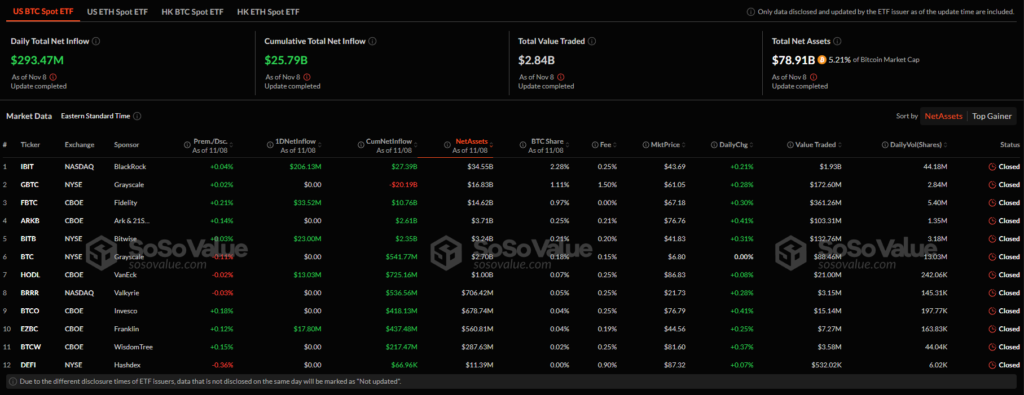

On November 8, 2024, US-based spot crypto funds for Bitcoin and Ethereum recorded a net capital inflow of $379.3 million. The majority of the funds flowed into Bitcoin-focused ETFs, which collectively received $293.47 million, according to data from SoSo Value.

The leader in financial inflows was the crypto fund from BlackRock. The investment product with the ticker IBIT received $206.1 million, bringing its assets under management (AUM) to $34.55 billion.

In second place was the spot Bitcoin ETF from Fidelity Investments, FBTC, which received $33.5 million, with an AUM of $14.62 billion.

Third place went to the crypto fund from Bitwise Asset Management. The spot Bitcoin ETF with the ticker BITB received $23 million, with an AUM of $3.24 billion.

Additionally, capital inflows were recorded in funds from Franklin Templeton ($17.8 million) and VanEck ($13 million). The remaining seven spot Bitcoin ETFs finished the day with no net change in inflows or outflows.

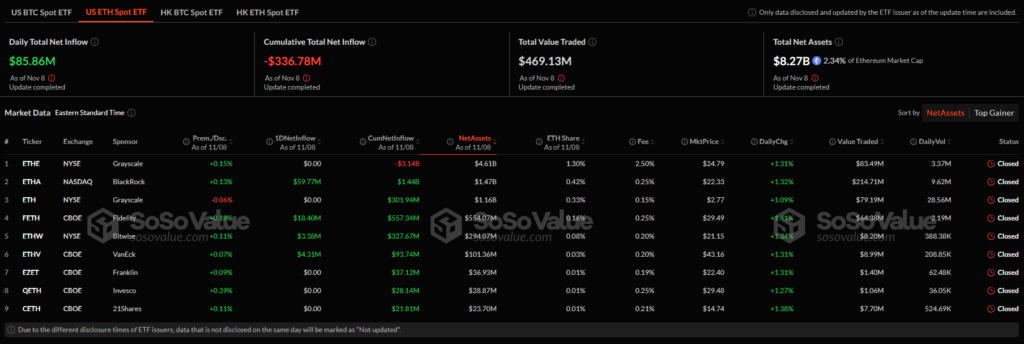

The segment of cryptocurrency funds based on Ethereum saw inflows of $85.9 million over the past 24 hours. The leader in financial inflows was the spot Ethereum ETF from BlackRock. The product with the ticker ETHA received $59.8 million.

Funds also received inflows from the following companies:

The other five spot Ethereum ETFs finished the day with zero net change in inflows and outflows.

Earlier in November 2024, spot Bitcoin ETFs saw a record inflow of $1.38 billion.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.