A $9.7 billion influx into stablecoins over the past 30 days will likely push Bitcoin’s price to $100,000 by the end of November, according to Leon Weidman, head of research at The Onchain Foundation.

“The largest monthly inflow in history. […] Speculative demand continues to rise!” — he stated.

This viewpoint is shared by Ryan Li, Chief Analyst at Bitget Research.

“If history repeats itself, there’s a growth potential of 14.7%, well above the $100,000 target. The trend after the halving is very positive for Bitcoin’s future prospects,” — the specialist noted.

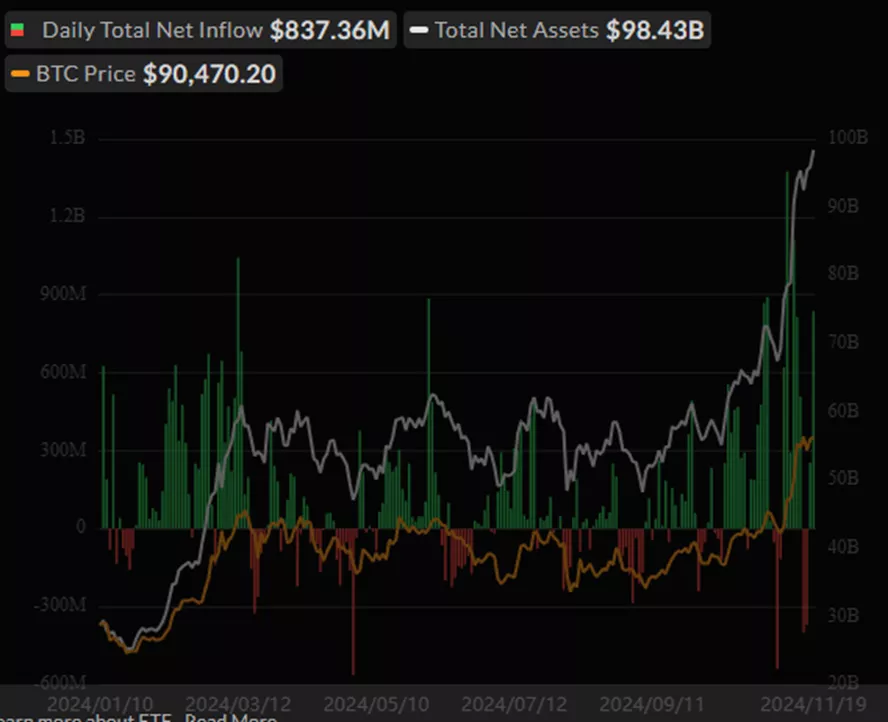

Additional support comes from inflows into BTC-ETFs. On November 20, $773 million flowed into these products. The positive trend continued for the third consecutive day.

The total assets in these products have exceeded $100 billion, accounting for 5.4% of the market capitalization of digital gold.

Since approval, investors have sent $29.35 billion into exchange-traded funds.

Earlier, the launch of Bitcoin-ETF options helped propel Bitcoin to a new all-time high near $94,000.

As a reminder, Glassnode highlighted that Bitcoin’s price has not yet reached levels for holders to lock in profits. CryptoQuant emphasized that only one of five indicators points to the end of Bitcoin’s rally.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.