On December 16, Bitcoin’s price surpassed the $106,000 mark, reaching $106,648 on Binance.

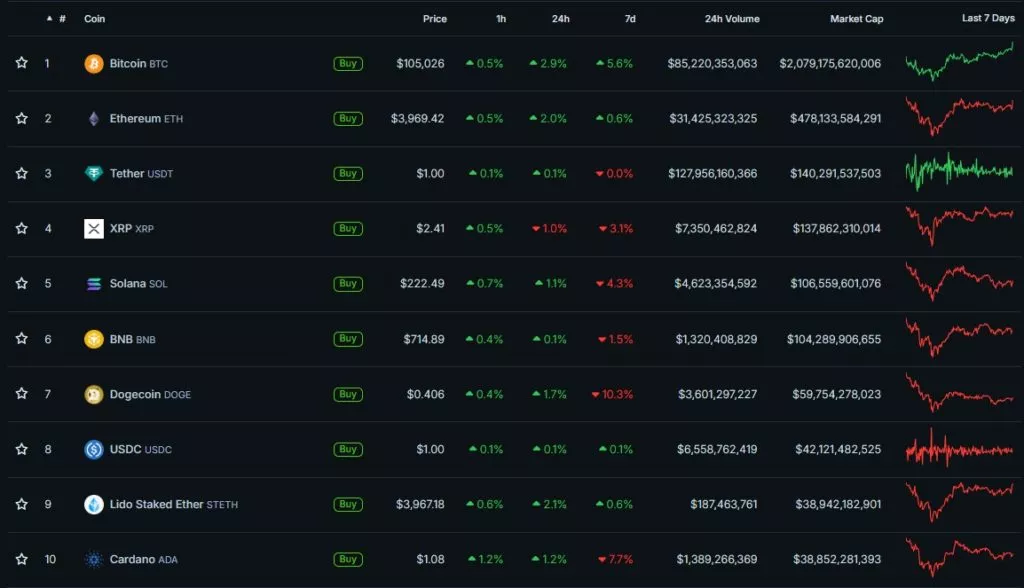

At the time of writing, Bitcoin is trading around $105,000, reflecting a 2.9% increase over the past 24 hours, according to CoinGecko.

The flagship cryptocurrency outpaced other leading digital assets in growth, with XRP by Ripple being the only major token remaining in a correction phase.

The total cryptocurrency market capitalization has climbed to $3.89 trillion, with Bitcoin’s dominance index increasing to 53.5% and Ethereum holding 12.3%.

The Crypto Fear and Greed Index has reached 83 points, signaling extreme buyer interest. This same level was recorded on December 5, when Bitcoin first surpassed $100,000.

One of the key drivers behind Bitcoin’s surge may have been U.S. President-elect Donald Trump’s confirmation of plans to establish a national strategic reserve for the cryptocurrency.

“Yes, I think so,” Trump responded when asked directly during a CNBC broadcast.

Jack Mallers, founder and CEO of Strike, believes Trump will issue the corresponding executive order immediately after his inauguration on January 20, 2025.

TRUMP TO MAKE DAY 1 EXECUTIVE ORDER

— Bitcoin Archive (@BTC_Archive) December 15, 2024

FOR #BITCOIN STRATEGIC RESERVE pic.twitter.com/haZUO2SIL0

During his campaign, Trump labeled himself the “crypto president” and pledged support for the industry. After his election, he introduced the role of a “czar” for AI and digital assets in his administration, nominating David Sacks for the position.

Personnel is policy: Perianne Boring pic.twitter.com/52IPUr2owR

— Mornings with Maria (@MorningsMaria) December 13, 2024

“If Donald Trump manages to implement the multitude of initiatives he has promised to the community, there will be no limit [to Bitcoin’s price growth], given its fixed supply,” said Perianne Boring, co-founder of The Digital Chamber, in an interview with Fox Business.

As a reminder, after Bitcoin crossed the $100,000 milestone, Trump congratulated the community on the historic achievement.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.