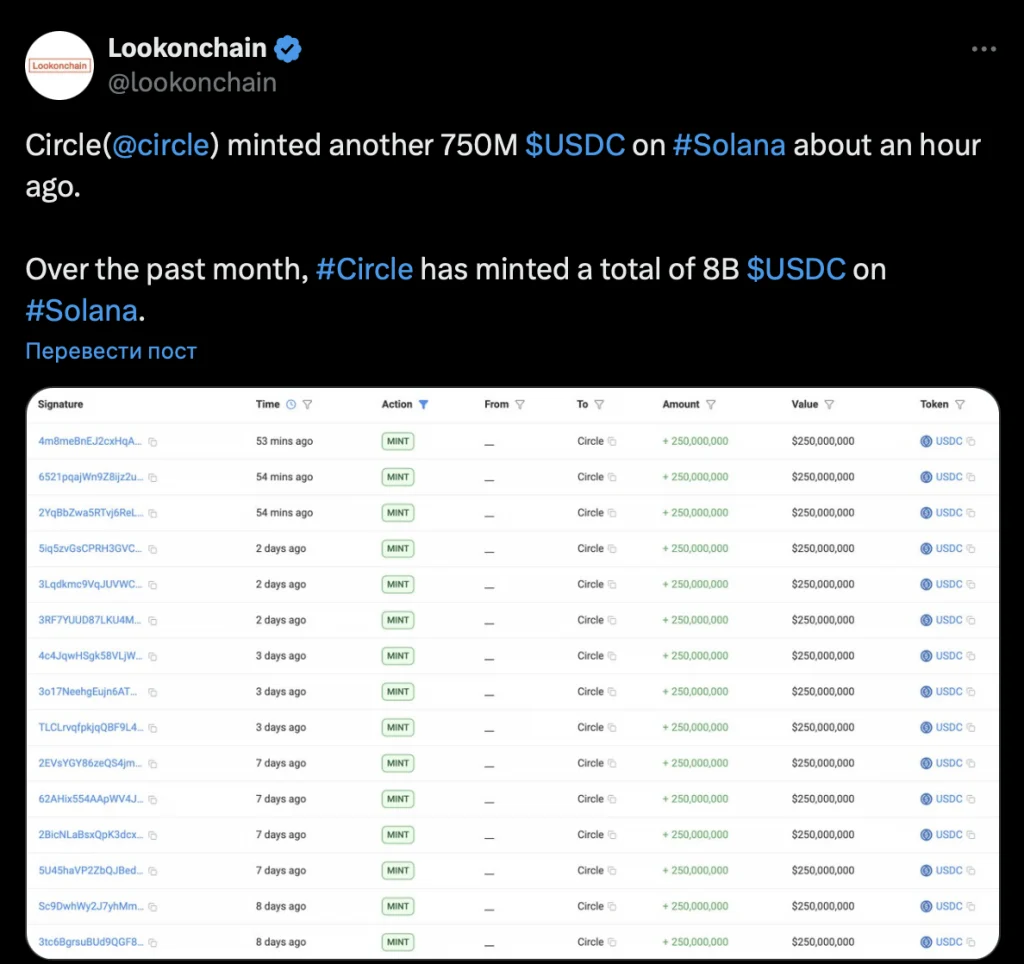

Taken: lookonchain x

for the last month Circle Released $8 billion in USDC Online only Solana, of which $750 million was created in one day – on Thursday, according to the platform lookonchain.

Technical Analyst and Popular Trader Kyle Dups noted:

“Capital does not last long. The record volume of stablecoins will sooner or later begin to flow into the crypto market.”

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.