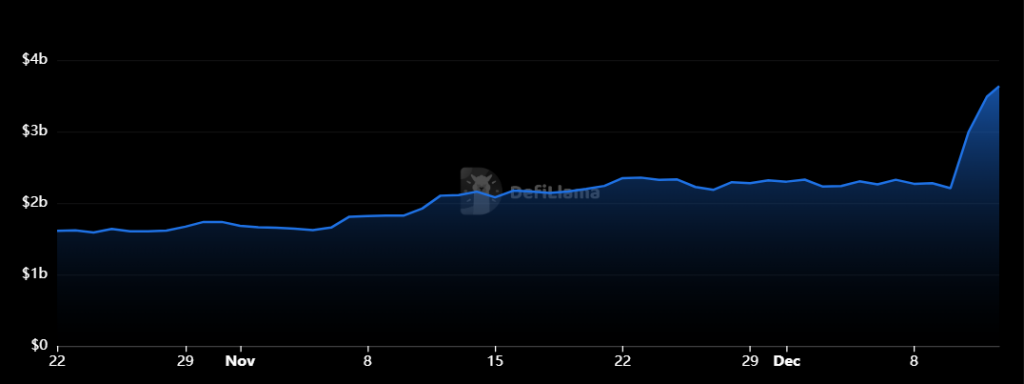

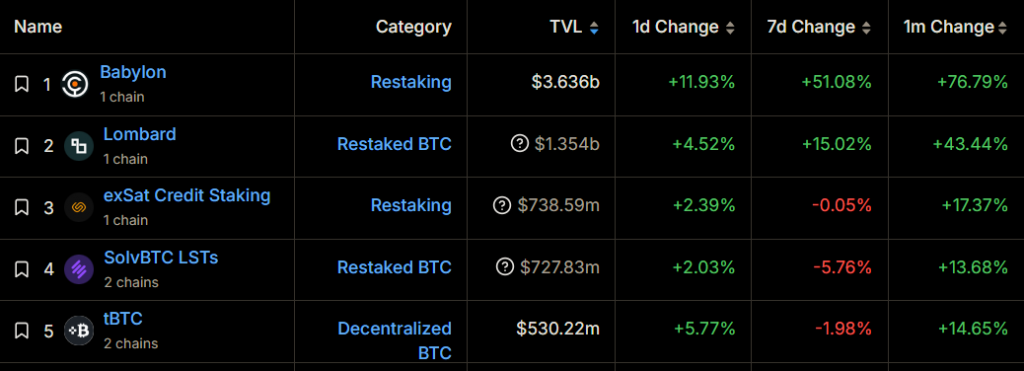

On December 12, the total value locked (TVL) in the Babylon Bitcoin staking protocol reached $3.63 billion.

🥳 $3.5bn BTC staked so far🥳

— Babylon (@babylonlabs_io) December 12, 2024

Let that sink in.

And we’re only just getting started. Still 700+ blocks to go. Cap-3 is still open.

For those who have already staked directly through the Babylon protocol, you can now head over to our discord, verify your BTC address and secure… pic.twitter.com/p6ZIr7NByi

Over the past week, TVL surged by 77%, driven by the launch of the protocol’s second staking round on December 9.

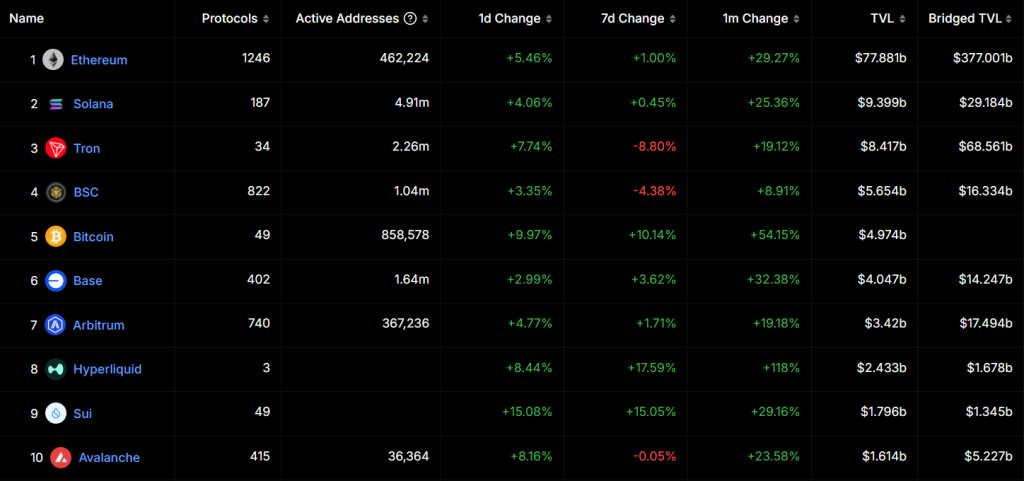

Currently, Babylon accounts for over 75% of the total Bitcoin ecosystem TVL, which stands at $4.974 billion.

This milestone places Bitcoin in fifth position among all networks by total value locked.

In an interview with Cointelegraph, Babylon co-founder Fisher Yu explained that Bitcoin DeFi was virtually non-existent until recently, as all previous staking or token-wrapping methods through dApps required trust. According to him, “true DeFi” relies solely on the blockchain or smart contract.

“We invented Bitcoin staking as a native use case for the cryptocurrency that does not require the holder to trust any third party. Similar to holding or using Bitcoin for simple payments, you trust only Bitcoin and yourself. There’s no need to trust anyone else,” Yu emphasized.

He noted that Bitcoin DeFi is likely to face challenges similar to those in other ecosystems, including coding errors and protocol attacks.

Reminder: On December 5, Binance announced the launch of its On-chain Yields financial products, supported by Babylon staking.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.