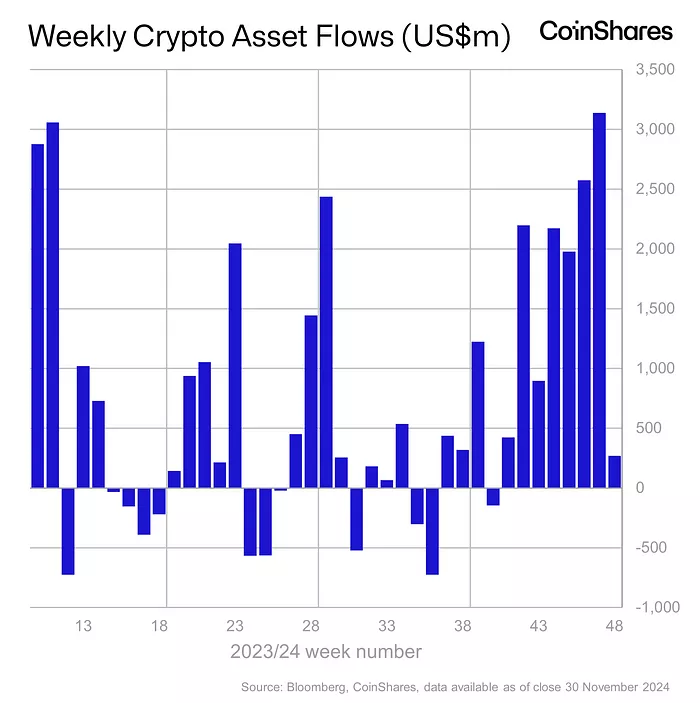

According to CoinShares, the week of November 24–30 saw cryptocurrency investment funds receive $270 million in inflows. This marks the eighth consecutive week of positive net flows, albeit at a slower pace compared to the previous reporting period.

Year-to-date, total capital inflows into crypto funds have reached a record $37.3 billion.

Bitcoin Funds See Profit-Taking

Over the past week, Bitcoin-based investment products experienced $457 million in outflows, ending a streak of consistent inflows.

“[…] In our view, this reflects profit-taking after Bitcoin tested the psychological level of $100,000,” the CoinShares report noted.

Ethereum Funds Show Steady Growth

In contrast to Bitcoin, Ethereum-focused funds recorded strong inflows of $634 million over the same period. Year-to-date, these inflows have reached a record-breaking $2.2 billion, underscoring growing interest in the second-largest cryptocurrency by market capitalization.

XRP Funds Set New Records

XRP-linked funds also posted impressive gains, with inflows totaling $95 million during the week. Analysts at CoinShares attributed this surge to growing excitement over the potential launch of an XRP-based ETF in the U.S.

Notably, on December 2, XRP surpassed the $2.5 mark and climbed into the top three cryptocurrencies by market capitalization, overtaking the stablecoin USDT.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.