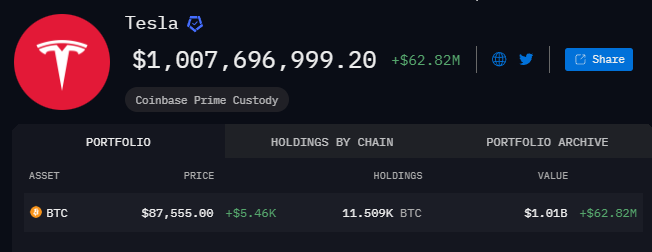

Tesla continues to hold 11,509 bitcoins on its balance sheet, with the total value exceeding $1 billion due to the rising cryptocurrency prices, according to data from Arkham.

Tesla ranks fourth among corporate bitcoin holders, with 9,720 BTC actively held, according to BitcoinTreasuries. In February 2021, Tesla invested $1.5 billion in bitcoin, sparking widespread discussion in the crypto community. At the time, Elon Musk described the investment as “reasonably risky.”

Shortly after, Tesla began accepting bitcoin for vehicle purchases but later suspended the option. By the end of Q2 2022, Tesla converted approximately 75% of its bitcoin into fiat currency, generating $936 million.

MicroStrategy: The Largest Corporate Bitcoin Holder

MicroStrategy remains the largest corporate bitcoin holder, owning 279,420 BTC acquired for $11.9 billion at an average price of $42,692. Currently, these assets are valued at $23.75 billion, with unrealized profits exceeding $10 billion.

El Salvador’s Bitcoin Assets Exceed $500 Million

El Salvador continues to expand its bitcoin reserves, currently holding 5,932 BTC worth over $500 million. The country officially recognized bitcoin as legal tender in 2021, giving it equal status to the U.S. dollar. Businesses are mandated to accept bitcoin payments if they have the technical capability.

President Nayib Bukele actively supports bitcoin adoption, including purchasing and mining initiatives. The country follows a consistent acquisition strategy, buying 1 bitcoin daily.

Bitcoin Sales: Losses for Germany and the U.S.

Germany sold 50,000 BTC in the summer of 2024 for $2.88 billion, incurring a $1.6 billion loss in potential profits at current market prices. The average sale price was $57,600 per bitcoin. Bundestag member Joana Cotar criticized the move, calling it counterproductive.

The U.S. has seen even greater losses, selling 195,091 BTC across 11 auctions. At the current price of $85,000 per bitcoin, these holdings could have generated $16.5 billion, compared to the $366.5 million earned from the sales.

Trump’s Potential Impact on Bitcoin Policy

With Donald Trump’s return to the presidency, the U.S. approach to cryptocurrencies may change. Trump has previously pledged to establish a strategic national bitcoin reserve and to halt the sale of confiscated bitcoins.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.