As of October 28, spot Bitcoin ETFs have attracted $479.35 million in inflows, marking the largest figure in the past two weeks.

BlackRock’s Dominance

The IBIT fund by BlackRock contributed the most, with inflows of $315.19 million, extending its streak of “positive” days to 11.

The total trading volume for all Bitcoin ETFs reached $3 billion, up from $2.9 billion recorded on Friday, October 25. Since October 11, cumulative inflows into spot Bitcoin funds have totaled $3.85 billion.

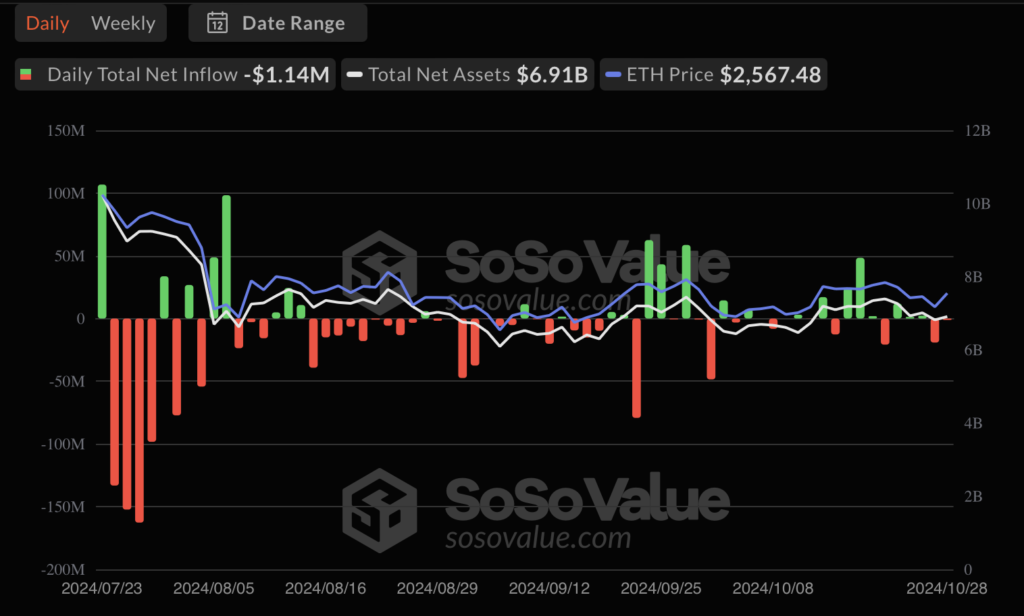

Ethereum ETF Performance

In contrast, Ethereum-based ETFs showed less dynamic performance. On October 28, near-zero inflows were observed, with previous days also showing little growth.

Outflows of $8.44 million were recorded from Grayscale’s ETHE fund, while other funds showed modest increases:

- FETH by Fidelity: $5.02 million

- ETHA by BlackRock: $2.28 million

Total trading volume for Ethereum ETFs was $187.49 million, nearly matching the $189.88 million recorded on October 25.

Broader Context

On the morning of October 29, Bitcoin’s price surged above $71,000. However, analysts caution about a potential correction following the upcoming US elections.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.