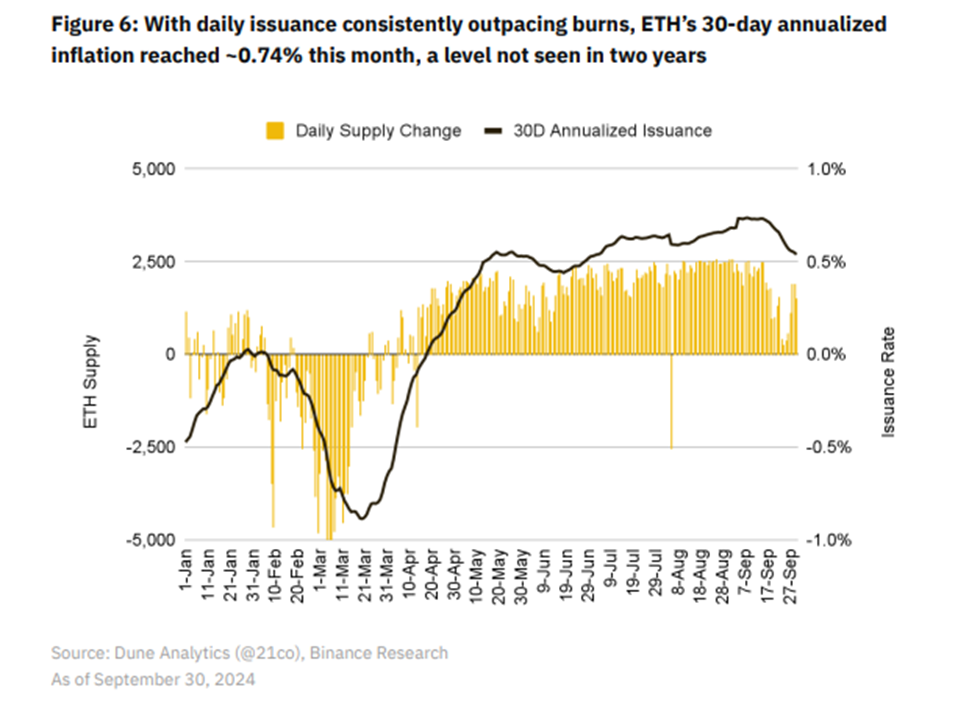

Ethereum’s inflation has reached a two-year high of 0.74% annually (30-day moving average), which raises questions about its deflationary prospects and “hard money” status. According to analysts at Binance, the cause of this inflation is a decrease in base layer network transactions due to the migration of activity to Layer 2 (L2) solutions, which has reduced the coin burning volume. The burning mechanism was introduced as part of the EIP-1559 hard fork, which occurred in 2021 with the London upgrade.

“The reduction in activity at the base layer of the network led to a decrease in transaction fees and a slowdown in coin burning. In September, the burning rate reached one of the lowest levels since The Merge,” states the Binance report.

Impact of Decreased Coin Burning on Ethereum Inflation

EIP-1559, introduced in 2021, implemented a burning mechanism for part of the transaction fees, which was meant to contribute to Ethereum’s deflation. However, as many transactions have moved to Layer 2 solutions like Arbitrum and Optimism, the base network is experiencing a decrease in transaction activity, leading to a decline in burning volumes and an increase in inflation. Binance highlights that this raises concerns about ETH’s prospects as “hard money,” which was previously considered one of the cryptocurrency’s main advantages after the implementation of EIP-1559.

Possible Consequences

The rise in Ethereum’s inflation could put pressure on its price in the long term, especially if the coin burning volume continues to decrease. Layer 2 solutions such as Arbitrum and Optimism offer lower fees, leading users to prefer them for transactions, leaving the base network less congested. This decreases the usage of coin burning mechanisms, which previously helped maintain the deflationary nature of ETH.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.