On Wednesday, October 16, the price of the first cryptocurrency, Bitcoin, exceeded $68,000, rising by 4% over the past 24 hours, according to CoinGecko.

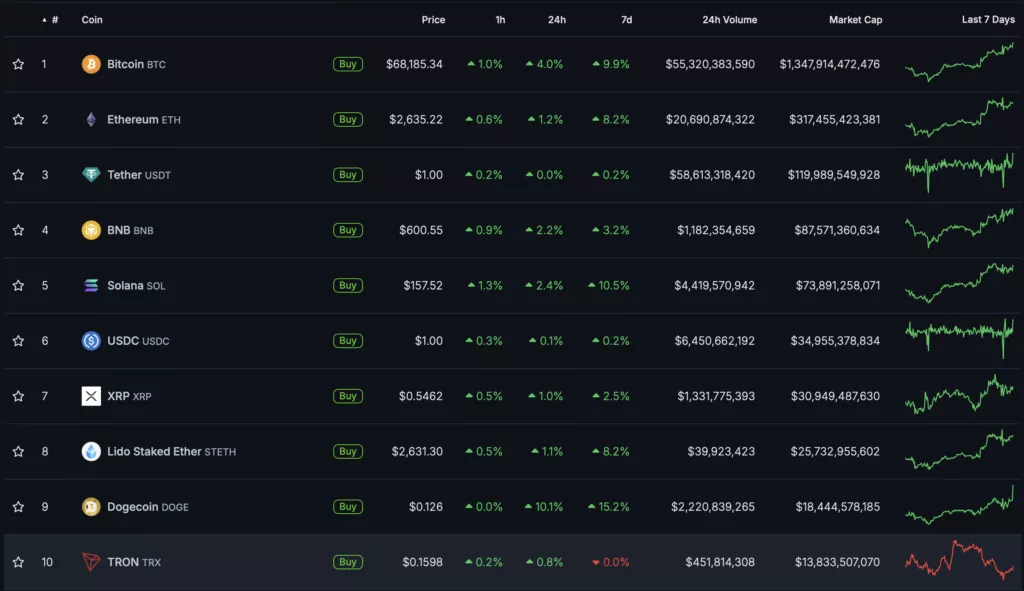

At the time of writing, Bitcoin is trading at $68,200 — its first time reaching this level since July. All top-10 digital assets by market capitalization also show positive movement, following Bitcoin’s lead. The highest gains were seen in Dogecoin (+15.2%) and Solana (+10.5%).

The total market capitalization of digital assets reached $2.45 trillion, with Bitcoin dominance at 59%.

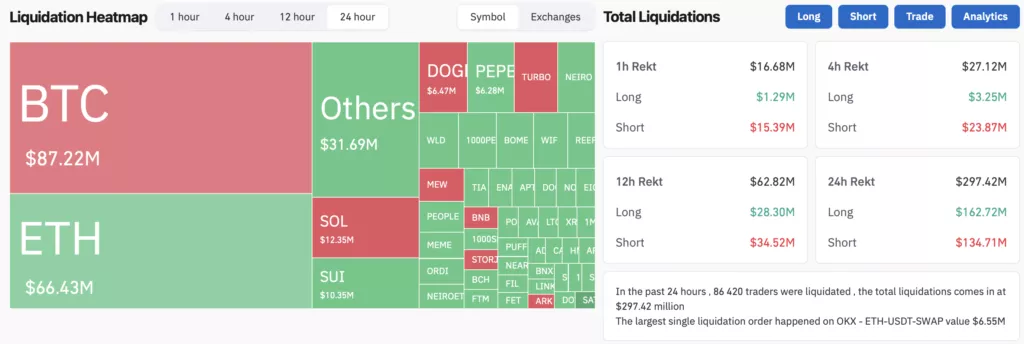

According to Coinglass, the total volume of liquidated positions in the past 24 hours exceeded $297 million. Of that, $162.6 million came from long positions, and $134.7 million from shorts.

The Fear and Greed Index has risen to 73, signaling high levels of greed in the market.

Previously, on October 12, Bitcoin tested the $63,000 level, and just two days later, the price surpassed $66,000, reaching $68,000.

Factors Behind the Growth

Analysts at Bernstein link the current Bitcoin rally to increased chances of Donald Trump’s victory in the upcoming U.S. presidential elections. This view is also shared by experts from JPMorgan.

Additionally, factors contributing to Bitcoin’s potential rise above $80,000 by the end of the year include the possibility of a 50bps rate cut by the Federal Reserve, China’s economic stimulus measures, and the absence of major surprises in the crypto industry.

In October, CEO of BlackRock, Larry Fink, also expressed confidence in Bitcoin’s continued price growth.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.