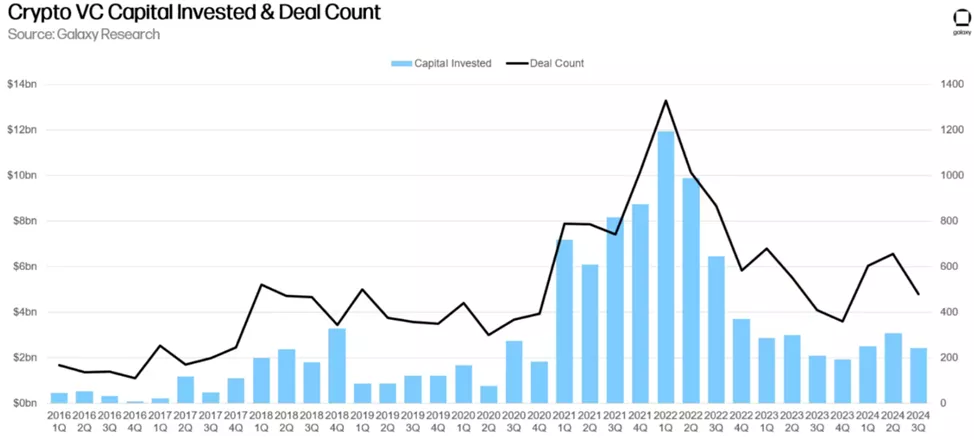

According to a report by Galaxy Digital, the volume of funding for cryptocurrency startups dropped by 20% in the third quarter of 2024 compared to the previous quarter, reaching $2.4 billion. This decline was accompanied by a 17% decrease in the number of deals, down to 478.

However, compared to the same period last year, funding increased by 21.5%.

Reasons for Stagnation

“Stagnation is explained by investors focusing on Bitcoin and spot ETFs, as well as minimal activity in the meme-coin segment,” the Galaxy Digital report stated.

These factors have led to decreased interest from major players, resulting in a “slow” market throughout the year. Currently, investors’ portfolios are dominated by high-cap cryptocurrencies like Bitcoin, Ethereum, and speculative meme-coins. Meanwhile, tokens from the second tier and projects typically seeking venture funding are being overlooked.

Impact on the Market and Predictions

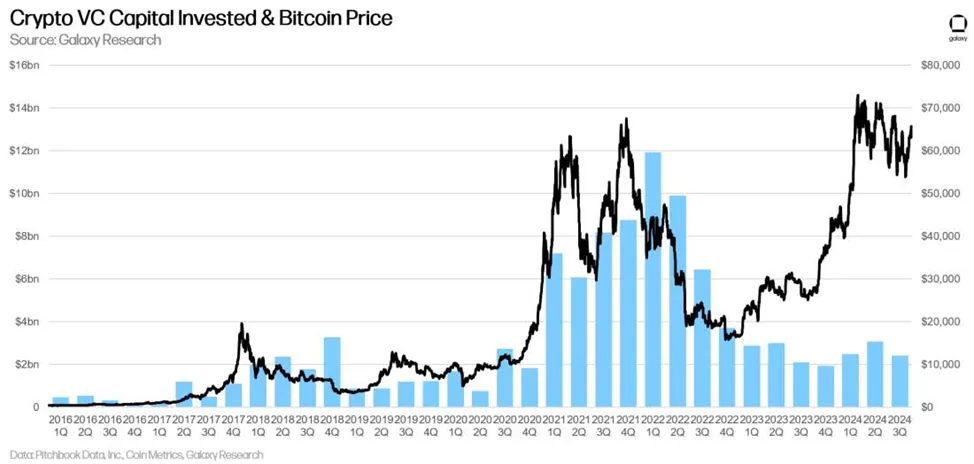

Experts noted that this trend has disrupted the long-standing correlation between Bitcoin’s price growth and cryptocurrency startup funding. It is expected that the popularization of Ethereum-ETFs may further reduce interest in investments in DeFi and Web3 projects.

The majority of funding in Q3 — 85% — went to early-stage startups, signaling the long-term potential of the ecosystem despite current challenges.

Top Fundraising Leaders

The largest amount of funds was received by teams working on exchanges, trading companies, and Layer 1 blockchain development. Special activity was observed in startups integrating artificial intelligence (AI) technologies, which increased their fundraising fivefold compared to the previous quarter.

Among the largest investment rounds:

- Sentient — $85 million

- CeTi — $60 million

- Sahara AI — $43 million

Geography of Venture Funding

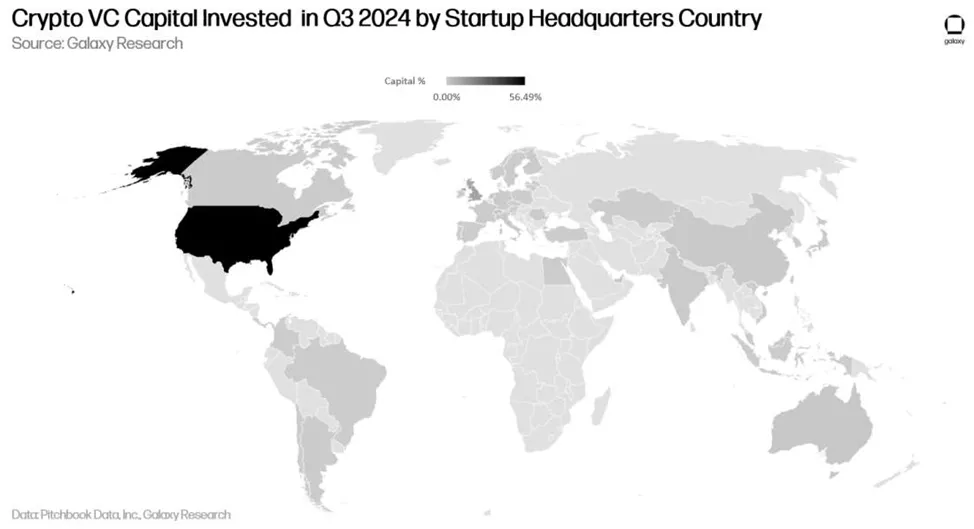

Cryptocurrency companies from the U.S. received 56% of all venture investments, followed by Singapore (8.7%) and the UK (6.8%). The UAE and Switzerland also ranked in the top five.

Forecast for the Near Future

Galaxy Digital analysts predict a rise in investments in cryptocurrency startups over the next two quarters, driven by expected interest rate cuts and potential easing of regulations.

They also highlight the DePIN (Decentralized Physical Infrastructure Networks) sector’s resilience to bear markets, thanks to its solid fundamentals and broad application across various industries.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.