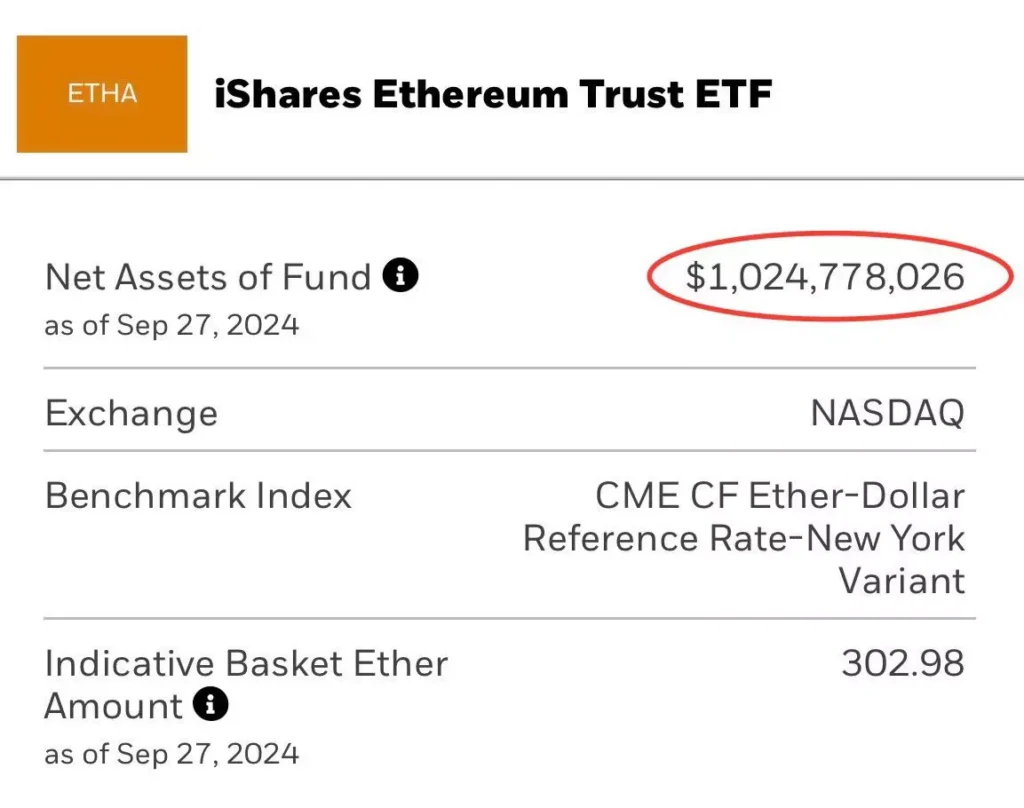

Just two months after its launch, assets in BlackRock’s spot Ethereum ETF have surpassed $1 billion, positioning it among the top 20% of leading ETFs in the U.S. market. This achievement places the investment product among the most successful of the 3,700 ETFs available on the American market.

Success of the Ethereum ETF

Last week, total inflows into the Ethereum ETF in the U.S. amounted to $84.5 million, highlighting growing institutional interest in the asset. This success reflects the continued rise in popularity of cryptocurrency ETFs and strengthens BlackRock’s position as one of the leaders in innovative investment products. The Ethereum ETF market provides investors with a new tool for diversifying assets in the expanding crypto sector.

Prospects and Significance

The inflow dynamics into the Ethereum ETF highlight increased demand for investment products tied to digital assets. The success of this product may encourage the creation of new tools focused on cryptocurrencies, making them even more accessible to both retail and institutional investors.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.