VanEck experts project that Ethereum will reach $6,000 at the peak of the current bull cycle, Solana will climb to $500, and Sui will hit $10.

“After reaching these peaks, we anticipate a 30% correction in Bitcoin’s price. Altcoins may experience sharper declines of up to 60% due to market consolidation during the summer. However, by autumn, recovery is likely, and key tokens may return to their all-time highs by the end of the year,” the analysts stated.

The crypto market is expected to hit its “mid-term peak” in Q1 2025, with a new all-time high projected for Q4.

Signs of a Market Peak

According to VanEck specialists, the following indicators suggest the market is nearing its peak:

- Sustained high funding rates exceeding 10% for a three-month period;

- Excessive unrealized gains, pointing to market euphoria;

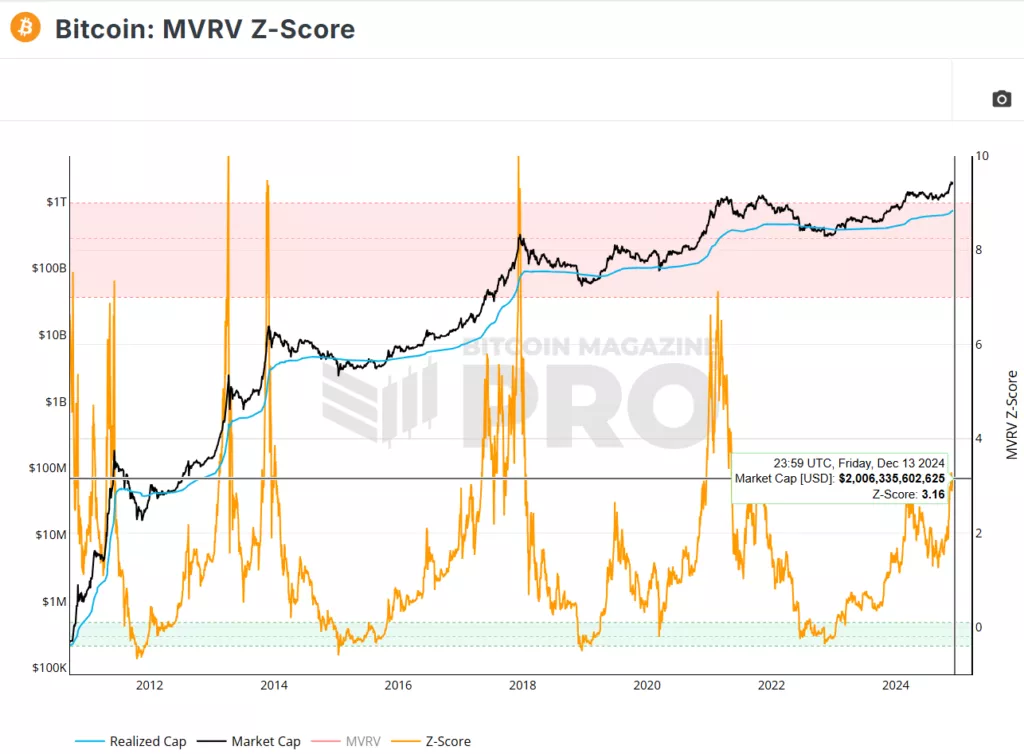

- On-chain MVRV metrics above 5, indicating extreme overvaluation and speculative sentiment;

- A drop in Bitcoin dominance below 40%, signaling a shift toward riskier altcoins;

- Widespread FOMO and a surge in interest from people unfamiliar with crypto—often a reliable sign of “speculative mania at the top.”

Currently, the MVRV Z-Score stands slightly above 3, indicating considerable growth potential and a safe distance from the “red zone” of overheating.

As before, VanEck analysts maintain their Bitcoin price target of $180,000 for the current cycle.

Earlier, Matrixport had predicted Bitcoin would reach $160,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.