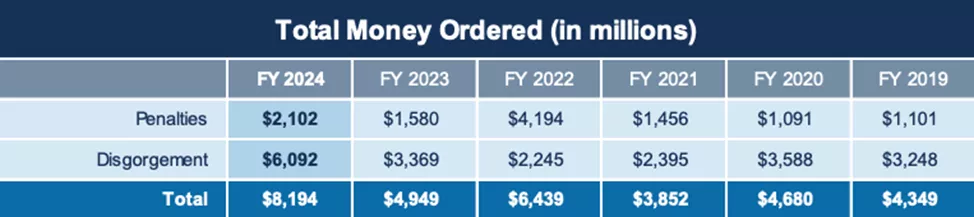

The U.S. Securities and Exchange Commission (SEC) achieved a record-breaking recovery of $8.2 billion in enforcement actions during the fiscal year ending September 30, with $4.47 billion coming from a settlement with Terraform Labs (TFL).

The breakdown includes $2.1 billion in penalties and $6.1 billion in restitution to affected investors. Compared to the previous fiscal year, this marks a 65.5% increase in total recoveries.

Key Enforcement Figures

The SEC initiated 583 cases during the year, a 26% drop from the prior period. Despite the reduced caseload, the settlement with TFL, founded by Do Kwon, accounted for the largest recovery in the agency’s history.

Excluding the TFL case, the SEC secured $3.72 billion, its lowest enforcement total since 2013, when recoveries amounted to $3.4 billion.

On April 5, a jury in the Southern District of New York found Terraform Labs and Do Kwon guilty of securities fraud and deceiving investors. Initially, the SEC sought $5.3 billion in penalties. Defense attorneys argued for a “maximum feasible” payment of $3.4 million.

Changes in SEC Leadership

The current SEC Chair Gary Gensler is set to step down on January 20, 2025. Potential successors include billionaire Mark Cuban, Dan Gallagher, CLO of Robinhood, former CFTC Chair Chris Giancarlo, SEC Commissioner Hester Peirce, and ex-SEC General Counsel Robert Stebbins.

Broader Legal Challenges for the SEC

The SEC faced legal pushback this year, with 18 U.S. states filing a lawsuit accusing the agency of overstepping its authority and unfairly targeting the cryptocurrency industry.

Reminder: Terraform Labs was found liable for one of the largest frauds in the crypto sector, and the SEC’s enforcement actions highlight its intensified focus on protecting investors.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.