The recent dip in Bitcoin’s price to $93,000 is expected to be short-lived, with the cryptocurrency still on track to reach six figures by year-end, according to Bluntz Capital.

likely thats the pullback done on #btc here, i think up from here and its aint going as low as ppl think pic.twitter.com/pVeiFZzVC4

— Bluntz (@Bluntz_Capital) November 25, 2024

“Further gains are coming, and it won’t drop as low as people think,” said the trader.

A similar sentiment was echoed by analysts at K33 Research, who linked the pullback to Bitcoin’s tendency to weaken at the end of the month.

“Bitcoin is consolidating ahead of the Thanksgiving holiday [November 28] as traders anticipate lower implied volatility. […] We remain confident that the price will surpass $100,000 in the coming weeks and maintain a bullish outlook for 2025,” the K33 Research team added.

A Healthy Correction

Charlie Sherry of BTC Markets described the correction to $93,000 as “healthy” within the context of Bitcoin’s historical patterns of sharp upward movements. He noted that these pullbacks allow the market to consolidate and reduce leverage before resuming its upward trajectory.

Sherry suggested that the correction could deepen toward $80,000 but would still align with behavior seen in previous bull runs.

Causes of the Pullback

According to CryptoQuant, Bitcoin holders offloaded 728,000 BTC (~$68 billion) over the past 30 days, reversing October’s accumulation of 250,000 BTC. This marks the highest sell-off rate since April.

Long-term holders have offloaded 728,000 #Bitcoin in the past 30 days.

— CryptoQuant.com (@cryptoquant_com) November 26, 2024

This marks the highest sell-off since April. pic.twitter.com/oWqqgIUeSR

Analysts at Standard Chartered attributed the pullback to Bitcoin’s reduced appeal as a hedge for traditional finance investors amid declining premiums on U.S. Treasury bonds.

Additionally, the impending expiration of monthly options is expected to affect prices. Data from Deribit shows that contracts for 18,000 BTC with strike prices between $85,000 and $100,000 are set to expire this week, potentially leading to price stagnation.

Long-Term Outlook

Standard Chartered reaffirmed its $125,000 year-end target and a $200,000 projection for the end of 2025. These forecasts are supported by continued Bitcoin purchases by MicroStrategy and ETF investors.

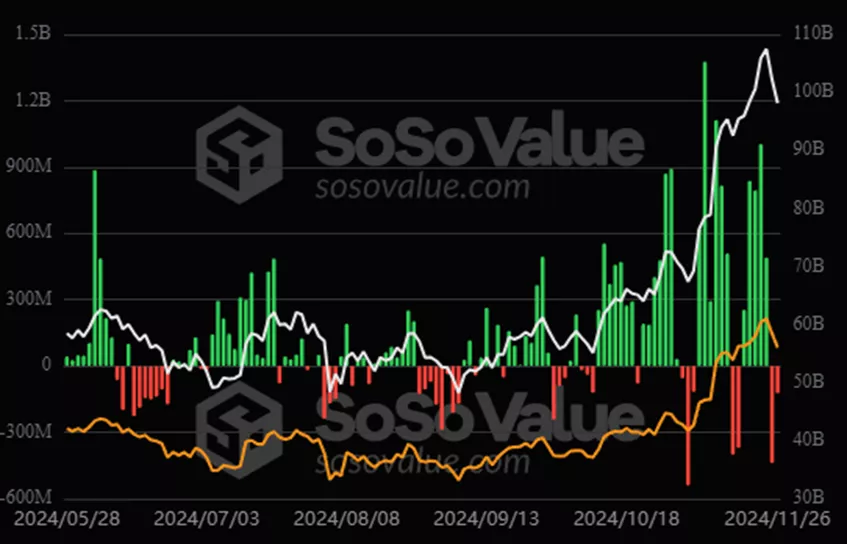

On November 26, outflows from spot Bitcoin ETFs slowed from $438.4 million to $122.8 million.

“The average purchase price for ETFs and MicroStrategy since the elections is $88,700. This could form a short-term bottom, with prices consolidating between $85,000 and $88,700 before resuming their upward trajectory,” analysts concluded.

Reminder: Pantera Capital previously forecasted Bitcoin’s rise to $740,000, while Bernstein identified catalysts for the cryptocurrency’s price increase to $200,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.