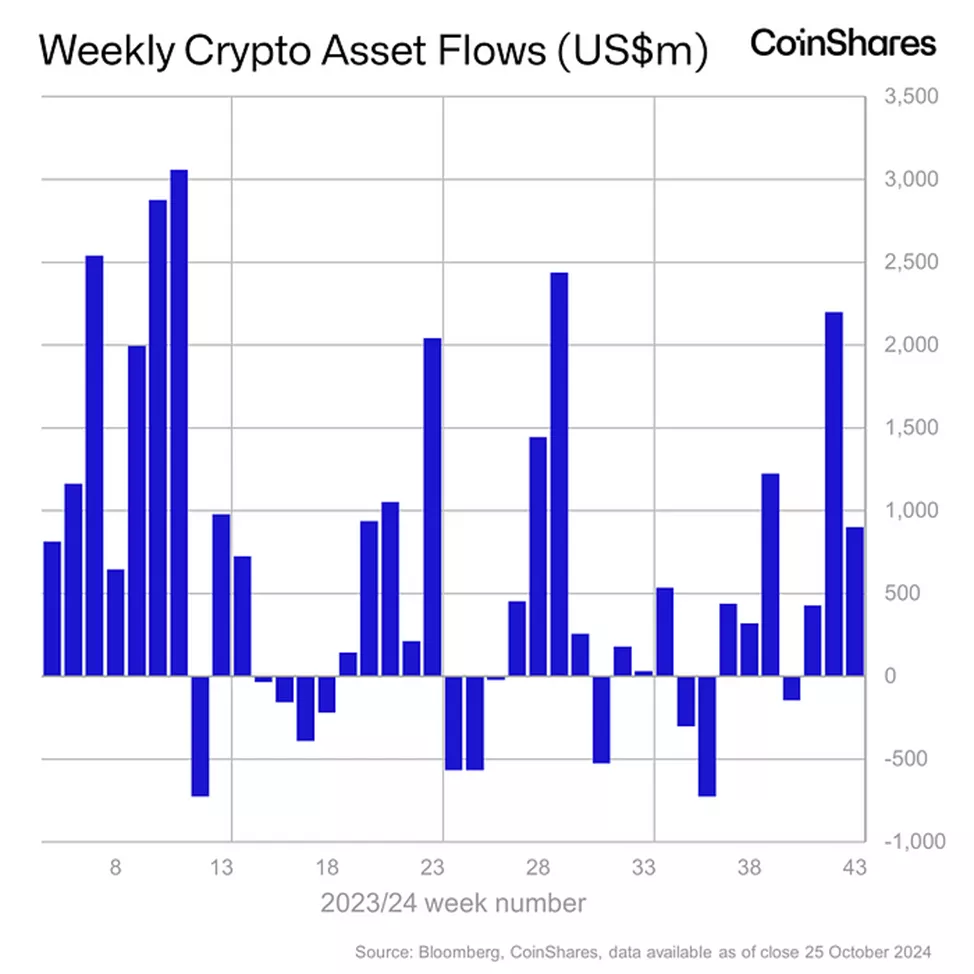

From October 20 to October 26, cryptocurrency investment funds saw inflows of $901 million, following a record $2.2 billion the previous week, according to CoinShares.

Since the beginning of the year, total investments in such products have exceeded $27 billion, tripling the 2021 record of $10.5 billion.

“US politics significantly influence Bitcoin inflows. The recent surge in interest is likely linked to the strengthening position of Republicans,” the analysts noted in the report.

Bitcoin and Other Assets

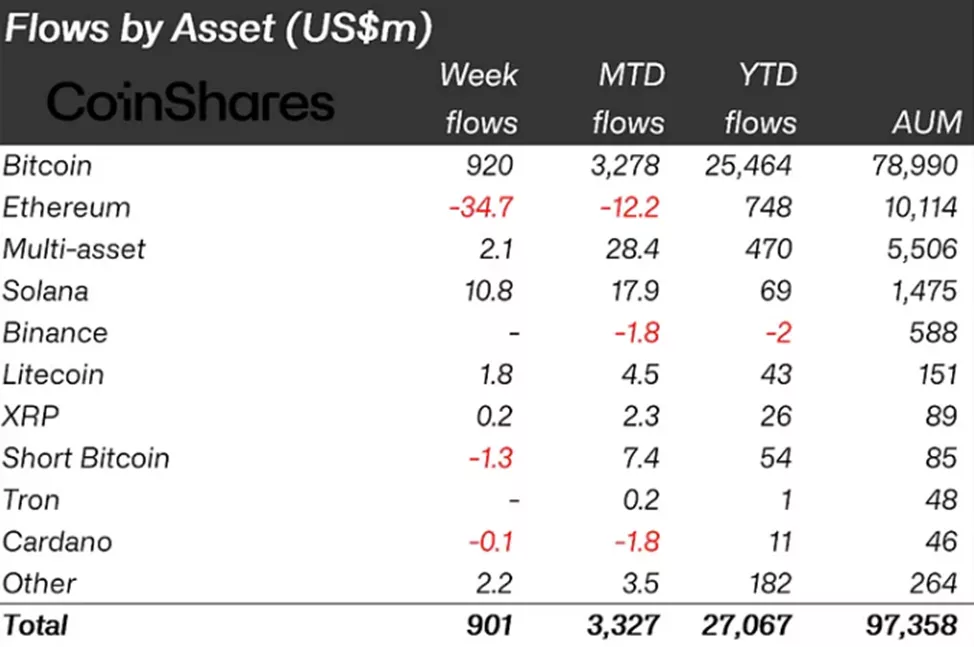

Funds focused on Bitcoin instruments saw a $920 million increase, compared to $2.13 billion the prior week.

Meanwhile, short Bitcoin funds recorded outflows of $1.3 million after attracting a record $12.3 million the previous week, the highest since March.

Ethereum funds experienced another outflow of $34.7 million following an inflow of $57.5 million the week before.

Other highlights include growing interest in Solana, Litecoin, and XRP-based products, with inflows of $10.8 million, $1.8 million, and $0.2 million, respectively. Investments in other altcoins totaled $2.1 million.

BTC-ETF Accumulation and Options Activity

BTC-ETF issuers, including BlackRock and Fidelity, acquired 976,873 BTC valued at $66.2 billion, representing approximately 5% of the available Bitcoin supply.

In the options market, investors anticipating a potential rally following the US elections and the Federal Reserve meeting are actively increasing open positions in November call options with strike prices above $80,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.