On November 7, the U.S. Federal Reserve (Fed) reduced its key interest rate by 25 basis points, setting it in the range of 4.5-4.75% annually. This marks the second rate cut this year, following a 0.5% reduction in September.

The decision aligned with market expectations and analysts’ consensus forecasts. In its press release, the Fed emphasized its commitment to maximum employment and maintaining 2% inflation over the long term, noting that risks to these goals remain relatively balanced.

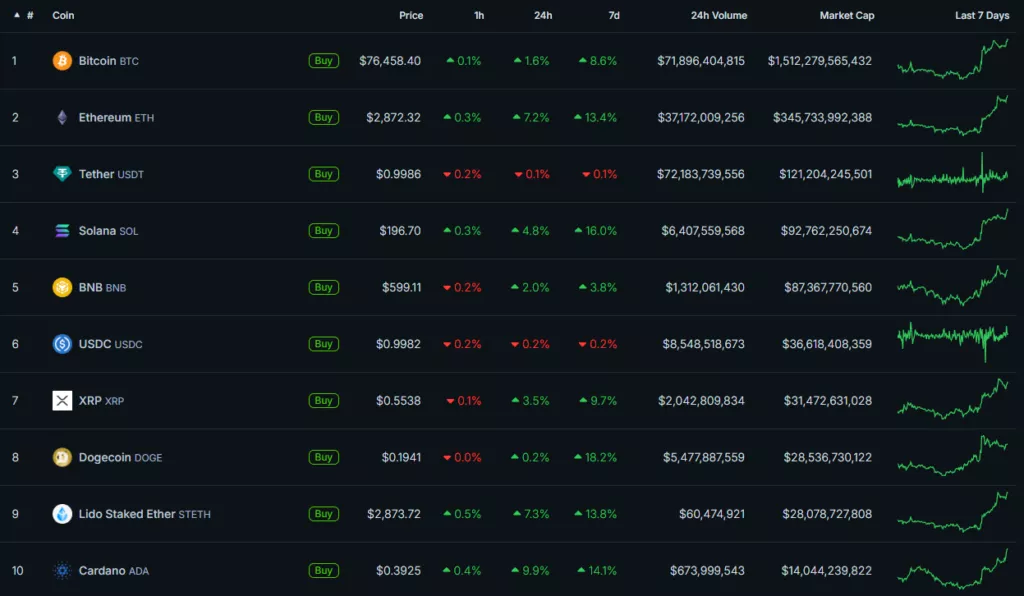

Amid this news, Bitcoin has maintained its position above the $76,000 level.

Stability in Altcoins

Leading altcoins continue to show stability following recent gains. The total cryptocurrency market capitalization currently stands at $2.68 trillion.

Future trends in risk assets, including cryptocurrencies, will largely depend on comments by Fed Chair Jerome Powell during his press conference at 10:30 PM MSK/9:30 PM Kyiv time.

According to The Wall Street Journal, Donald Trump’s victory in the U.S. presidential election may prompt changes to Federal Reserve policy. Such adjustments are likely to be discussed during the December meeting, alongside the release of updated macroeconomic forecasts.

Options traders also predict heightened price volatility for Bitcoin following the U.S. elections.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.