By 2030, over $47 billion in liquidity could flow into Layer-2 (L2) solutions for Bitcoin, according to the Bitcoin L2s report from Galaxy Digital.

The study takes into account the market share of wrapped Bitcoin in DeFi, native BTC in L2 networks, and BTC locked in staking protocols. Currently, these segments make up 0.8% of the total circulating supply of Bitcoin. Analysts predict that this figure will increase to 2.3% over the next six years.

“If Bitcoin reaches $100,000 by 2030, the total market for L2 solutions on Bitcoin could hit $47 billion, assuming that 2.3% of the total BTC supply is locked in them by then,” the analysts noted.

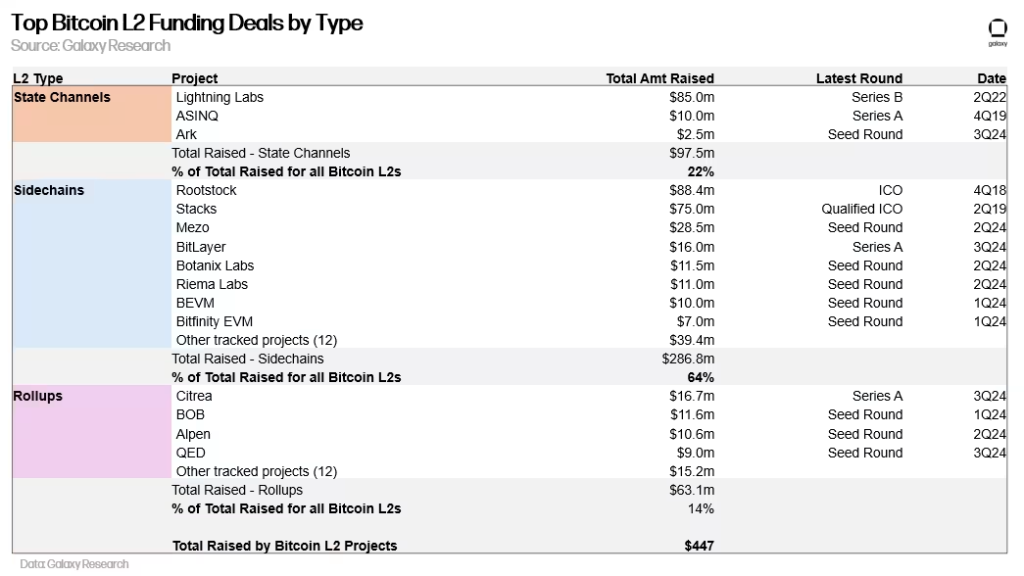

Since 2018, companies in this segment have raised approximately $447 million in venture capital, with $174 million raised from January to September 2024 alone. This year, sidechain projects raised $105 million, and rollups raised $63 million.

Galaxy Digital experts highlighted that in Q2 2024, L2 solutions on Bitcoin received 44% of all venture investments in the L2 segment, a 159% increase compared to the same period in 2023.

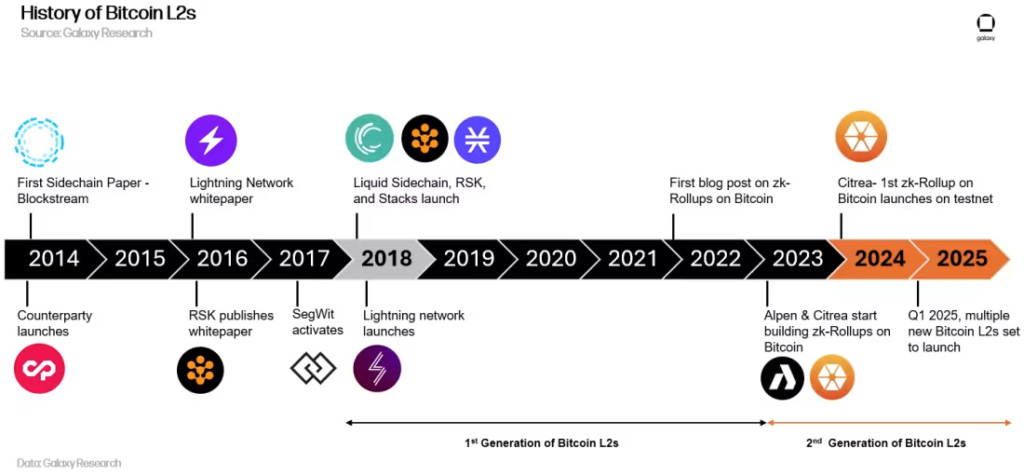

They attribute this dynamic to the fact that many traditional venture firms had not engaged with the Bitcoin ecosystem until 2024. The introduction of Ordinals and BRC-20 in 2023 opened up new investment opportunities for them.

Against the backdrop of growing investment activity in 2024, Galaxy Digital researchers noted a sevenfold increase in the number of projects in the niche. However, according to the analysts, in six years, there will only be 3–5 major players in the market, down from around 75 today.

One of the key factors for the long-term adoption of L2 solutions on Bitcoin will be the DeFi ecosystem:

“In order to capture market share from wrapped BTC, DeFi applications on Bitcoin’s L2 solutions will have to offer higher yields compared to their counterparts on Ethereum. L2 solutions will likely only succeed if they manage to take market share from DeFi applications that accept tokenized versions of BTC, like WBTC, tBTC, and cbBTC.”

Researchers pointed out that L2 solutions on Bitcoin are more decentralized compared to their counterparts in other ecosystems. They cited the example of WBTC, which faced delisting due to the Bitcoin reserves being partially controlled by BitGlobal, a company owned by Justin Sun.

As a reminder, in September Vitalik Buterin shared his vision for how scaling solutions should evolve by 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.