Analysts at Bitwise have released a global crypto market report for Q3 2024, analyzing the performance of major blockchains, key trends, and important events.

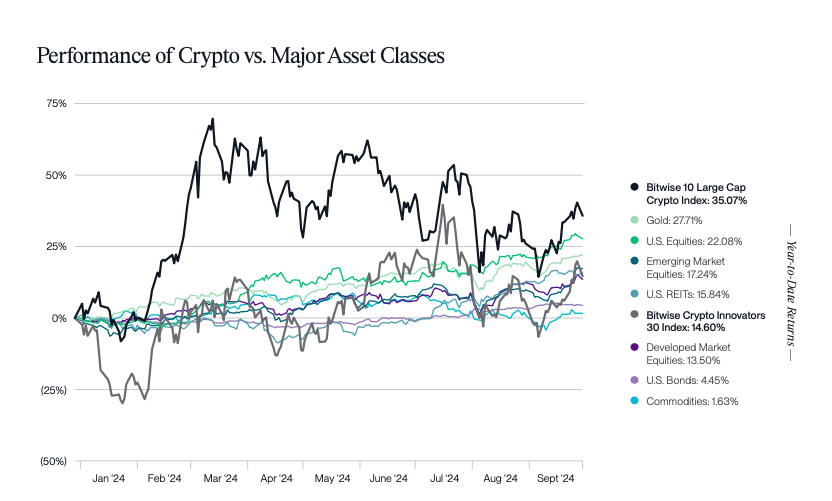

“During the reporting period, cryptocurrency prices remained unchanged. The Bitwise 10 Large Cap Crypto Index ended the quarter down 3.5%, marking one of the smallest price fluctuations in crypto history. But external calm masked significant progress,” the report states.

Key and Upcoming Events

Here are the top 10 narratives from July to September according to the analysts:

- Support for Cryptocurrencies by Politicians: Donald Trump spoke at the Bitcoin 2024 conference in Nashville, and his opponent Kamala Harris voiced support for digital assets.

- Bank Involvement: The SEC approved BNY Mellon’s decision to begin custody of crypto assets.

- Approval of Spot Ethereum ETFs: This came as a surprise to the market.

- Institutional Dominance: Around 60% of the largest hedge funds now hold crypto assets.

- Morgan Stanley Embraces Bitcoin: The firm will allow its brokers to recommend cryptocurrency-based ETFs to clients.

- Polymarket Overcomes the “Chasm”: Trading volume surpassed $1 billion.

- Tether Prints Money: USDT issuer Tether earned $6.2 billion in profits.

- Mt.Gox Completes Distribution of Funds: The long-awaited payouts were finalized.

- Bitcoin ETF Options: The SEC gave a green light to Bitcoin ETF options.

- Vehicle Registration on the Blockchain: 42 million vehicle titles were registered on Avalanche.

Future Catalysts for the Market

Bitwise also identified several future catalysts for the crypto market:

- U.S. Elections and Regulation: Cryptocurrencies are expected to make their way into the White House, regardless of the election results.

- Interest Rate Cuts and Economic Stimulus: Low rates create favorable conditions for cryptocurrencies.

- Resumption of Inflows into ETFs: Bitcoin funds attracted $18.9 billion, with further growth expected.

- New Projects and Applications: Many solutions, including stablecoins and DePIN, will begin to scale.

Q3 Market Performance

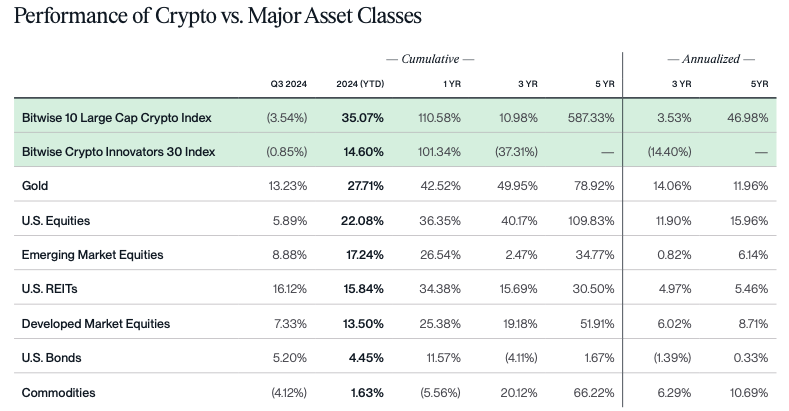

- YTD Performance: The Bitwise index of the top 10 cryptocurrencies has gained 35% year-to-date, outperforming gold (27.7%) and U.S. Treasury bonds (22%).

However, in quarterly terms, the index underperformed most other asset classes.

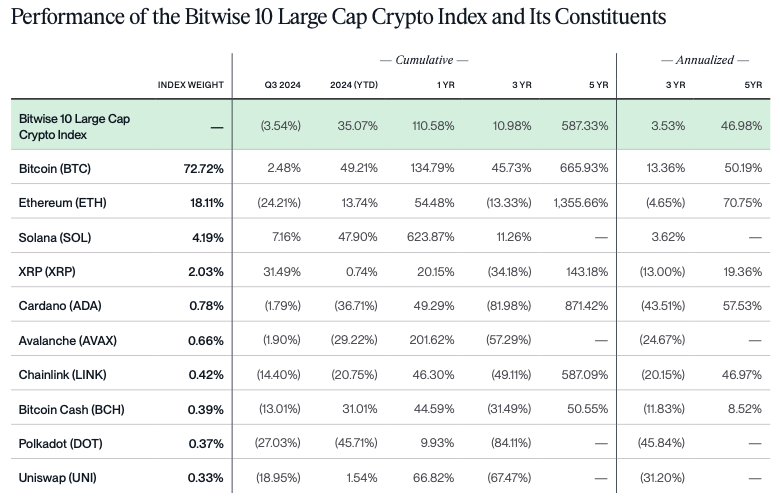

- Top Performers: XRP saw the biggest gains in Q3, up 31.5%, followed by Polkadot at 27% and Ethereum at 24.2%.

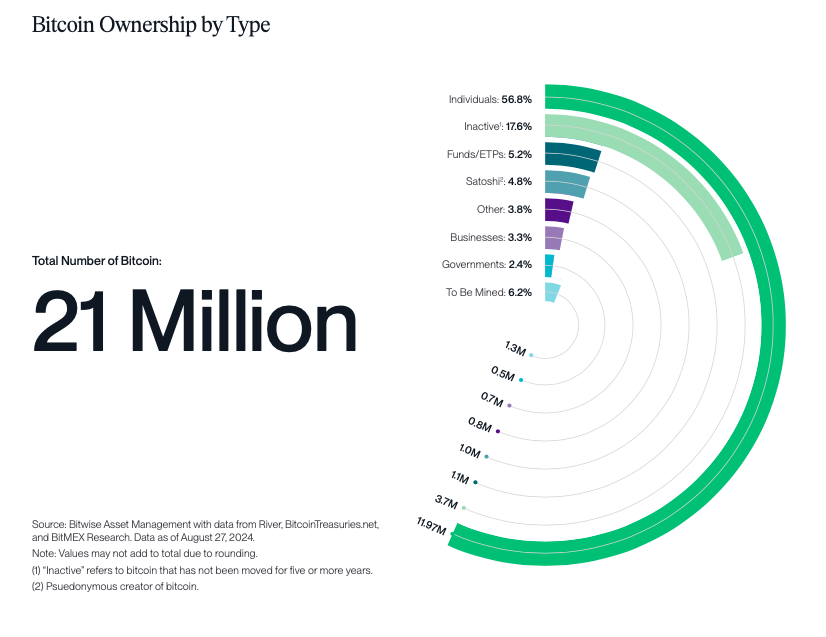

- Bitcoin Distribution: As of September, 56.8% of Bitcoin’s supply is held in personal wallets, 17.6% is inactive, 5.2% is in funds, 4.8% is on Satoshi Nakamoto’s addresses, 3.3% belongs to businesses, and 2.4% is held by governments. The remaining 6.2% has not yet been mined.

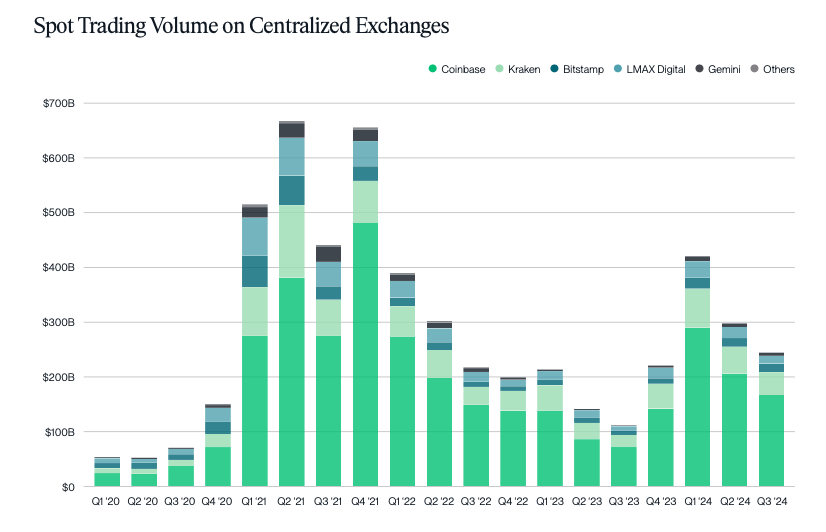

- Trading Volume Decline: Trading volumes on centralized exchanges continued to decline, falling to $240 billion.

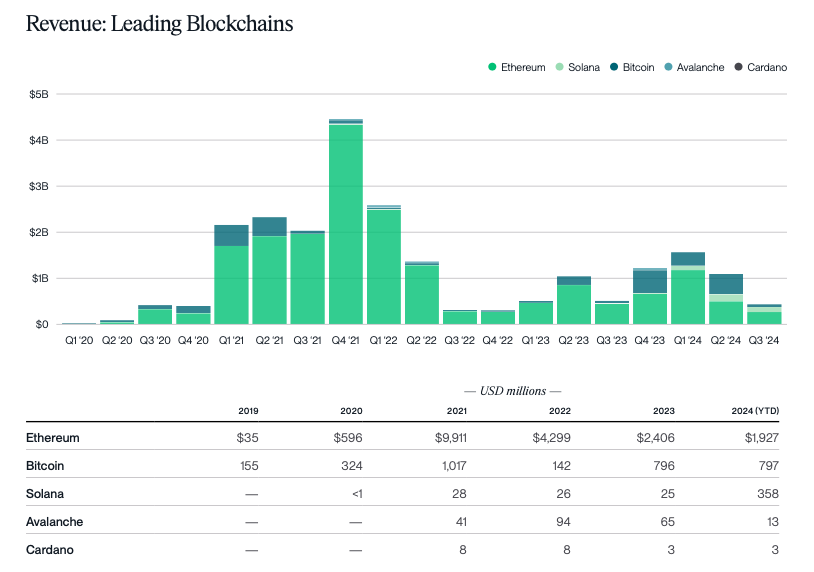

- Leading Blockchain by Revenue: Ethereum leads with $1.92 billion in revenue year-to-date, followed by Bitcoin ($797 million) and Solana ($358 million).

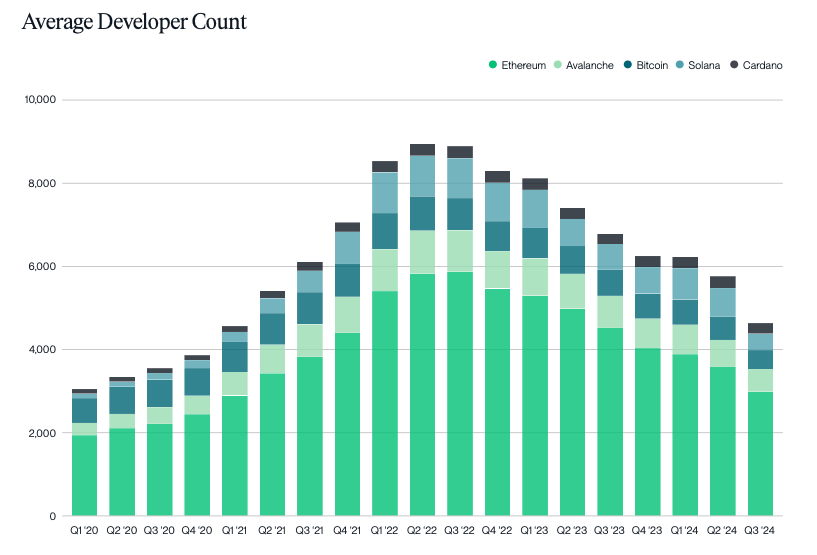

- Developer Numbers: The number of developers across ecosystems continues to decrease since Q2 2022.

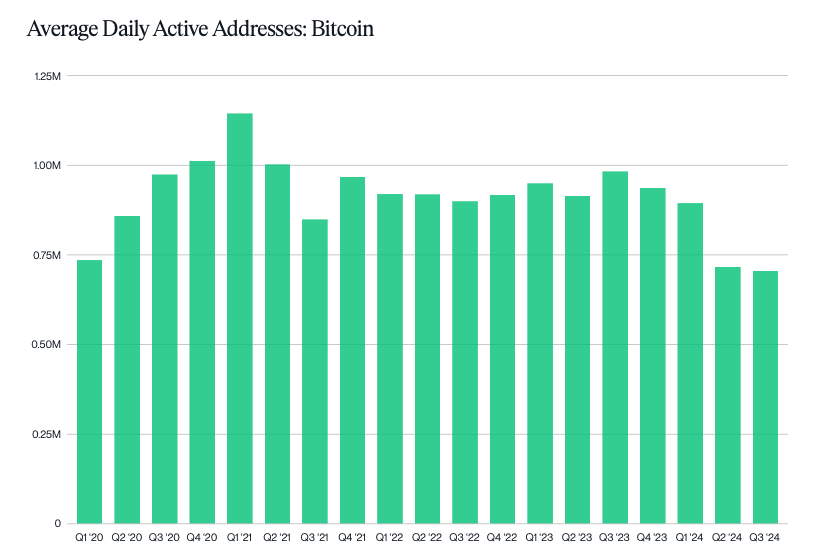

- Active Bitcoin Addresses: The average number of daily active Bitcoin addresses dropped to 700,000.

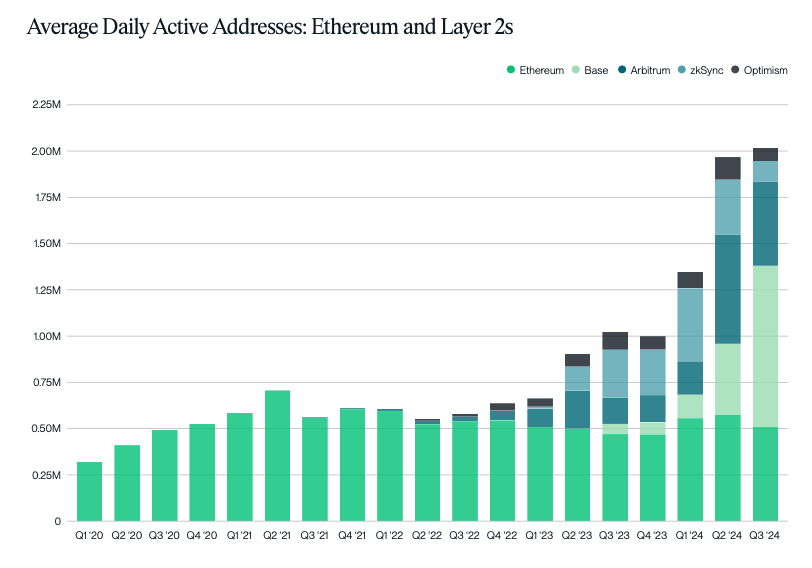

- Ethereum and L2 Networks: Ethereum and Layer-2 solutions saw more than 2 million active addresses daily.

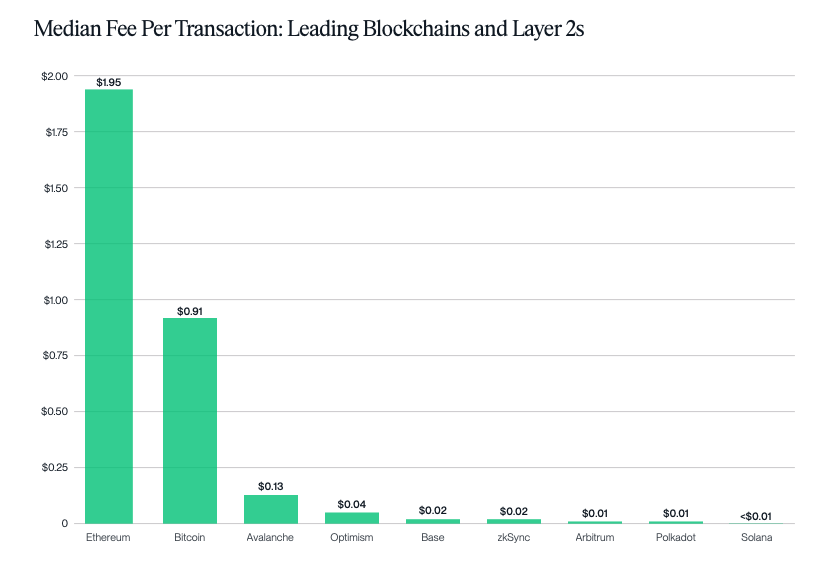

- Transaction Costs: Ethereum’s average transaction cost is more than double Bitcoin’s.

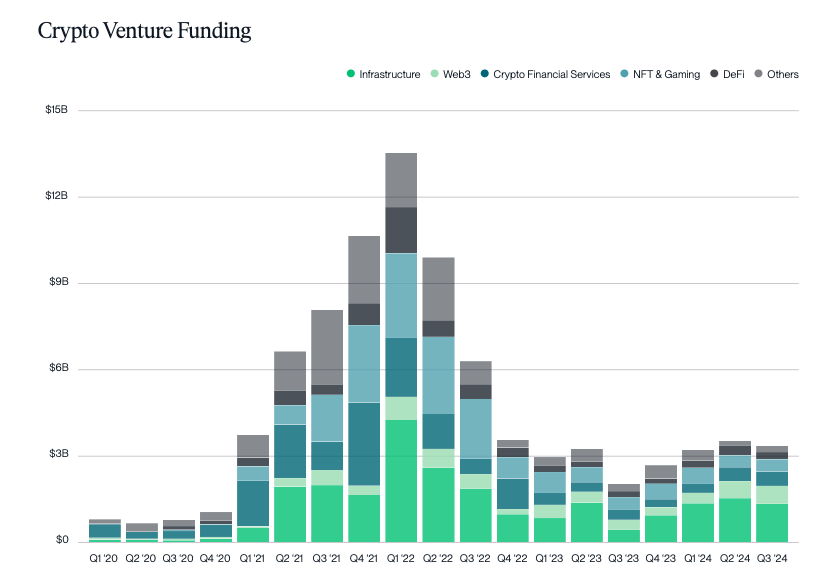

- Venture Capital Funding: Venture funding for the crypto industry remained steady at about $3 billion, similar to the previous quarter.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.