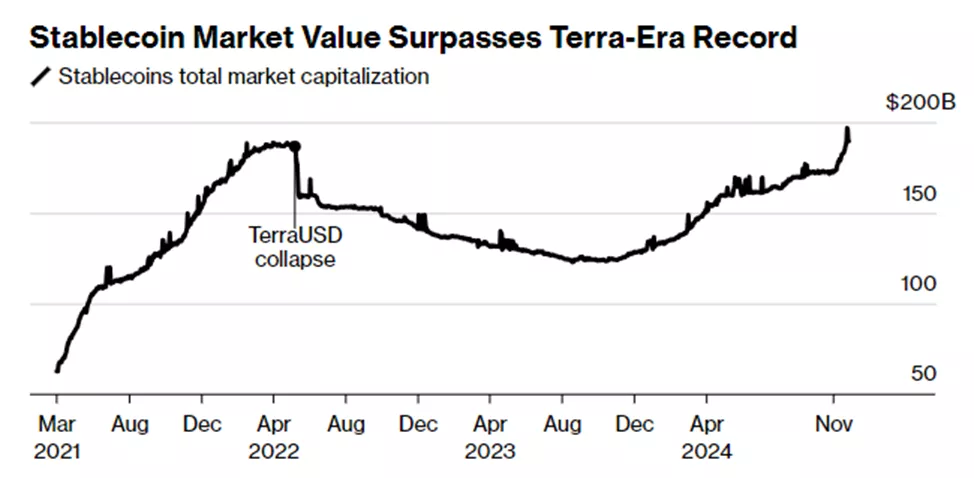

The combined market capitalization of stablecoins has reached an all-time high of $191.5 billion, marking a new peak since the collapse of Terra’s UST in May 2022, as reported by Bloomberg.

Since the beginning of the year, the figure has grown by 46%.

Bloomberg highlighted the growing role of stablecoins in global trade, especially as a tool for cross-border payments.

Tether accounts for 70% ($133 billion) of the total market value. The company aims to expand USDT’s use into new sectors, including commodity trade financing.

The agency also noted increasing interest in the stablecoin space from fintech companies like Stripe and PayPal.

Reminder: Christopher Giancarlo, a candidate for the role of “crypto czar,” emphasized that passing stablecoin legislation is among the priorities of President-elect Donald Trump.

Previously, reports revealed the sale of a 5% stake in Tether to Cantor Fitzgerald. The issuer views the CEO of its partner, Howard Lutnick, as a key ally in countering regulatory pressure on the stablecoin sector.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.