Bitcoin closed November with a 37.3% gain, positioning itself to potentially reach six-figure territory in December due to favorable seasonal trends, according to Bitfinex.

The analysts highlighted that, historically, December has been a strong month for Bitcoin during halving years, with average gains of 38.9%.

Despite the optimism, Bitfinex warned of heightened volatility, largely driven by profit-taking from hodlers and fluctuations in BTC-ETF activity.

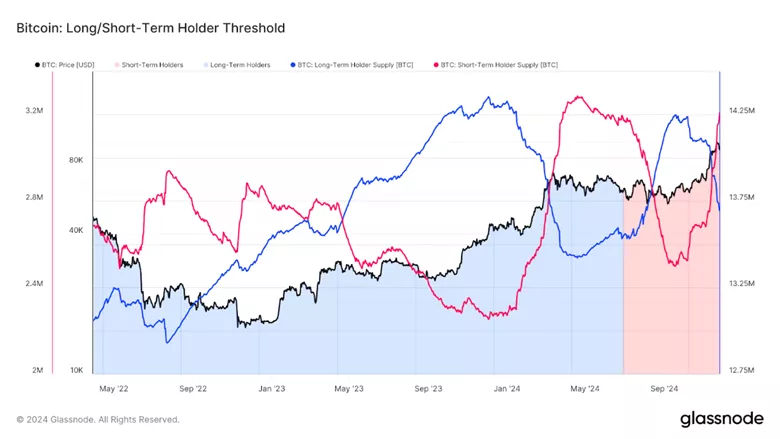

Last week, $135.1 million was withdrawn from spot ETFs, while long-term holders reduced their balances by 508,990 BTC.

“Although this remains below the 934,000 BTC distributed before the March 2024 peaks, continued selling pressure necessitates sustained demand to prevent further price declines,” the analysts added.

Bitfinex noted that the number of coins held by short-term speculators is nearing a cyclical peak of 3,282,000 BTC. Historically, the final stage of a bull run has followed when this metric surpassed pre-halving highs.

The ongoing consolidation phase serves as a critical period for absorbing profit-taking and realigning market demand, they concluded.

Meanwhile, QCP Capital attributed the current correction to reports of the U.S. government moving 10,000 BTC (~$963 million at the time), linked to Silk Road.

Asia Color – 3 Dec 24

— QCP (@QCPgroup) December 3, 2024

1/ Bitcoin soared past $97K before pulling back to hover above $95K. This retrace followed news of the U.S. government moving 10K #BTC (~$963M) linked to Silk Road—a transfer that rattled markets.

Experts added that options markets are increasingly favoring puts in the near-term contracts, signaling bearish sentiment.

Earlier, CryptoQuant CEO Ki Young Ju explained the lack of an altcoin season.

In contrast, Benjamin Cowen of ITC Crypto predicted a significant correction for altcoins before any substantial growth.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.