On November 24, Bitcoin briefly dipped below $96,000, driven by a surge in profit-taking that reached an all-time high of $443 million in daily realized gains, according to data from CryptoQuant.

BTC: Realized Profit reached an ALL-TIME HIGH of $443 million (daily) 🤑 pic.twitter.com/XXANCIogxk

— Maartunn (@JA_Maartun) November 23, 2024

Sharp Decline and Recovery

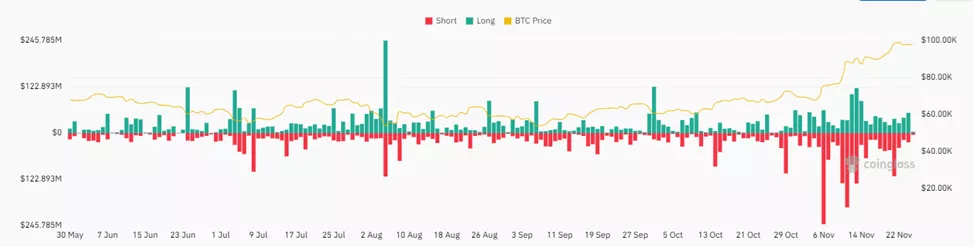

As of now, Bitcoin has partially recovered, trading at $98,000. The sharp drop triggered significant liquidations in the derivatives market, with total positions worth $53.8 million being wiped out.

Expert Insights

Analysts at CryptoQuant report that unrealized profits currently stand at 57%, compared to a peak of 69% in March 2024. This indicates a heightened probability of further price corrections, according to experts.

Likelihood of a correction increased? 😱

— Maartunn (@JA_Maartun) November 23, 2024

Unrealized Profit levels are elevated, currently sitting at 57%. This is approaching the March 2024 peak of 69%, signaling an increased probability of a price correction. pic.twitter.com/f0VEJMJSYw

“Such price swings are common in highly volatile markets. However, profit-taking at this scale often signals significant market movements ahead,” noted analysts.

Long-Term Outlook

Despite the recent correction, investment firm VanEck has reaffirmed its optimistic outlook, predicting Bitcoin could reach $180,000 in the near future. Similarly, analysts from Bernstein highlighted key catalysts that could drive Bitcoin’s price to $200,000.

Bitcoin’s recent volatility follows a prolonged rally during which the cryptocurrency repeatedly hit new all-time highs throughout 2024.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.