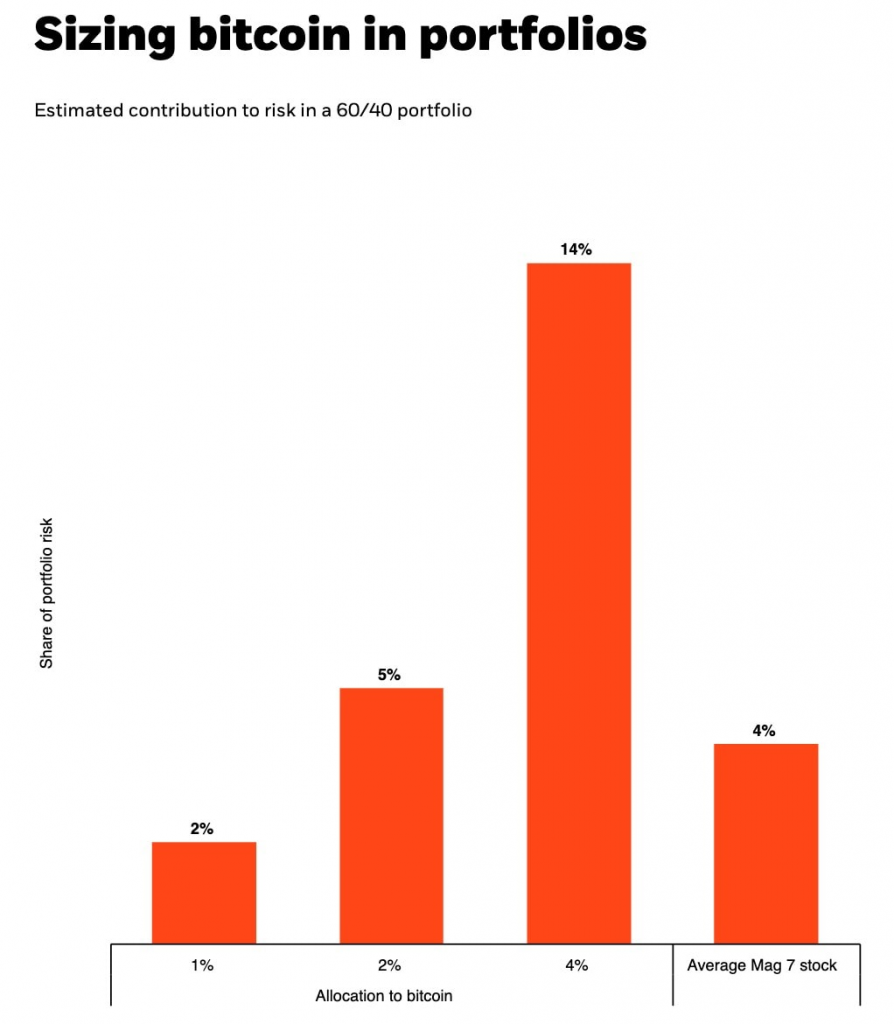

Analysts at BlackRock suggest that Bitcoin should make up 1% to 2% of traditional investment portfolios. They compared the risk level of such an allocation to that of stocks from the “Magnificent Seven,” which include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

According to a report by the BlackRock Investment Institute, this allocation in a standard “60/40” portfolio (60% stocks, 40% bonds) is considered reasonable. It allows Bitcoin to act as a diversifier while minimizing the impact of its volatility on overall risk.

As of the report’s release, the market capitalization of Bitcoin exceeded $2 trillion. Over the past 12 months, Bitcoin’s price has surged by more than 130%, significantly outperforming the S&P 500‘s 32% growth. However, BlackRock recommends capping Bitcoin’s share at 2% to avoid increased risks.

Samara Cohen, BlackRock’s head of ETF and index investments, highlighted that such an allocation strikes the right balance:

“We propose an allocation strategy that minimizes risks while preserving Bitcoin’s potential as a diversifier.”

BlackRock experts pointed to several factors driving a shift in attitudes toward Bitcoin:

- Global fragmentation of financial systems,

- Increasing geopolitical tensions,

- A lack of trust in banks,

- Rising deficits.

They also emphasized Bitcoin’s historically low correlation with traditional markets, making it an attractive diversification tool.

The report notes that Bitcoin’s value grows when its fixed supply meets increasing demand. Widespread adoption of cryptocurrency could further enhance its appeal due to its decentralization and cross-border capabilities.

While BlackRock advises capping Bitcoin allocations at 2%, the company also noted that future price increases might face greater challenges due to changes in return characteristics.

It’s worth mentioning that the assets under management (AUM) of BlackRock’s spot Bitcoin exchange-traded fund (ETF) have surpassed $50 billion in less than a year.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.