On the night of October 26, Bitcoin’s price briefly dropped below the $66,000 mark.

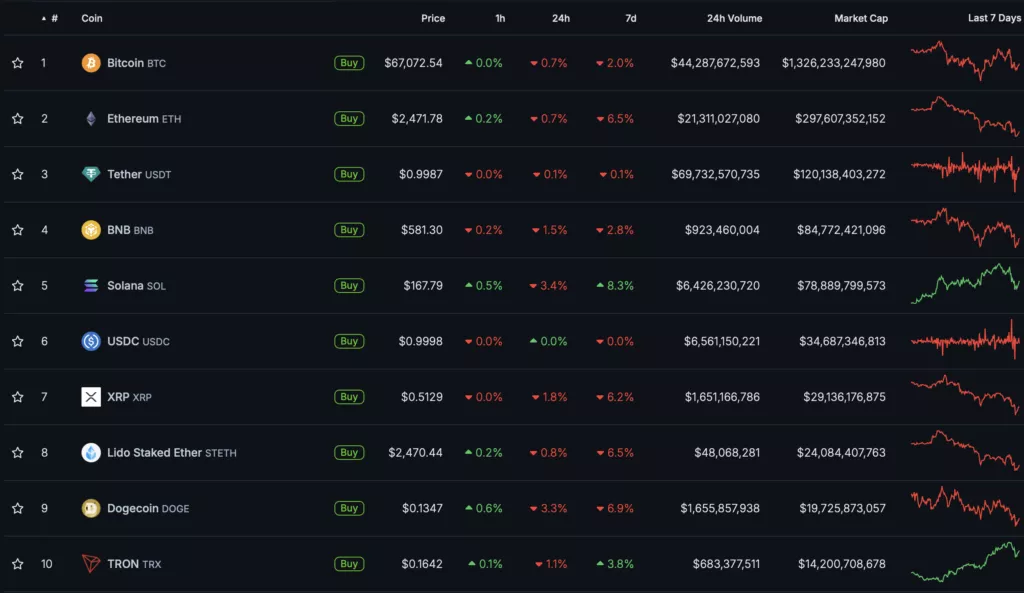

At the time of writing, Bitcoin is trading above $67,100. According to CoinGecko, the cryptocurrency has decreased by 0.7% in the last 24 hours, with a total market capitalization exceeding $1.3 trillion.

The likely cause of the correction is the ongoing conflict between Israel and Iran, which has affected sentiment in the cryptocurrency market. All top-10 assets by market capitalization also showed declines, including Solana (-3.4%) and Dogecoin (-3.3%).

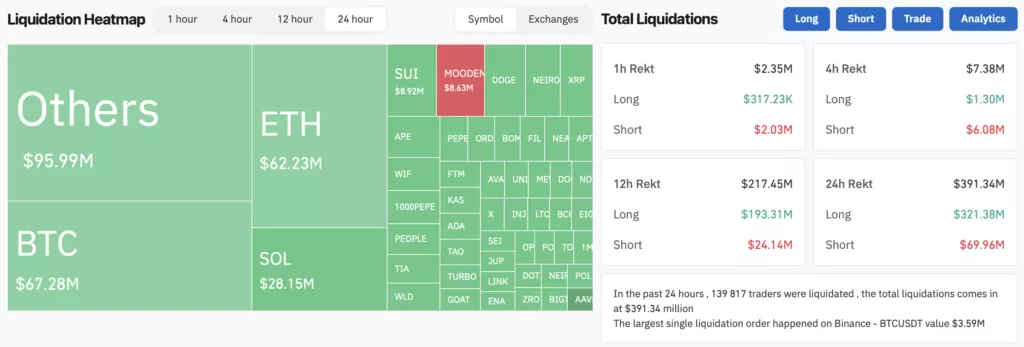

The total cryptocurrency market capitalization stands at $2.38 trillion, with Bitcoin’s dominance index at 59.4%. According to Coinglass, $391 million in positions were liquidated in the past 24 hours, with $321 million of that coming from long positions.

A week ago, on October 21, Bitcoin tested the $69,000 level, after previously trading below $60,000.

Analysts at Bernstein confirmed their $200,000 Bitcoin price forecast by the end of 2025, calling it “conservative.” Jeff Kendrick, Head of Digital Asset Research at Standard Chartered, also predicted a new all-time high above $73,000 amid the upcoming U.S. elections, scheduled for November 5.

Analysts at Hashkey Capital believe that for a full altseason to begin, Bitcoin needs to reach $76,000–108,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.