The traditional indicator for the start of an altcoin season—capital rotation from Bitcoin into other cryptocurrencies—no longer applies. This conclusion comes from CryptoQuant CEO Ki Young Ju.

Alt season is no longer defined by asset rotation from #Bitcoin.

— Ki Young Ju (@ki_young_ju) December 2, 2024

The surge in altcoin trading volume isn’t driven by $BTC pairs but by stablecoin and fiat pairs, reflecting real market growth rather than asset rotation.

Stablecoin liquidity better explains the altcoin markets. pic.twitter.com/riejM7oXyk

According to Ki, trading volumes in fiat and stablecoin pairs, rather than Bitcoin pairs, are the key metric for the altcoin market. Liquidity in these assets better reflects overall market growth.

In an earlier thread, the analyst explained that Bitcoin’s current bull rally is driven overwhelmingly by institutional investors and spot ETF issuers.

These market participants are unlikely to exchange Bitcoin for altcoins and predominantly operate outside of crypto exchanges. This makes capital rotation into altcoins even less likely, as they typically depend on trading platforms and the influx of new retail investors, Ki noted.

“Don’t get me wrong—I’m optimistic about altcoins. However, only a select few will attract fresh capital. Altcoin season will come, but not for all tokens. Not every coin will return to its all-time high,” he stated.

Diverging Opinions

Glassnode senior analyst CryptoVizArt offered a different perspective, citing on-chain activity data.

I believe altseason has already begun and probably lose to its peak ! https://t.co/9TwNF9m4vJ

— CryptoVizArt.₿ | ZiCast 🎙 (@CryptoVizArt) November 27, 2024

“I believe altcoin season has already begun, although it’s unlikely to reach its previous peaks,” said the analyst.

Ki agreed with this assessment but clarified that it applies only to “a few major coins.” He pointed out that the total value of the altcoin market remains far below its all-time highs.

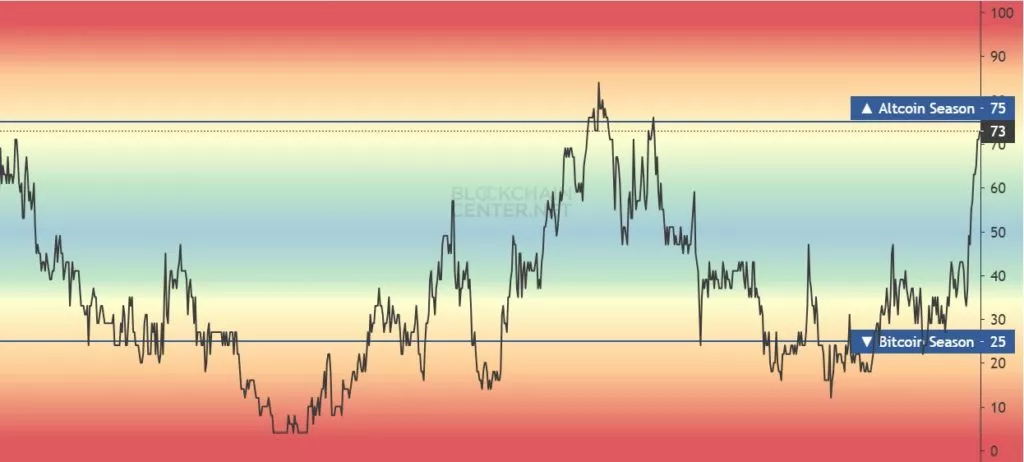

As of now, the Altcoin Season Index by Blockchain Center sits at 73, indicating that 73% of the top 50 cryptocurrencies by market cap have outperformed Bitcoin over the past 90 days. The altcoin season threshold is considered to be an index score of 75.

What Lies Ahead

In October, analysts from Hashkey Capital predicted that an altcoin rally would begin once Bitcoin surpassed $80,000. The flagship cryptocurrency crossed this level on November 10, and later that month, it reached a new all-time high near $100,000.

Cautious Optimism

ITC Crypto founder Benjamin Cowen warned that altcoins could face a deep correction before seeing substantial growth.

Reminder: The altcoin market remains highly volatile and dependent on Bitcoin’s performance as well as macroeconomic conditions. Investors are advised to tread carefully.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.