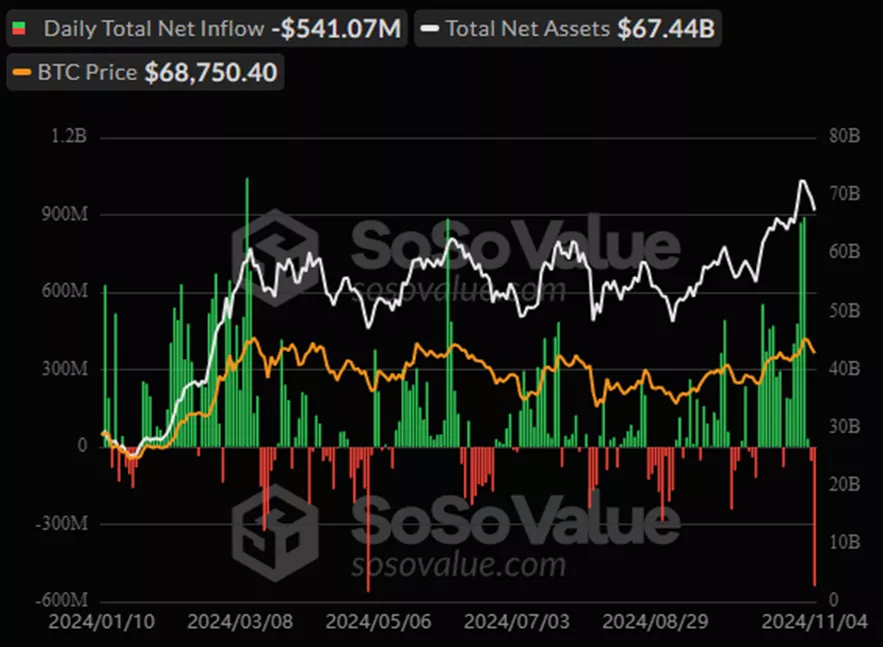

On November 4, investors withdrew $541 million from Bitcoin ETFs, marking the second-largest outflow ever recorded, following the $561 million outflow on May 2, according to SoSoValue. This marks the second consecutive day of significant outflows.

Political Uncertainty and Market Impact

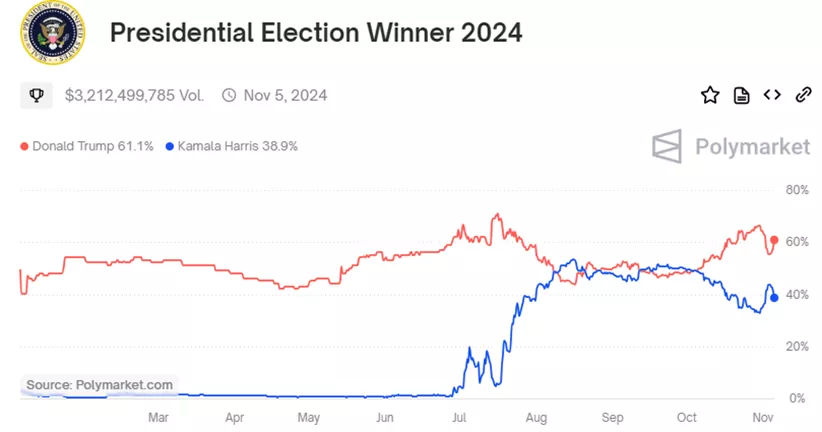

The reversal in fund flows coincided with narrowing polling gaps between presidential candidates. Republican Donald Trump lost part of his lead over Democrat Kamala Harris, with his win probability dropping from 66% to 61%. This shift has been accompanied by declines in Bitcoin and other major cryptocurrencies.

Weekly Inflows and ETF Performance

For the week ending November 2, total inflows into cryptocurrency funds amounted to $2.18 billion. On October 30, BlackRock’s IBIT product saw a record-breaking $872 million inflow, surpassing its previous high of $849 million in March.

However, by November 4, BlackRock’s ETF was the only product to record a positive inflow of $38.4 million, while others faced significant outflows:

- FBTC (Fidelity): -$169.6 million

- ARKB (ARK Invest & 21Shares): -$138.3 million

- BTC (Grayscale): -$89.5 million

- BITB (Bitwise): -$79.8 million

- GBTC (Grayscale): -$63.7 million

- HODL (VanEck): -$15.3 million

- BRRR (Valkyrie): -$5.7 million

Since the approval of Bitcoin ETFs in January, total cumulative inflows have now fallen to $23.6 billion.

Market Outlook

Analysts at Bernstein predict that a Trump victory could propel Bitcoin’s price to $80,000–$90,000, while a Harris victory may lead to a drop to $50,000.

Meanwhile, options traders are betting on Bitcoin hitting new all-time highs by the end of November, with heightened volatility expected after the U.S. elections. Firms like Tyr Capital, Bitget Research, and Standard Chartered have also warned of potential market turbulence tied to election outcomes.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.