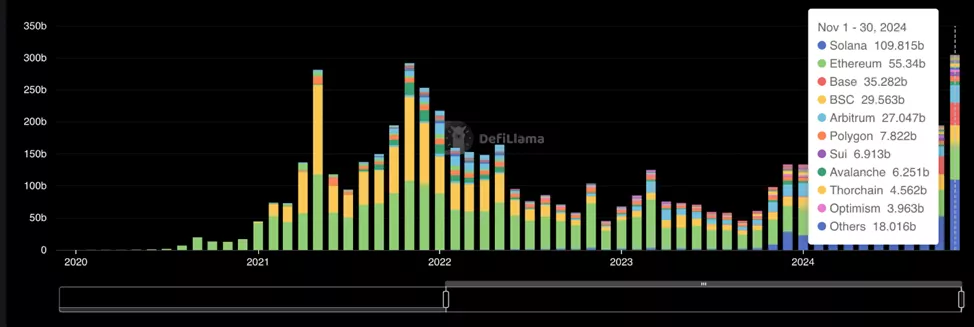

In November, decentralized exchanges (DEXs) on the Solana network recorded a staggering trading volume of $109.8 billion, setting a new monthly high. For comparison, Ethereum reported a volume nearly half that figure, at $55.3 billion, according to DeFi Llama.

In October, Solana DEX trading volume totaled $52.9 billion. The November figure marks a 107.6% increase, more than doubling the previous month’s performance.

The last record-high volume was in March 2023, when DEX activity reached $59.8 billion, fueled by a surge in meme coin trading. Similarly, November’s numbers were heavily influenced by the same trend.

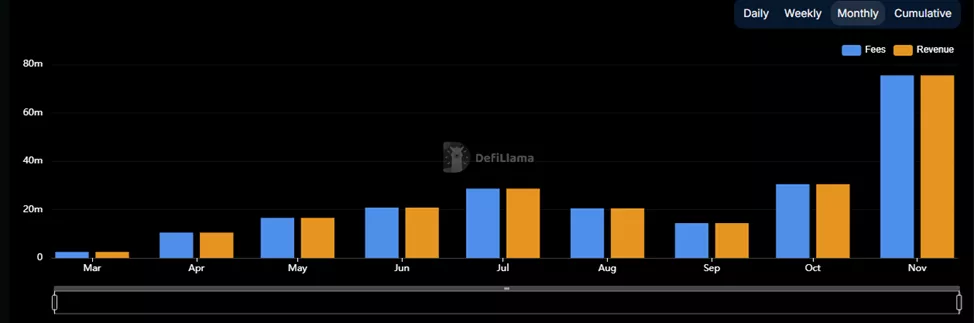

Additionally, November saw Pump.fun achieve its highest monthly fee collection ever, totaling $75.4 million.

This surge in trading activity has positively impacted SOL’s price. Between November 5 (following Donald Trump’s election victory in the U.S.) and November 22, Solana’s price increased by 61.5%, reaching an all-time high of $264.

Other on-chain metrics, like active addresses, have also seen improvement, peaking at 24.48 million.

According to analyst Aylo, Solana’s market capitalization now accounts for 29.5% of Ethereum’s.

Solana's fundamentals are at ATH.

— Aylo (@alpha_pls) November 17, 2024

It's the dominant chain by most metrics right now, and has the largest share of DEX volume.

It's currently ~29.5% of Ethereum's market cap, and is continuing to be repriced. $SOL will be heading into price discovery soon. pic.twitter.com/hcb0vFVfoX

Reminder: Alexander Blum, CEO of Two Prime Digital Assets, has forecasted the approval of a Solana-based ETF by the end of 2025. On November 21, the Chicago Board Options Exchange (CBOE) submitted applications to the SEC on behalf of VanEck, 21Shares, Canary Funds, and Bitwise Asset Management.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.