The leading cryptocurrency continued its upward trend, breaking the $63,000 mark.

On the four-hour chart below, it can be seen that the rise is happening against the backdrop of declining trading volumes; the RSI indicator has already entered the overbought zone. This could signal the risk of a short-term correction.

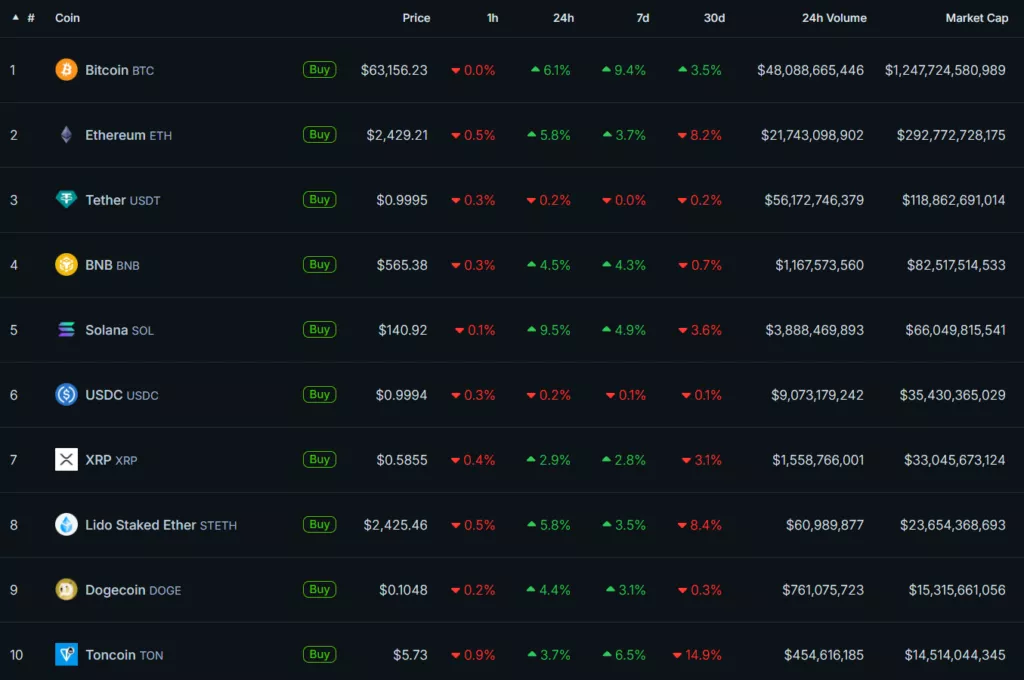

“As is traditionally the case,” the rise of the flagship cryptocurrency has revived the rest of the market. Here’s the top 10 cryptocurrencies by market capitalization:

A noticeable rally began ahead of the latest Federal Open Market Committee (FOMC) meeting; on September 18, the Federal Reserve lowered the key interest rate range to 4.75-5% annually for the first time since 2020, which fueled the continued growth of the first cryptocurrency’s price.

According to BitMEX co-founder Arthur Hayes, all eyes are now on the upcoming meeting of the Bank of Japan, scheduled for September 20.

“Weak yen — strong Bitcoin. Strong yen — weak Bitcoin,” the expert shared his insight.

Analyst and founder of MN Trading, Michaël van de Poppe, expects further easing of monetary policy by the American regulator to “keep the economy moving forward.”

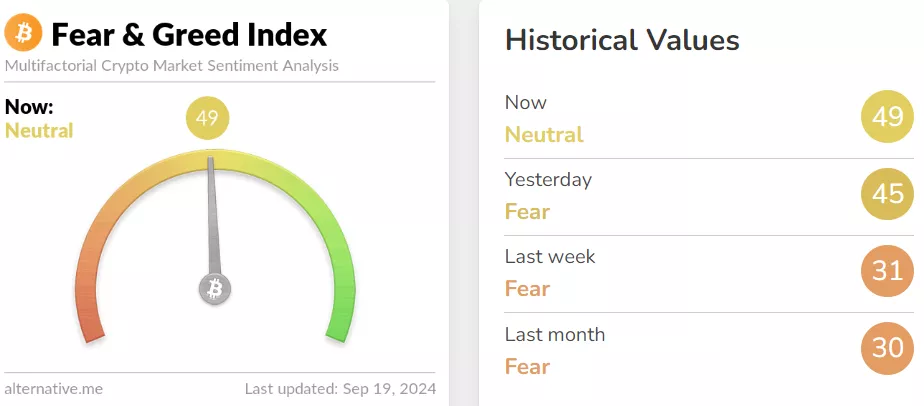

Despite the confident recovery of crypto asset prices, the Fear & Greed Index is still in the neutral zone. Previously, this indicator had shown panic sentiments for a significant period.

At the time of writing, the total market capitalization stands at $2.28 trillion with Bitcoin’s dominance index at 55%, according to CoinGecko.

It’s worth recalling that the world’s largest asset manager, BlackRock, referred to Bitcoin as a “unique diversifier.”

According to analysts, digital gold “shows minimal fundamental exposure” to macroeconomic factors affecting most traditional financial instruments.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.