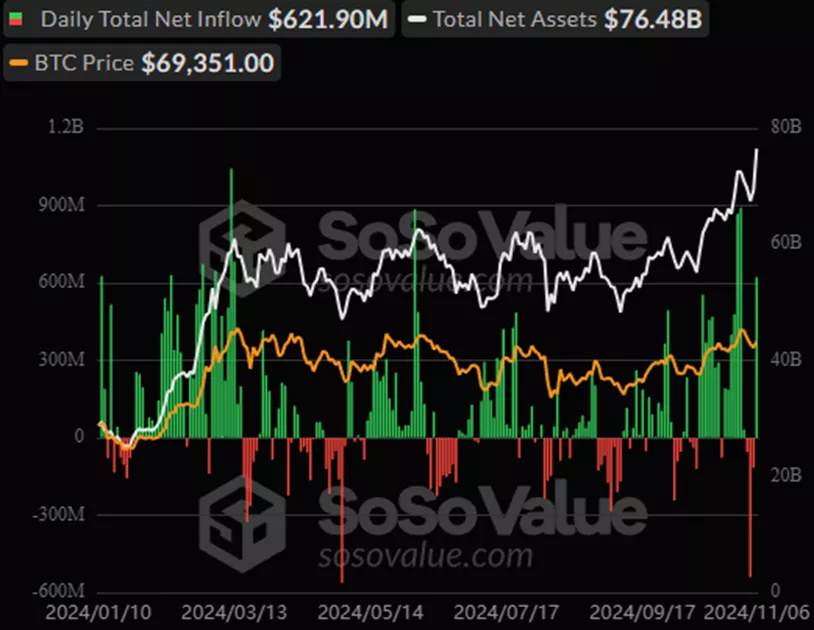

On November 6, BTC-ETF trading volume peaked at $6.1 billion, the highest since March 15. Notably, BlackRock’s IBIT set a record with $4.14 billion in trading volume.

Bloomberg analyst Eric Balchunas highlighted that this figure surpassed the trading volumes of companies like Berkshire Hathaway, Netflix, and Visa. Balchunas anticipates that high activity in the coming days will lead to increased inflows into this product.

On November 6, inflows into the BTC-ETF sector amounted to $622 million, breaking a three-day negative streak.

Year-to-date cumulative inflows into BTC-ETFs reached $24.1 billion.

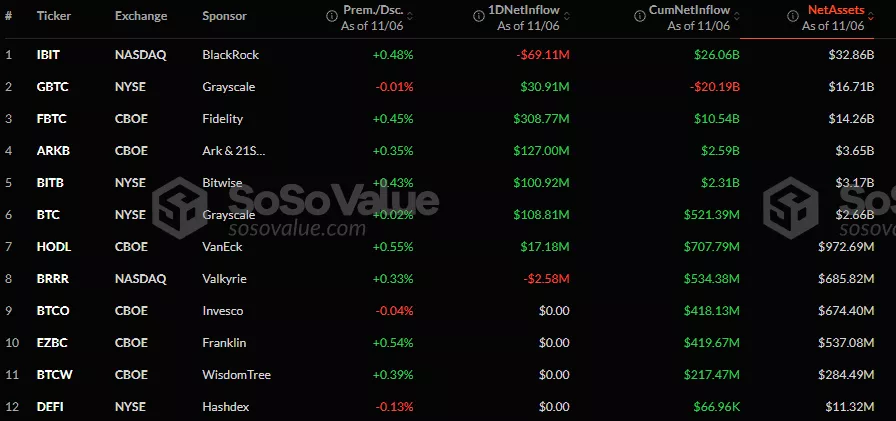

Meanwhile, withdrawals were also recorded on November 6, with $69.1 million pulled from BlackRock’s IBIT and $2.6 million from Valkyrie’s BRRR. Inflows were distributed as follows:

- FBTC by Fidelity: $308.8 million

- ARKB by ARK Invest and 21Shares: $127 million

- BTC by Grayscale: $108.8 million

- BITB by Bitwise: $100.9 million

- GBTC by Grayscale: $30.9 million

- HODL by VanEck: $17.2 million

It’s worth noting that recently, the Michigan state pension fund announced the acquisition of 460,000 shares of Grayscale Ethereum Trust (ETHE) for over $10 million, as well as 460,000 shares of Grayscale Ethereum Mini Trust ETF worth approximately $1.1 million.

Earlier, Syncracy Capital co-founder Daniel Chung expressed the opinion that following Trump’s victory, approval of a SOL-ETF could happen as early as Q1 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.