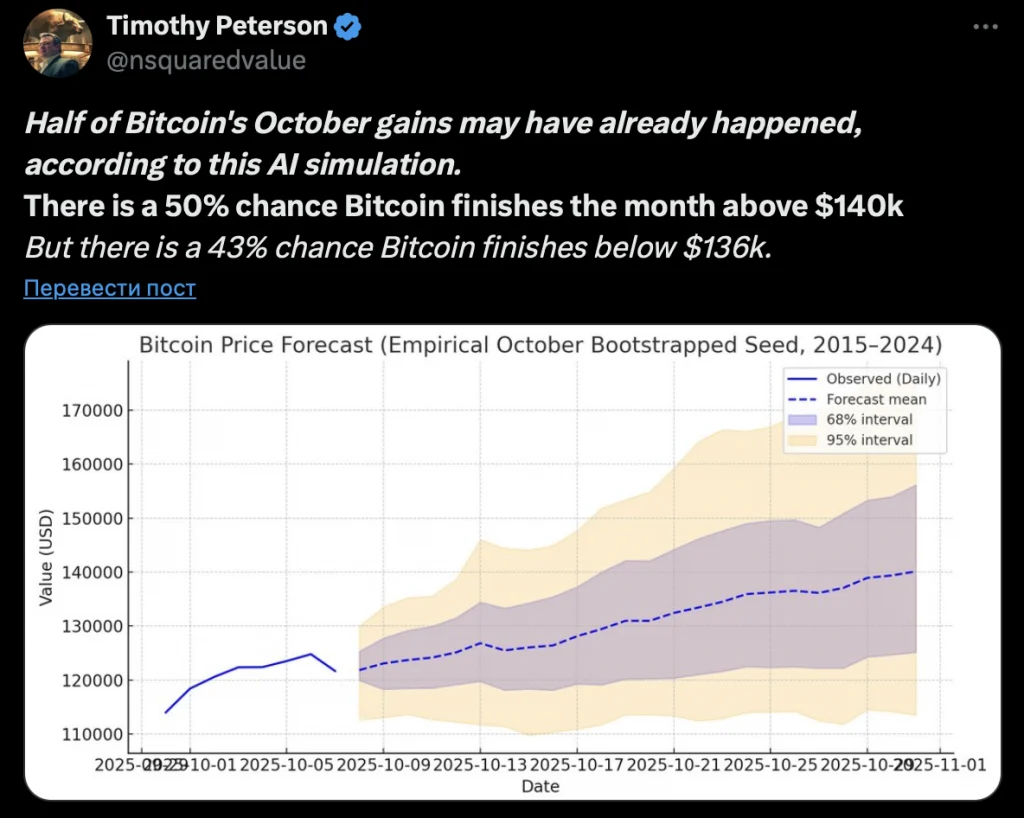

According to economist Timothy Peterson, Bitcoin has one to two chance to end October at $140,000, based on the historical price dynamics over the past 10 years.

According to the calculations of the economist Timothy Petersonthe probability that the price Bitcoin (BTC) will exceed $140,000 this month, makes 50%. The analysis is based on modeling market behavior using data for the last ten years.

“There is a 50 percent chance that Bitcoin will end a month above $140,000. But there is also a 43% chance that the price will remain below $136,000,” Peterson wrote in X (former Twitter) on October 2.

Source: X Timothy Peterson

Bitcoin trades in the area at the time of publication $122,000, rolled back a little after the update historical maximum of $126,200 at the beginning of the week (according to CoinMarketCap).

To achieve the mark of $140,000, the cryptocurrency must be added about 14.7%.

The model is based on data, not emotions

Peterson noted that his forecast is not a subjective opinion, but the result of ‘hundreds of simulations built exclusively on real data, without the influence of human emotions or bias.’

“Each model relies on the patterns of historical volatility and the rhythm of bitcoin price movement. This is not fortune-telling, but a probabilistic picture of where the price is most likely by the end of the month,” the expert stressed.

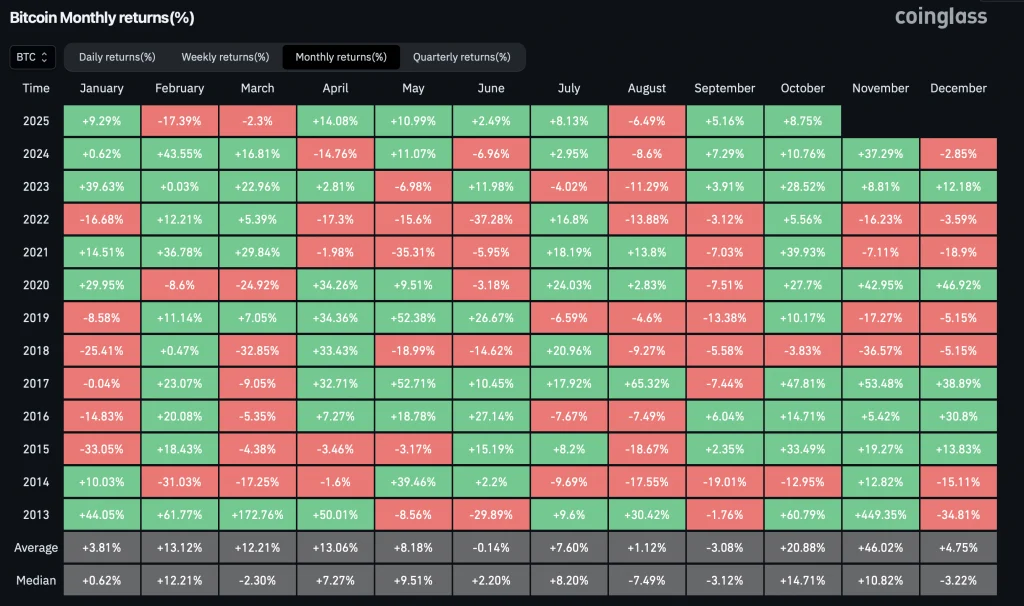

Bitcoin started October at the level $116,500, and growth to $140,000 would mean a rise of approximately 20.1% – almost identical to Average historical indicator of Bitcoin growth in October (20.75%), according to the data Coinglass.

Source: Coinglass

October – ‘Good Month’ for Bitcoin

Historically, October is considered the second most profitable month for Bitcoin since 2013. In this period, increased trading volumes and the influx of institutional capital are often recorded.

Peterson noted that October is of particular importance for traditional financial markets:

“This is the time of completion of quarterly rebalancing, the beginning of a new fiscal year for funds and preparation for the annual reporting period. That is why liquidity and interest in risky assets often grow.”

Analysts divided in opinion

The market as a whole remains optimistic. After updating the analytics record Jelle and Matthew Hyland They said that Bitcoin is ‘ready for a new momentum of growth.’

Source: x jelle

Source: X Matthew Hyland

However, Peterson stressed that despite statistical predictability, Bitcoin often deviates from historical patterns.

“Markets are not chaotic in the short term, but their cyclicity in liquidity and mood does not always coincide with the expectations of traders,” the economist noted.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.