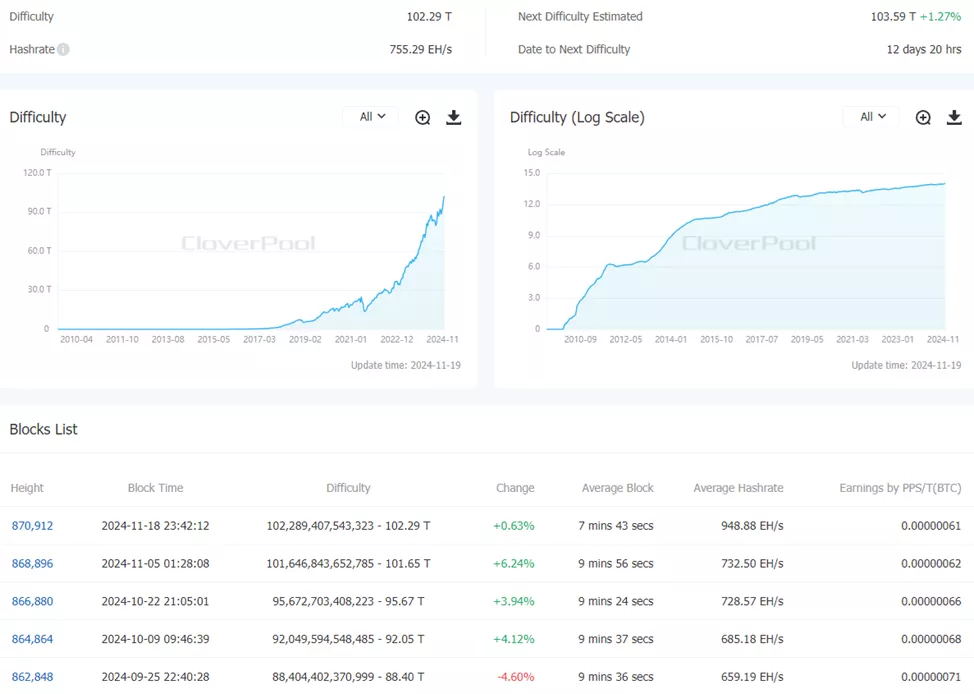

Following the latest Bitcoin mining difficulty adjustment, the metric increased by 0.63% to reach an all-time high of 102.29 T. This milestone underscores the sustained growth in the network’s computational power despite ongoing challenges.

The average hash rate over the two-week adjustment period rose to 755.3 EH/s, reflecting significant improvements in computational power dedicated to securing and operating the network.

According to Glassnode, as of November 18, the 7-day smoothed moving average for the hash rate was 738.4 EH/s, with peaks reaching 755.8 EH/s.

Data from Hashrate Index shows that the hash price climbed to $58.6 per PH, further highlighting the strengthening of mining industry economics.

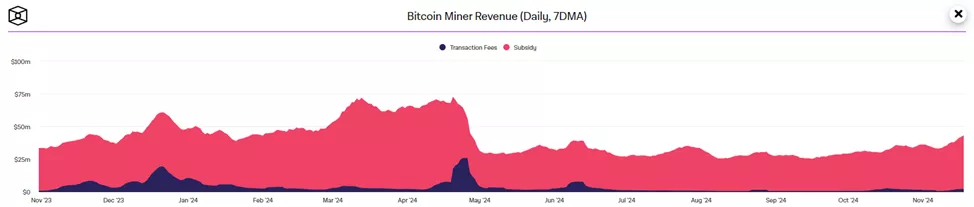

According to The Block, daily miner revenue based on the 7-day smoothed moving average increased to approximately $41 million, reflecting higher mining profitability.

In October, the hash rate of 14 publicly listed U.S.-based mining companies reached a record 28.9% of the total hash rate for all Bitcoin miners.

Research from Bernstein suggests that Donald Trump’s victory and his pro-mining promises could become a key driver for Bitcoin to hit $200,000 by 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.