Fox Business journalist Eleanor Terrett, citing insider sources, has reported that the U.S. Securities and Exchange Commission (SEC) has rejected at least two applications for spot Solana ETFs. It remains unclear which of the five applicants are affected at the time of writing.

🚨SCOOP: I’ve confirmed that the @SECGov has notified at least two of the five prospective issuers that it will reject their 19b4 filings for the $SOL spot ETFs.

— Eleanor Terrett (@EleanorTerrett) December 6, 2024

The consensus here, I’m told, is that the SEC won’t entertain any new #crypto ETFs under the current administration.

According to Terrett, the SEC under the current administration is unlikely to approve new cryptocurrency exchange-traded funds. She suggested that further rejections of pending applications are possible.

“Remember what happened with spot Bitcoin ETFs? Eleven products were launched on the same day,” the journalist noted.

Five firms have filed applications for spot Solana ETFs: VanEck, 21Shares, Bitwise, Canary Capital, and Grayscale Investments. None of the companies had officially confirmed Terrett’s statement at the time of this publication.

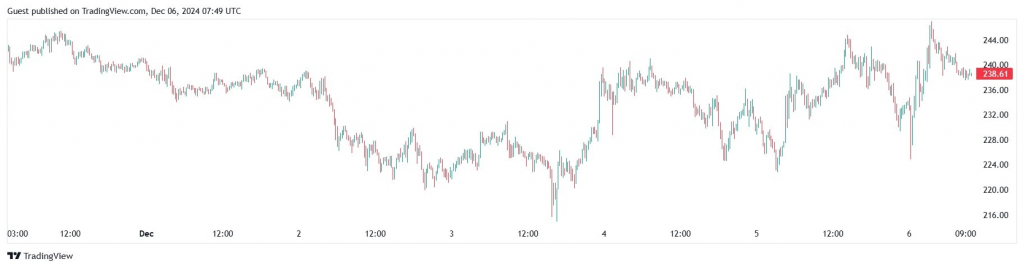

Market Reaction

Solana (SOL) exhibited minimal reaction to the news. The price chart shows high volatility with a slight downward trend.

The muted market response might be attributed to community optimism surrounding the potential appointment of a new SEC chair, expected to reform the agency’s stance on cryptocurrencies. Further details on the anticipated changes in leadership are forthcoming.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.