Since the beginning of the year, Bitcoin has risen by 49.2%, showing the best performance among key assets. According to NYDIG, several factors could support continued growth in Q4 2024.

NYDIG: Bitcoin remains the best-performing asset so far this year with a year-to-date gain of 49.2%. The upcoming US election on Nov. 5 will play a big part in market performance for Q4, and expects larger gains if Trump wins. Q4 is traditionally a bullish period for BTC and… pic.twitter.com/8jYmktA116

— Wu Blockchain (@WuBlockchain) October 7, 2024

Key Drivers

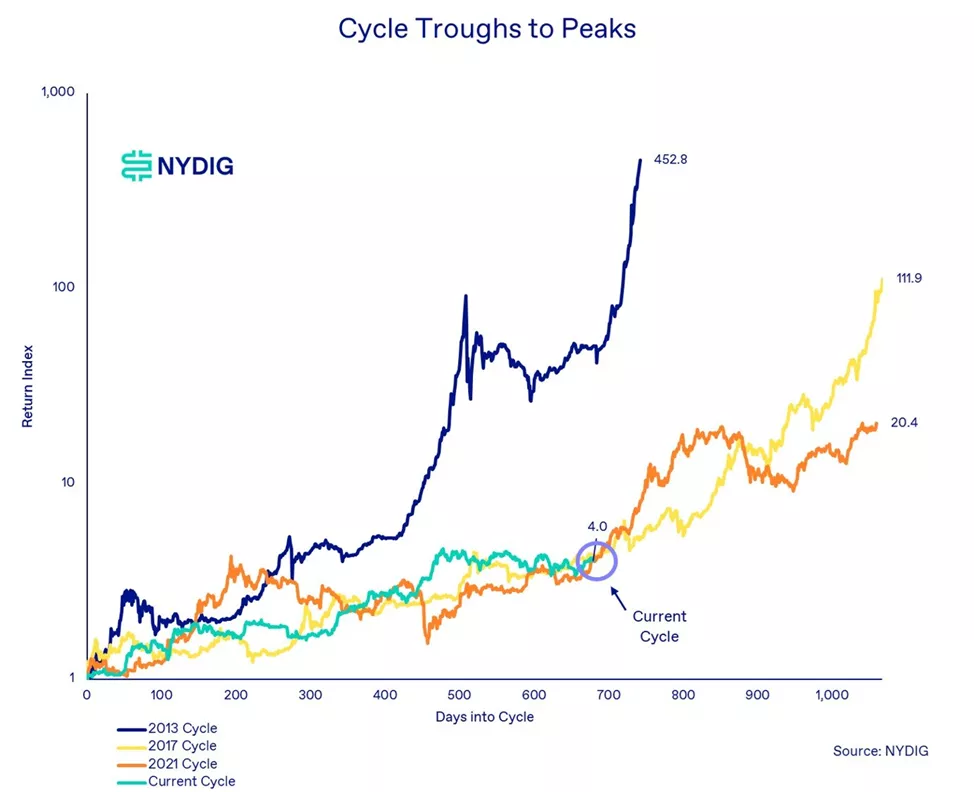

The end of Q3 brought positive momentum due to global monetary policy easing and stimulus measures from China. Experts noted that Bitcoin’s current position aligns with phases from previous cycles.

“Investors may be frustrated with range-bound trading, but Bitcoin is now at the same stage as in past cycles,” said analysts.

Correlation with the Stock Market

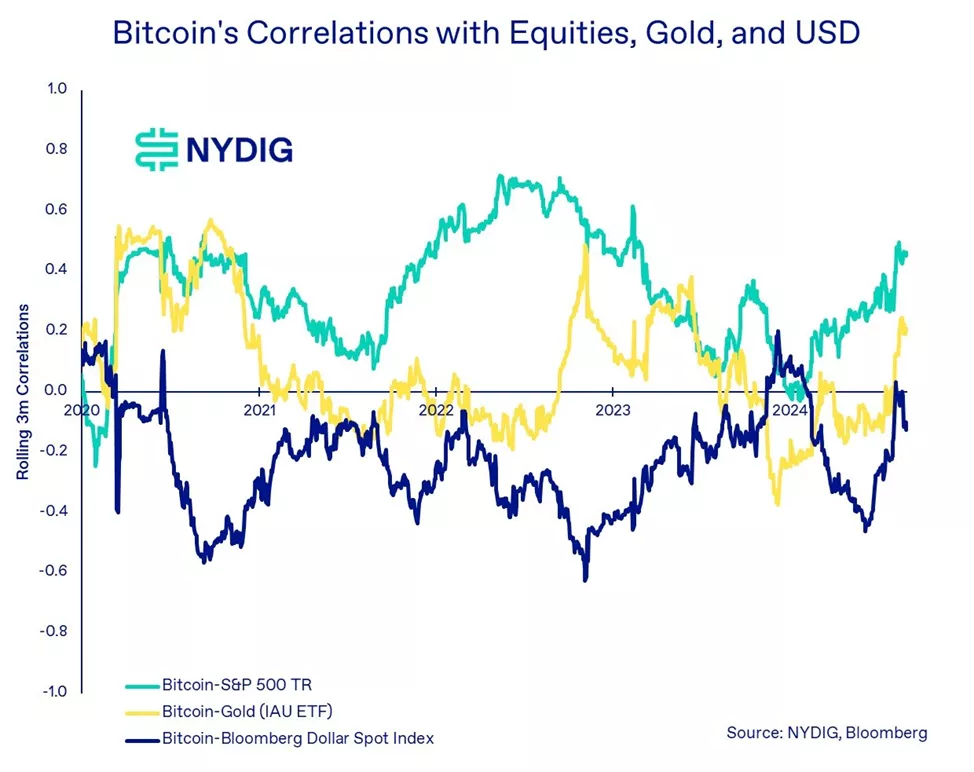

Bitcoin’s correlation with the U.S. stock market over the past 90 days has been 0.46, a figure that indicates significant benefits from adding Bitcoin to multi-asset portfolios.

Experts also believe that October-December is traditionally a “bullish” period for Bitcoin, and several factors could “rhyme” with previous cycles. One such factor is the U.S. elections on November 5. If Donald Trump wins, cryptocurrencies are expected to receive significant endorsement and support.

“Trump, if he wins, will provide more growth for assets than his opponent,” said the specialists.

Current Forecasts

Analysts noted that despite volatility, Bitcoin’s rally is expected to continue. Canaccord has previously stated that such a rally is inevitable.

As a reminder, on the night of October 7, Bitcoin reached the $64,000 mark due to positive U.S. labor market data and expectations of a Federal Reserve rate cut in November.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.