The Italian government has announced an increase in the capital gains tax on cryptocurrency profits to 42%, according to a statement from Deputy Minister of Economy Maurizio Leo, reported by Il Sole 24 Ore.

This increase will apply to profits exceeding €2000 and is a significant step in tightening tax control over cryptocurrency assets in the country.

Reasons for the Tax Hike

The tax increase on cryptocurrencies is part of a series of measures approved by the Italian government aimed at supporting social programs and business development. These changes include raising the tax rate on cryptocurrency profits, introduced for the first time in 2023. Additionally, the government plans to review criteria for online income and tighten measures against tax evasion, focusing on enhanced control over electronic payments.

“We expect the capital gains tax on Bitcoin to rise from 26% to 42%,” Leo stated at a conference discussing the 2025 budget.

Cryptocurrency Community’s Reaction

The news of the tax hike has sparked mixed reactions in the cryptocurrency community.

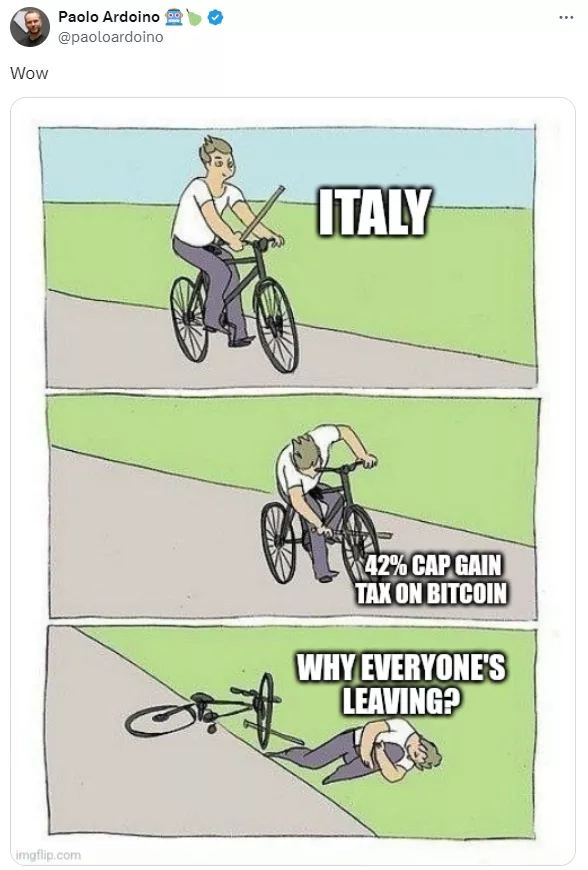

Paolo Ardoino, CEO of Tether and originally from Italy, responded to the news with a meme, which sparked heated discussions on social media. His colleague, Luigi D’Onorio Demeo, Chief Operating Officer at Ava Labs, known for the Avalanche blockchain, also expressed his discontent, briefly calling the situation “harsh.”

Despite statements from Italian Prime Minister Giorgia Meloni that the government does not plan to introduce new taxes, the cryptocurrency community has perceived this change as contradictory to the promise of reducing the tax burden on citizens.

Oggi, in Consiglio dei Ministri, abbiamo varato la legge di bilancio, un intervento che mette al centro i cittadini, le famiglie e il rilancio della nostra Nazione.

— Giorgia Meloni (@GiorgiaMeloni) October 15, 2024

Come avevamo promesso, non ci saranno nuove tasse per i cittadini. Inoltre, rendiamo strutturale il taglio delle… pic.twitter.com/scgmgnzBw9

Context and Impact on Cryptocurrency Jurisdictions

Italy has been considered less favorable as a tax jurisdiction for cryptocurrency holders in recent times. In February 2024, Manimama, a law firm specializing in cryptocurrency law, published a list of jurisdictions with the most favorable tax conditions for digital assets, and Italy did not make the list.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.