Analysts at 21Shares have identified Ethereum’s potential for growth, drawing parallels with Amazon’s development in the early 1990s when the company transformed into a global tech giant with a market cap of $2 trillion. The report, published by Cointelegraph, highlights that Ethereum also has the ability to create revolutionary opportunities that are hard to fully imagine at this stage.

“Just like Amazon, which started with books and revolutionized entire industries, Ethereum has the potential to surprise us with new applications that are difficult to predict.”

Just as Amazon transformed the way we shop and consume digital services, Ethereum launched in 2015 as a platform for smart contracts and now supports the DeFi ecosystem, valued at over $140 billion. With a market cap of $320 billion, Ethereum now represents roughly 6.25% of Amazon’s total value.

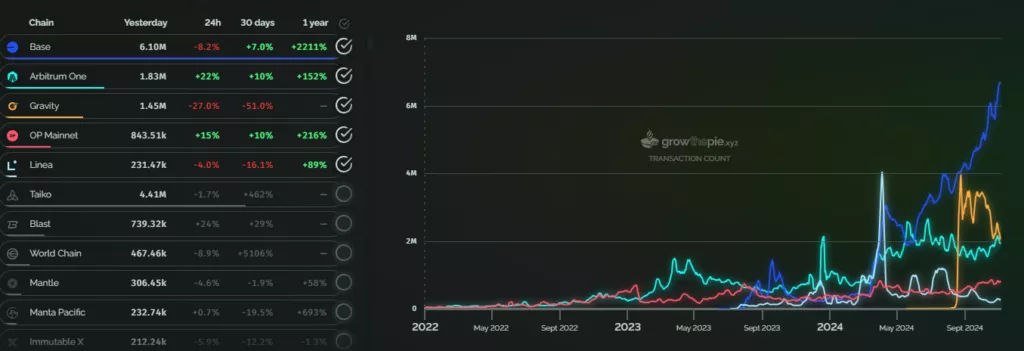

Despite competition from Solana and other layer-1 (L1) solutions, Ethereum remains dominant in decentralized exchanges, lending, stablecoins, and the tokenized asset market.

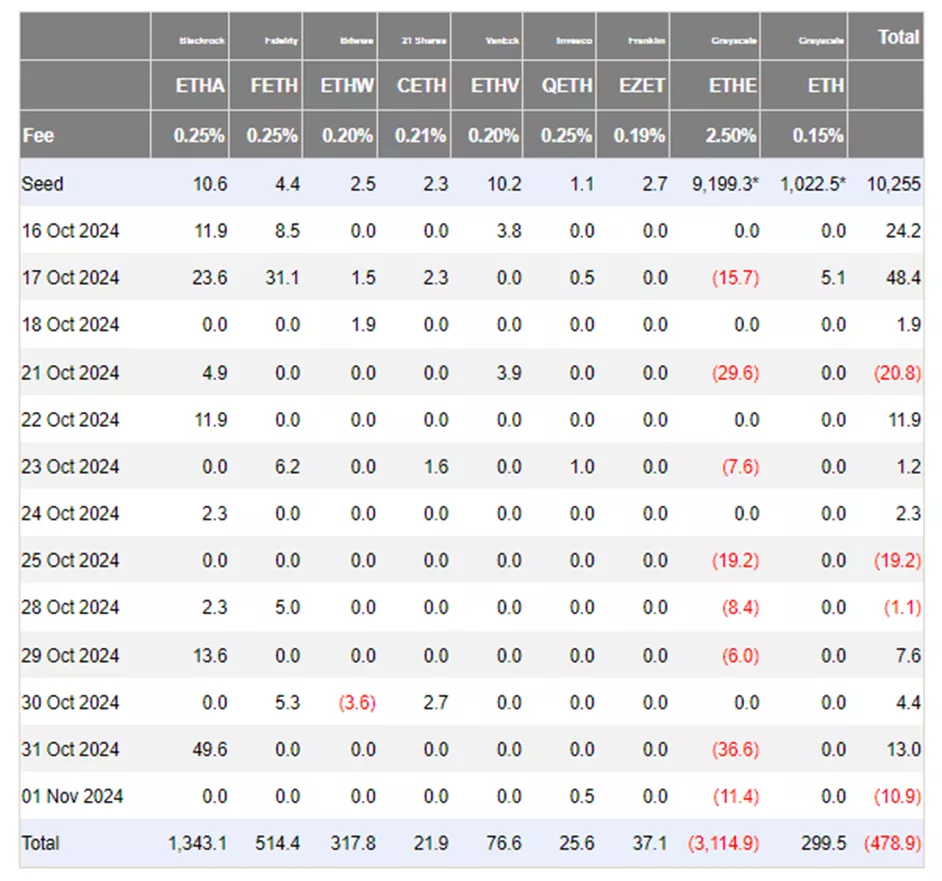

Low Inflows into ETH-ETFs: Expert Analysis

The low interest in ETH-ETFs is attributed by 21Shares to a lack of awareness among traditional investors about Ethereum’s potential. The company believes that as understanding deepens and new use cases for the second-largest cryptocurrency emerge, the situation regarding inflows will improve.

At Sygnum Bank, they note that interest in ETH-ETFs is limited due to the absence of staking yields in such products, as well as the fact that investors are still evaluating Bitcoin funds. ZX Squared Capital also pointed out the decline in Ethereum’s earnings as more activity shifts to L2 solutions.

Quote from Chang Guang Zhen:

“On Wall Street, cash flow analysis is widely used to assess assets, and the decline in Ethereum’s earnings due to L2 solutions may dampen interest in ETH.”

Scaling Through L2: Lessons from Amazon

According to 21Shares, Ethereum’s strategy for developing layer-two solutions allows the platform to attract millions of new users with minimal costs. Much like Amazon, which endured losses for years to scale, Ethereum is prepared to continue its development. The fees generated from L2 solutions are expected to eventually bring the network’s earnings back to previous levels.

Earlier, Cointelegraph noted Ethereum’s potential growth, including a possible rise to $6,000. Hashkey Capital believes that the altseason could begin once Bitcoin hits the $80,000 mark.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.