On September 18, 2024, the U.S. Federal Reserve (Fed) lowered its key interest rate range to 4.75–5% annually, marking the first reduction since March 2020.

The decision aligned with market expectations.

“Recent data indicates that economic activity continues to grow at a steady pace. Job growth has slowed, and the unemployment rate has increased, but it remains low,” the press release states.

The Fed reaffirmed its previous goals: maximum employment and 2% inflation in the long term. The regulator believes that inflation is “steadily moving” in this direction.

On September 11, the U.S. Bureau of Labor Statistics published its consumer price report, which came in at 2.5%, matching the forecast.

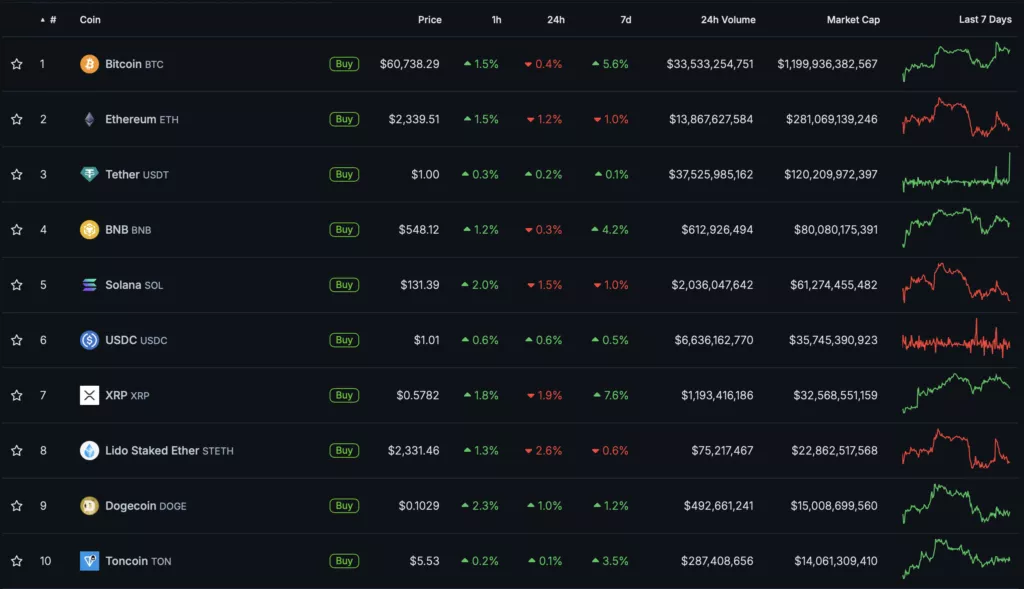

In response to the Fed’s decision, Bitcoin surged above $60,000, briefly reaching $61,000.

Following Bitcoin, other digital assets in the top-10 by market capitalization also entered a growth phase.

As of writing, the total cryptocurrency market capitalization stands at $2.15 trillion.

The Fed’s decision today marked the end of the key interest rate-holding cycle. The last change occurred in July 2023, when the Fed raised the range by 25 basis points to 5.25–5.5% annually.

Earlier, analysts from CoinShares linked the increase in inflows to cryptocurrency investment funds with market hopes for a 50 basis point rate cut by the Fed. From September 8 to 14, the inflow was $436 million after a $726 million outflow the previous week.

It’s worth noting that experts have differing opinions on Bitcoin’s prospects for September.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.