Following Bitcoin’s recent price correction, key metrics indicate the bull market may persist, with a target of $146,000. This analysis comes from CryptoQuant.

Is it too late to buy in?

— CryptoQuant.com (@cryptoquant_com) November 27, 2024

Bitcoin has surged 34% in November '24, with the bull run in full swing.

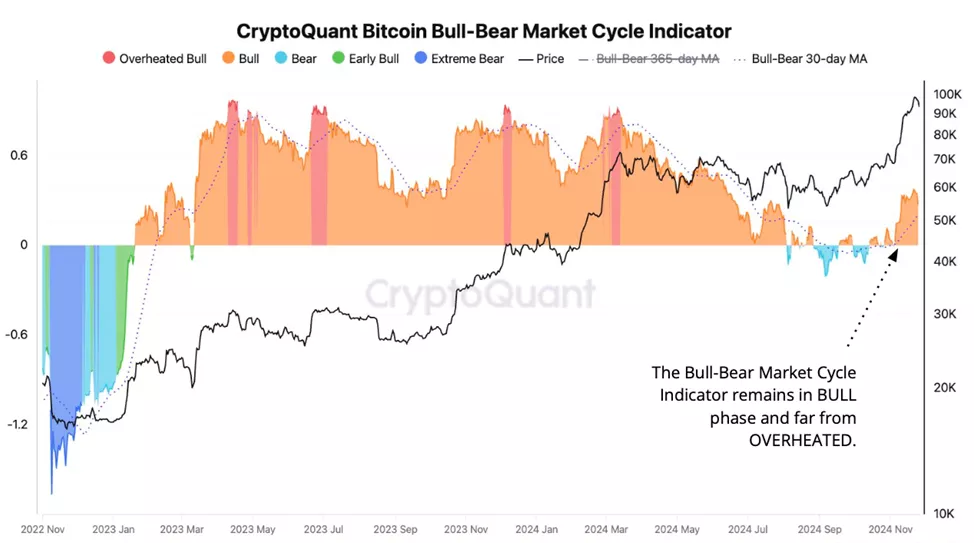

The CryptoQuant Cycle Indicator shows that Cycle Peak hasn't reached the Extreme Bull phase yet, indicating there's still potential for growth.

How can you enter? A thread 👇 pic.twitter.com/DCIovZzuTI

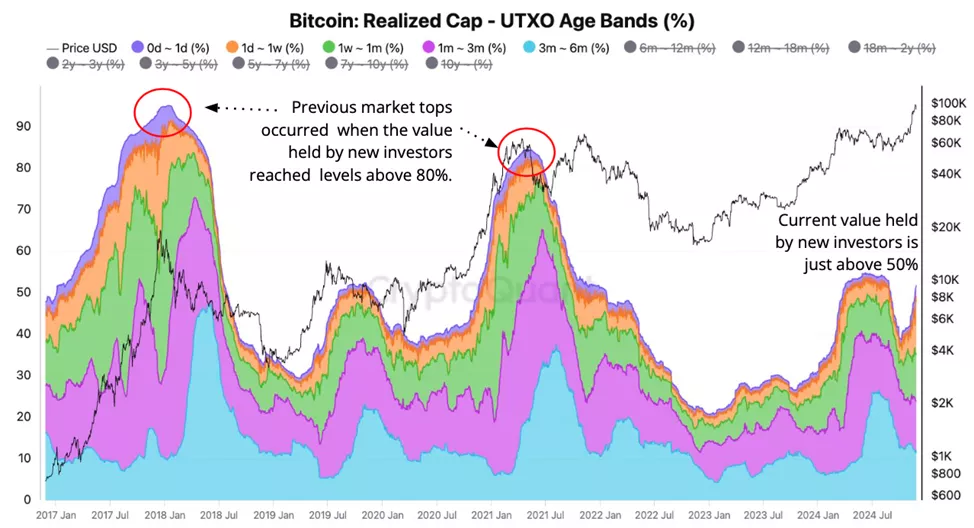

The analysts highlight that currently, coins held by “new investors” represent just over 50% of the total supply. During peak rallies in 2017 and 2021, this metric exceeded 90% and 80%, respectively.

This lower percentage reflects subdued activity among retail investors, a stark contrast to the conditions typically associated with market cycle extremes, according to CryptoQuant.

Since October, retail investors have reduced their holdings by 41,000 BTC, while whales have added 130,000 BTC to their positions.

“Previous bull runs ended when retail investors aggressively bought in. Today, that’s not the case,” the analysts explained.

This shift could signal a change in the accumulation phase, with institutional and large-scale players taking the lead. Between November 18 and 22, inflows into spot BTC ETFs hit a record $3.1 billion as Bitcoin neared the $100,000 mark.

CryptoQuant’s market cycle indicator has remained in bullish territory since early November and continues to rise. Unlike March 2024, when Bitcoin reached an all-time high of $74,000, the indicator has yet to enter the “overheated” zone.

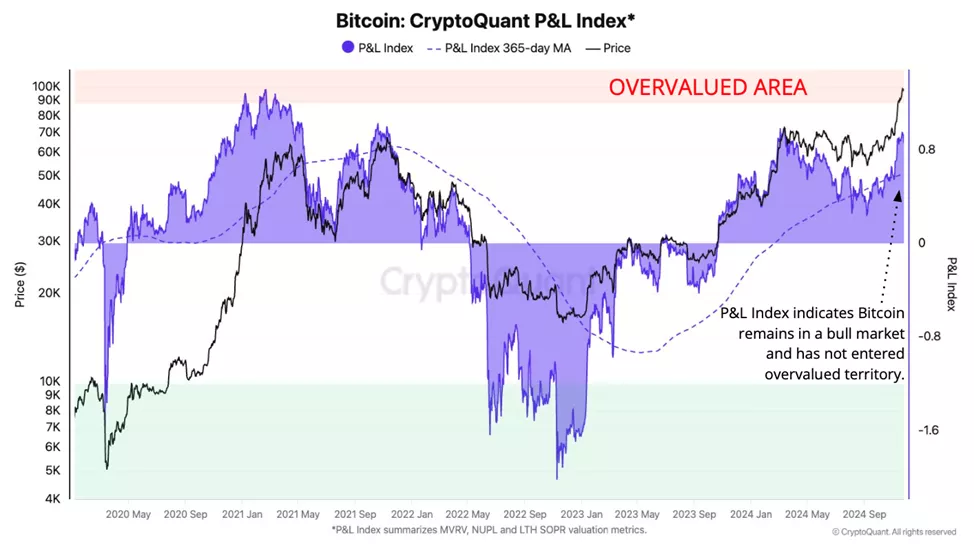

From the perspective of realized price, $146,000 serves as a key target for Bitcoin.

“This range has historically marked the peak during previous bull markets. The P&L index in this cycle has yet to reach overbought levels, suggesting further growth potential,” the report noted.

Reminder: Analysts recently described Bitcoin’s current pullback as a pause before its rise to $100,000.

In a separate forecast, Pantera Capital predicted Bitcoin could climb to $740,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.