Michael Saylor, founder of MicroStrategy, shared his approach to effective Bitcoin investment in an interview with Yahoo Finance, emphasizing that his strategy is straightforward and effective.

“Every day for the past four years, I’ve said: Buy Bitcoin, don’t sell Bitcoin. I’m going to buy more coins. I always buy the first cryptocurrency at its peaks,” Saylor stated.

He advised investors to consistently purchase Bitcoin with their available capital, expressing confidence that the asset will continually appreciate against the dollar. In his view, Bitcoin should be treated as a long-term capital asset.

“If you have money you won’t need for four years—or better yet, ten years—invest it in Bitcoin. Use a cost-averaging strategy by buying weekly, monthly, or quarterly. Hold Bitcoin in your portfolio, expect stability over a decade, and don’t worry too much about short-term volatility,” he added.

Saylor pointed out that even without fully understanding Bitcoin’s use cases, the asset has already demonstrated significant utility. He emphasized that MicroStrategy creates immense value for its shareholders by holding Bitcoin, generating steady returns for the company.

“You don’t need to understand our corporate strategy to be successful. All you need is to own Bitcoin and let the market drive its price upward,” he said.

MicroStrategy’s Financial Performance

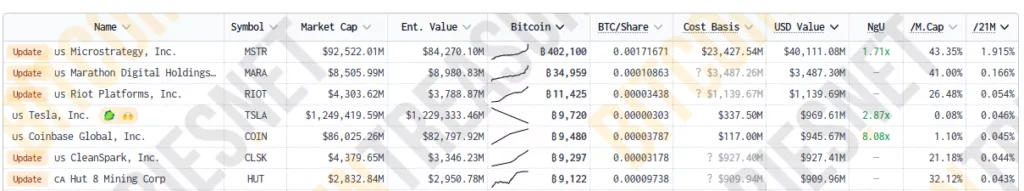

MicroStrategy currently holds 402,100 BTC, representing 1.915% of Bitcoin’s total supply. The value of these holdings exceeds $40 billion.

In early November, the company acquired an additional 15,400 BTC for $1.5 billion at an average price of $95,976. The purchase was financed through the sale of 3.7 million company shares on the stock market.

- MSTR shares are trading at $395.

- The company’s market capitalization stands at $92.52 billion.

Since the beginning of 2024, MicroStrategy’s stock price has increased by 650.2%, five times the growth rate of Bitcoin (123.1%). The company has also outperformed indices like the S&P 500 and tech leaders like Nvidia.

Projections and Crypto Strategy

Earlier, during a presentation to the Microsoft board of directors, Saylor proposed a crypto strategy he believes could add $5 trillion to the corporation’s market capitalization.

He also dismissed the likelihood of Bitcoin’s price dropping by 80%, highlighting significant changes in the market structure compared to previous cycles.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.